filmov

tv

GST 2A Vs GST 2B which data to be taken..? | Input Tax Credit | GST Auto populated data

Показать описание

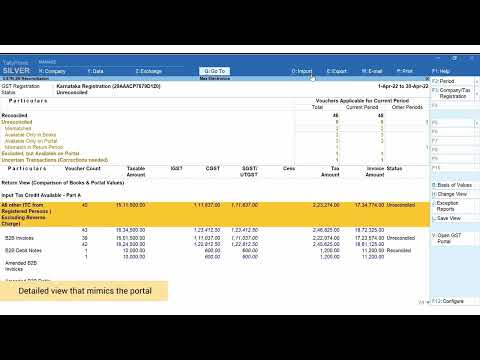

In continuation to our GST return series – in this video today we here to address the infamously famous question – 2A VS 2B. Yes, you heard me right I am talking not about 2A VS 3B but 2A VS 2B.

It was around July-2020 that this term 2B was first heard. And trade and industry went into a dizzy. 2B WHAT? And why? And what am I supposed to do? So in this video today – lets answer all of these.

Firstly, we all know what is 2A – it has been there ever since GST implementation and is a fairly known. GSTR-2A is an auto-drafted statement of input tax credit. It is auto-drafted by the GSTN basis the GSTR-01 returns filed by your suppliers.

Ok. So then what is GSTR-2B? : GSTR-2B is also an auto-drafted statement of input tax credit. GSTR-2B is also auto-drafted by GSTN basis the returns filed by your suppliers.

Then why have two forms to solve the same purpose?

Well – to put it vividly - GSTR-2B is static and unchanging where as GSTR-2A is dynamic and constantly updating.

GSTR-2A return keeps getting updated everytime any one of your supplier files his GSTR-01. GSTR-2B return is quite static meaning the ITC details auto-drafted in GSTR-2B is permanent forever. It is generated only once in a month taking the data uploaded by your suppliers starting from one date to one date (i.e.) 12th of every month.

Let us understand it with an illustration. Lets us take the month of March. If all suppliers file their GSTR-01 diligently on or before 11th of April 2021 – then GSTR2A & GSTR-2B for March-2021 will have basically the same credit autopopulating. But if any suppliers are non-compliant (i.e.) file belated GSTR-01 (i.e.) after 11th April, Then GSTR-2A of the month that is generated on lets say 17th or 18th April will have credit even on these belated uploads. But GSTR-2B of March will not capture this belated uploads since the clocking time of GSTR-2B stops on 11th of every month. These invoices uploaded by supplier beyond 11th april will get captured in GSTR-2B return generated for April-2021 not March-2021. GSTR-2B will stop capturing data uploaded beyond 11th April.

We can understand 2A & 2B better by classifying the types of supplier non-compliances in two categories:

A. Late filing

B. Wrong filing.

In case of late filing – GSTR-01 filed beyond the due date then GSTR-2A of the month keeps getting updated as and when any single vendor uploads his return whether on 11th 12th or even on 30th. But all these belated uploads get captured in GSTR-2B of the month when the vendors have actually filed their GSTR-1.

So, if a vendor is filing Dec-GSTR-01 return belated (i.e.) in Feb-2020 (say 15 Feb 2021) then these invoices will get reflected

A. GSTR-2A of Dec-2020

B. GSTR-2B of Feb-2020.

So for the purpose of month on month ITC reconciliation on a month on month basis:

A. It is advisable to consider GSTR-2B since it is static and does not keep changing.

B. For year end reconciliation GSTR-2A can be considered since it would consider the uploaded invoices of all vendors reflected in each and every month.

#GST2AVSGST2B #GSTINPUTTAXCREDIT #CAAPOORVAJAYASIMHA

Комментарии

0:07:00

0:07:00

0:13:30

0:13:30

0:08:31

0:08:31

0:05:42

0:05:42

0:08:01

0:08:01

0:00:15

0:00:15

0:00:52

0:00:52

0:01:00

0:01:00

0:51:05

0:51:05

0:09:57

0:09:57

0:05:19

0:05:19

0:17:18

0:17:18

0:00:59

0:00:59

0:14:29

0:14:29

0:00:51

0:00:51

0:01:01

0:01:01

0:08:16

0:08:16

0:01:30

0:01:30

0:08:32

0:08:32

0:00:47

0:00:47

0:16:28

0:16:28

0:00:31

0:00:31

0:01:01

0:01:01

0:11:58

0:11:58