filmov

tv

Tim Bennett Explains: EV/EBITDA - investing's 'Marmite' number

Показать описание

Key investing number EV/EBITDA is loved and loathed in equal measure. This week I explain how it works.

Tim Bennett Explains: EV/EBITDA - investing's 'Marmite' number

Tim Bennett Explains: What is EBITDA?

What is EV / EBITDA? - MoneyWeek Investment Tutorials

Enterprise Multiple Explained (EV/EBITDA) | Valuation Ratios

EV EBITDA - HOW TO CALCULATE - PROS and CONS

Tim Bennett Explains: Which profit figure can you trust?

👨🏫 EV/EBITDA - What It Is, 🤔 How To Calculate, & When To Use?

Tim Bennett Explains: What is a price earnings (P/E) ratio?

Tim Bennett Explains: Five problems with p/e ratios

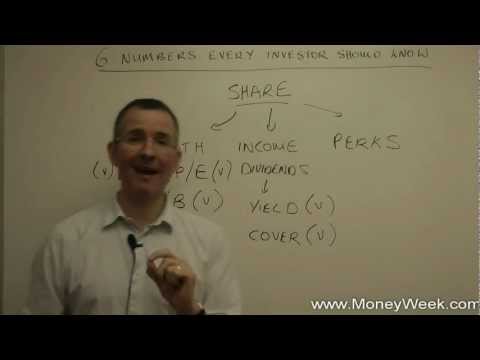

Six numbers every investor should know - MoneyWeek Investment Tutorials

Tim Bennett Explains: What's in the financial pages? Part One

Tim Bennett Explains: Liquidity: a short guide to a vital word - part one

Tim Bennett Explains: Three tips for lazy investors

Tim Bennett Explains: Is return on equity the ultimate ratio?

Tim Bennett Explains: How to invest - tips from the experts

Tim Bennett Explains: The first rule of stock market investing

Tim Bennett Explains: Investing Red Flags - a working capital crisis

Tim Bennett Explains: Six investing tips from Warren Buffett

Tim Bennett Explains: How call options could boost your investment income

Tim Bennett Explains: Balance Sheet Basics

Tim Bennett Explains: How to manage market cycles

Tim Bennett Explains: Property or shares? (Part Two)

Tim Bennett Explains: Why equity investors should follow the cash

Tim Bennett Explains: Investing red flags - acquisitions

Комментарии

0:11:25

0:11:25

0:08:09

0:08:09

0:10:02

0:10:02

0:02:41

0:02:41

0:12:52

0:12:52

0:07:05

0:07:05

0:05:10

0:05:10

0:09:59

0:09:59

0:08:46

0:08:46

0:12:26

0:12:26

0:11:15

0:11:15

0:10:50

0:10:50

0:11:02

0:11:02

0:12:57

0:12:57

0:10:13

0:10:13

0:09:56

0:09:56

0:09:25

0:09:25

0:09:05

0:09:05

0:09:55

0:09:55

0:09:11

0:09:11

0:13:21

0:13:21

0:12:12

0:12:12

0:09:32

0:09:32

0:09:33

0:09:33