filmov

tv

#2 Types of Islamic Finance - ACCA / CPA / SFM -By Saheb Academy

Показать описание

In this video I have explained 5 popular contracts or types of Islamic Finance

with examples and illustrations.

⏱TIMESTAMPS

0:00 - Intro

0:12 - Fast Recap of Concept

3:27 - Mudaraba

6:24 - Musharaka

8:33 - Sukuk

12:30 - Ijarah

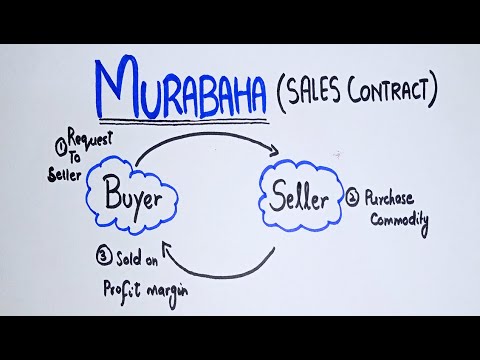

16:04 - Murabaha

This video is relevant for ACCA F9 Financial Management students, Strategic Financial Management (ICAI) and also for CPA students.

After watching this video your will feel this topic is very easy.

Previous - #1 Principles of Islamic Finance

PDF Notes

Clear your doubts by direct messaging us on Instagram

Please Like, Subscribe and Share this video on your social media account.

#acca #financialmanagement #finance

with examples and illustrations.

⏱TIMESTAMPS

0:00 - Intro

0:12 - Fast Recap of Concept

3:27 - Mudaraba

6:24 - Musharaka

8:33 - Sukuk

12:30 - Ijarah

16:04 - Murabaha

This video is relevant for ACCA F9 Financial Management students, Strategic Financial Management (ICAI) and also for CPA students.

After watching this video your will feel this topic is very easy.

Previous - #1 Principles of Islamic Finance

PDF Notes

Clear your doubts by direct messaging us on Instagram

Please Like, Subscribe and Share this video on your social media account.

#acca #financialmanagement #finance

#2 Types of Islamic Finance - ACCA / CPA / SFM -By Saheb Academy

#1 Principles of Islamic Finance - ACCA / CPA / SFM -By Saheb Academy

2. Understanding Wealth and Money | Islamic Finance 101

Introduction to Islamic Finance - Everything You NEED to Know!

Is Islamic financing halal? - Assim al hakeem

2 types of Halal mortgages #halalmortgage #halalhousing #islamicfinance #halalinvesting

What is Riba in Islam? Meaning, Definition, Types and Examples - AIMS Education

Introduction to Sukuk: Lesson-1

Islamic Finance 101- A (Very) Brief Introduction | Ali Siddiqui - Muslim Money Talk Ep 13

The difference between islamic banking and conventional banking explained in Urdu.

Simple Definition of SOOD (Interest) ??? RIBA & ISLAMIC Banking ??? By Engineer Muhammad Ali Mir...

Islamic Finance: Murabaha Contract | Buying a Home Islamically

Ijarah - Meaning, Types, Mechanism and Example of Islamic Lease - AIMS Education

Islamic Finance, Types of islamic finance, key principles in Urdu/Hindi for F9/P4/FM/AFM/ ACCA

Why I don’t trade the forex markets! 🚫

New Trading Setup #shortvideo #shorts #youtubeshorts

What is Murabaha with Example | Islamic Financing | Urdu/ Hindi |Class 11/ BBA/ B.COM |

Islamic Finance Q&A | Shaykh Dr. Yasir Qadhi and Dr. Main AlQudah Q&A | Epic Masjid

Islamic Banking Explained

#EthisEduSeries Ep 2: Islamic Crowdfunding VS Islamic Banking & Finance

Is the Riba which is Prohibited in the Quran the same as the Interest of Modern Bank? - Zakir Naik

How is Islamic finance different?

What type of wealth path speaks to you? #islamicfinance #ifg #halalinvesting

Gharar in Islamic Banking - Meaning, Definition, Types and Example - AIMS Education

Комментарии

0:18:41

0:18:41

0:13:25

0:13:25

0:25:26

0:25:26

0:10:13

0:10:13

0:05:00

0:05:00

0:00:39

0:00:39

0:07:24

0:07:24

0:09:35

0:09:35

1:06:02

1:06:02

0:02:16

0:02:16

0:04:19

0:04:19

0:02:24

0:02:24

0:10:33

0:10:33

0:09:00

0:09:00

0:00:54

0:00:54

0:00:15

0:00:15

0:03:10

0:03:10

0:36:37

0:36:37

0:00:06

0:00:06

0:03:54

0:03:54

0:06:57

0:06:57

0:01:57

0:01:57

0:00:36

0:00:36

0:02:55

0:02:55