filmov

tv

Capital Budgeting — Accounting Rate of Return & Payback Period

Показать описание

Capital Budgeting - Accounting Rate of Return

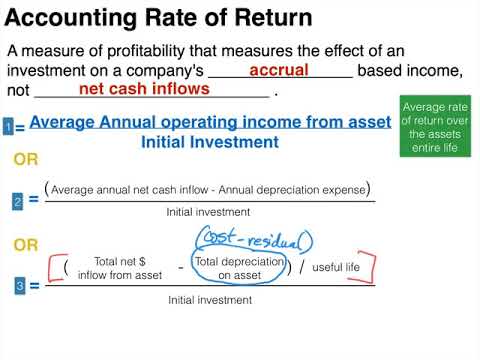

Accounting Rate of Return (ARR)

Accounting Rate of Return (ARR) | Explained with Example

MA42 - Capital Budgeting - Net Present Value - Explained

Capital Budgeting Accounting Rate of Return

INVESTMENT APPRAISAL (PART 1)

Capital Investment Models - Accounting Rate of Return

Accounting rate of return

Management Accounting Mcq🔥💯🥰| Ratio Analysis MCQ | Must Watch 200+ Question Series

#3 Average Rate of Return (ARR) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

Capital Budgeting Techniques in English - NPV, IRR , Payback Period and PI, accounting

Capital Budgeting Evaluation - Accounting Rate of Return

Capital Budgeting: Accounting Rate of return Part 1

Introduction to Capital Budgeting and The Accounting Rate of Return

average accounting rate of return cfa-course.com

#1 Investment decision/Capital budgeting/Project appraisal

Capital Budgeting: Accounting Rate of Return (ARR) Part 2

INVESTMENT APPRAISAL | CAPITAL BUDGETING TOOLS | PAYBACK | NPV | ARR | IRR | COMMERCE SPECIALIST |

What is Capital budgeting? | Importance, Methods, Limitations

Capital Budgeting | Accounting rate of return exercises

Payback Period Method | Capital Budgeting

ARR Accounting Rate of Return Capital Budgeting Technique| Financial Management #arr #commerce #fm

Accounting Rate of Return (Capital Budgeting/Investment Appraisal)

What is IRR? Internal Rate of Return ll be Varun Dua #irr #varundua #sharktankindia #shark

Комментарии

0:08:29

0:08:29

0:03:38

0:03:38

0:10:18

0:10:18

0:18:32

0:18:32

0:04:34

0:04:34

0:33:30

0:33:30

0:15:26

0:15:26

0:07:47

0:07:47

0:07:27

0:07:27

0:15:54

0:15:54

0:29:50

0:29:50

0:04:29

0:04:29

0:09:01

0:09:01

0:04:13

0:04:13

0:05:30

0:05:30

0:31:14

0:31:14

0:14:44

0:14:44

1:03:02

1:03:02

0:09:06

0:09:06

0:12:18

0:12:18

0:00:14

0:00:14

0:00:59

0:00:59

0:28:45

0:28:45

0:00:55

0:00:55