filmov

tv

Does this line predict America’s next recession?

Показать описание

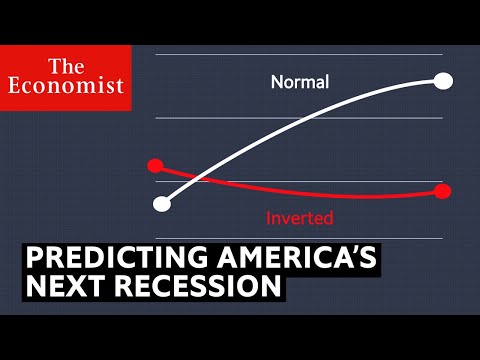

This graph makes a lot of people nervous. Why? It appears to predict that America is about to go into recession. It’s based on an economic indicator called the yield curve.

In fact only on one occasion in the last 70 years has there been a false alarm. And here’s the thing. So what is it about this curve that seems to make it such a good indicator of where the economy is heading?

The line illustrates the return, or yield investors get from investing in government bonds from short-term investments on the left to longer-term ones on the right. Usually the longer the time frame the higher the interest rate as investors demand a bigger return if they’re to lock their money up for longer. However, if investors fear the economy is slowing down then the long-term rates can drop below short-term rates the curve inverts.

When the outlook is gloomy investors are more likely to buy safe assets like long-term bonds, pushing their price up so the interest rate for holding them falls. Higher bond prices are also a signal that there are fewer exciting investment opportunities elsewhere such as the stockmarket. Of course there are plenty of other indicators you could look at to get a sense of what’s happening to the economy.

Then there’s the rate of change in unemployment which correlates closely with recessions. And even monitoring the number of times that newspapers publish the word “recession” can help to anticipate a downturn. But bear in mind that when you’re trying to predict a downturn you’re often trying to get a read on people’s expectations of where the economy is heading which is why that curve is so useful.

But these are extraordinary times for the US economy. Quantitative easing was a policy followed by the Federal Reserve to stimulate the economy after the 2008 financial crisis. The Treasury bought companies’ debt to reduce long-term interest rates. Some experts believe it’s distorted the yield curve.

In other words predicting America’s next recession just got a little harder. But the indicators are starting to flash red.

Комментарии

0:04:16

0:04:16

0:00:23

0:00:23

0:01:00

0:01:00

0:00:09

0:00:09

0:26:43

0:26:43

0:00:27

0:00:27

0:00:16

0:00:16

0:00:09

0:00:09

0:00:24

0:00:24

0:00:20

0:00:20

0:01:00

0:01:00

0:00:21

0:00:21

0:08:14

0:08:14

0:00:13

0:00:13

0:00:16

0:00:16

0:00:23

0:00:23

0:00:16

0:00:16

0:00:58

0:00:58

0:00:10

0:00:10

0:00:24

0:00:24

0:05:56

0:05:56

0:00:31

0:00:31

0:04:45

0:04:45

0:00:43

0:00:43