filmov

tv

'PANIC': Noted economist says markets could 'backfire' on the Fed

Показать описание

Former St. Louis Fed President and CEO James Bullard discusses whether central banks should worry about how markets react to their decisions on 'Cavuto: Coast to Coast.' #foxbusiness #cavuto

FOX Business Network (FBN) is a financial news channel delivering real-time information across all platforms that impact both Main Street and Wall Street. Headquartered in New York - the business capital of the world - FBN launched in October 2007 and is one of the leading business networks on television, having topped CNBC in Business Day viewers for the second consecutive year in 2018. The network is available in nearly 80 million homes in all markets across the United States. Owned by FOX Corporation, FBN is a unit of FOX News Media and has bureaus in Chicago, Los Angeles, and Washington, D.C.

FOX Business Network (FBN) is a financial news channel delivering real-time information across all platforms that impact both Main Street and Wall Street. Headquartered in New York - the business capital of the world - FBN launched in October 2007 and is one of the leading business networks on television, having topped CNBC in Business Day viewers for the second consecutive year in 2018. The network is available in nearly 80 million homes in all markets across the United States. Owned by FOX Corporation, FBN is a unit of FOX News Media and has bureaus in Chicago, Los Angeles, and Washington, D.C.

'PANIC': Noted economist says markets could 'backfire' on the Fed

PANIC SPREADS in the Housing Market | MUCH WORSE COMING

'Why I Fire People Every Day' - Warren Buffett

Don't Panic When Stocks Get Slammed

Market Cycles Report: May 6 | Andy Pancholi & Panic Patterns

Gary Shilling explains the only way to beat the market and win

Stock Losses Worsen, Leading to a Surge of Chinese Investors in Emergency Rooms

What If The US Economy CRASHES

China stock market crash: Chinese investors panic over market bubble

The Coming Crypto Panic with Teeka Tiwari

How to make a perfect budget for Singles? - Panic Padmanaban | Plip Plip

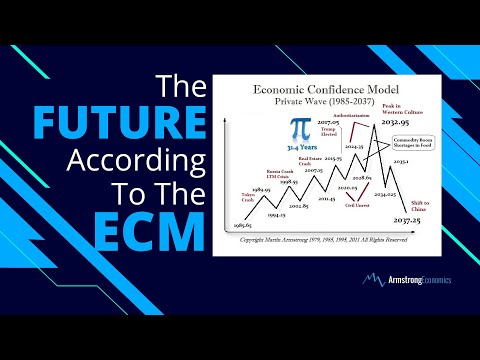

The Future According to the Economic Confidence Model

How to Thrive in Economic Panic with Gold and Oil Stocks

Stories from 2008's Great Recession | 60 Minutes Full Episodes

Robert Kiyosaki 2019 - The Speech That Broke The Internet!!! KEEP THEM POOR!

Panic Time Disturbing Reasons Why US Housing Market Is About To Crash Home Prices Will Never Be Same

The Corporate Lifecycle + The Market’s Fallen Heroes — ft. Aswath Damodaran | Prof G Markets

What the Hell Just Happened in the UK? Pounds, Pensions & Panic

Economists blame panic, overreaction for Monday’s Dow dive

The economics of COVID-19: panic-buying | Professor Sarah Smith

4 Reasons For the Next Stock Market Crash

Get Out Now - Banking Panic Has Triggered a Massive Machine Selling Program as Liquidity Dries Up

Why 99% Of Movies Today Are Garbage - Chris Gore

5. From Panic to Suffering

Комментарии

0:06:11

0:06:11

0:13:22

0:13:22

0:04:23

0:04:23

0:02:11

0:02:11

0:48:26

0:48:26

0:03:06

0:03:06

0:26:44

0:26:44

0:18:34

0:18:34

0:01:10

0:01:10

0:01:02

0:01:02

0:08:18

0:08:18

0:40:45

0:40:45

0:14:34

0:14:34

0:51:36

0:51:36

0:10:27

0:10:27

0:09:20

0:09:20

0:44:07

0:44:07

0:14:52

0:14:52

0:01:53

0:01:53

0:17:36

0:17:36

0:11:15

0:11:15

0:17:41

0:17:41

0:18:40

0:18:40

1:56:56

1:56:56