filmov

tv

Preparing Canadian Personal T1 Returns – Inputting Proper Personal Information (Part 1 of 5)

Показать описание

Preparing Canadian Personal T1 Returns – Inputting Proper Personal Information (Part 1 of 5)

TAX SEASON 2018 PROMOTION - ONLY $69 CDN (ALL TAXES INCLUDED) AT CANADIAN TAX ACADEMY.

Take the fully updated Canadian Personal Tax Course for only $69 CDN (including GST/HST). That is a savings of $228 off the regular price. Just click on this link:

COMPLETELY UPDATED FOR 2017 T1 TAX RETURNS (THE 2018 TAX PREPARATION SEASON).

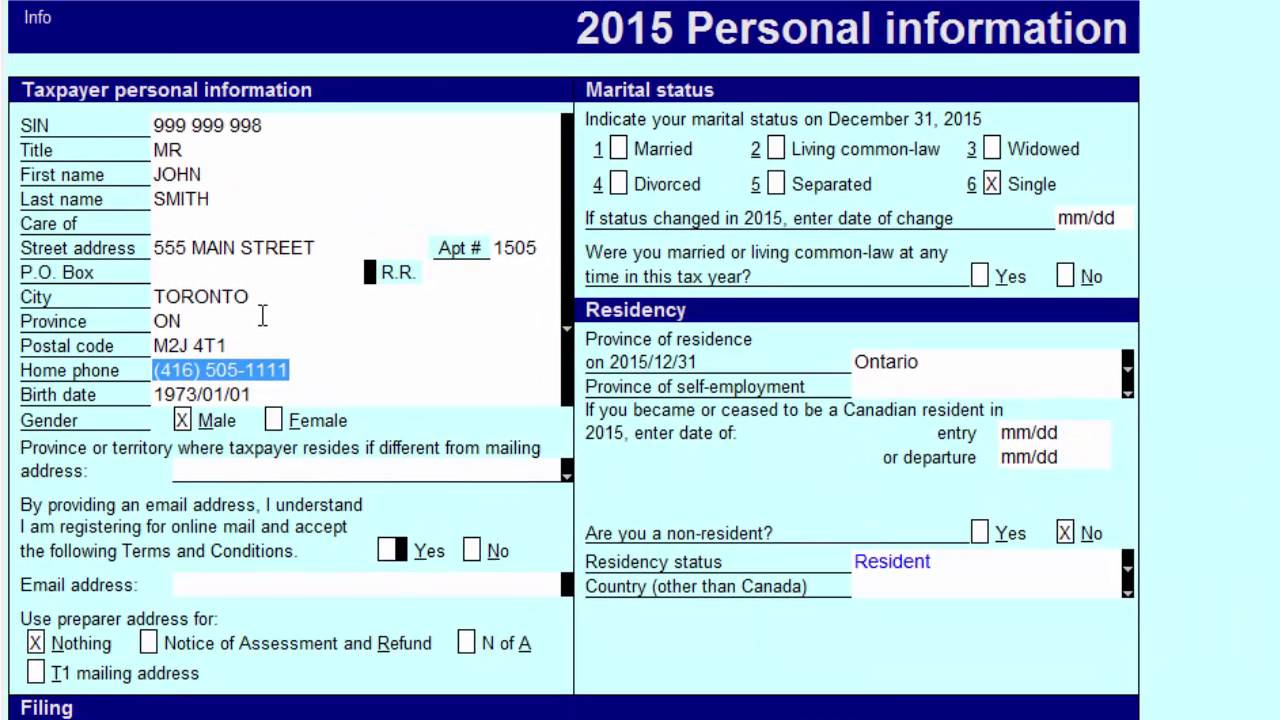

In this video tutorial, I review the first step in the T1 Tax preparation process by looking at the personal information portion of the T1

General Return found on page 1 (and page 2 of certain software).

You may think that this is a waste of time but do you realize how important this information truly is? In this tutorial we look at how important the marital status is on the general information page.

We also examine issues with disclosing the primary residence and mailing address of a taxpayer and how CRA (Canada Revenue Agency) uses this information to determine the Province of Residence. A look at immigration and emigration to and from Canada is also briefly discussed along with the importance of disclosing this properly on the T1 Return.

Canadian Tax Academy – My online Canadian Income Tax school is developed and focused on teaching students in tax and accounting the practical side of tax preparation. My tax training courses are a great supplement to any college and university tax courses where the primary focus is typically on the theoretical side of Canadian tax. With over 10,000 personal tax returns under my belt, I will guide you through the step by step process of preparing personal tax returns quickly and accurately.

The following are links the other YouTube video tutorials in this training series:

Part 2 - Reporting income and inputting T-slips on the T1 tax return

Part 3 - Determining T1 income tax deductions and reporting on the T1 return

Part 4 - Claiming personal tax credits on Schedule 1 and the T1 General Return

Part 5 - Doing a final review and reasonability test of your T1 tax return

You can check out my other YouTube tax videos here along with a detailed outline of the Canadian tax Academy Preparing Personal

Tax Returns – Introductory course.

Course Outline – A detailed breakdown of my Introductory Personal Tax Course

Canadian Personal Tax Returns - The 7 Deadly Sins

Common Tax Filing Errors

Starting Your Own Tax Preparation Business

Below is a link to the school, along with links to the online tax courses that are currently available. You can also enroll on the site for general information and to be put on the mailing list for future course releases.

Canadian Tax Academy - Home

Preparing Canadian Income Tax Returns – Introductory course only $69

Preparing Tax Returns Start to Finish – Best Practices – only $89

Tax Returns for Deceased Taxpayers

TAX SEASON 2018 PROMOTION - ONLY $69 CDN (ALL TAXES INCLUDED) AT CANADIAN TAX ACADEMY.

Take the fully updated Canadian Personal Tax Course for only $69 CDN (including GST/HST). That is a savings of $228 off the regular price. Just click on this link:

COMPLETELY UPDATED FOR 2017 T1 TAX RETURNS (THE 2018 TAX PREPARATION SEASON).

In this video tutorial, I review the first step in the T1 Tax preparation process by looking at the personal information portion of the T1

General Return found on page 1 (and page 2 of certain software).

You may think that this is a waste of time but do you realize how important this information truly is? In this tutorial we look at how important the marital status is on the general information page.

We also examine issues with disclosing the primary residence and mailing address of a taxpayer and how CRA (Canada Revenue Agency) uses this information to determine the Province of Residence. A look at immigration and emigration to and from Canada is also briefly discussed along with the importance of disclosing this properly on the T1 Return.

Canadian Tax Academy – My online Canadian Income Tax school is developed and focused on teaching students in tax and accounting the practical side of tax preparation. My tax training courses are a great supplement to any college and university tax courses where the primary focus is typically on the theoretical side of Canadian tax. With over 10,000 personal tax returns under my belt, I will guide you through the step by step process of preparing personal tax returns quickly and accurately.

The following are links the other YouTube video tutorials in this training series:

Part 2 - Reporting income and inputting T-slips on the T1 tax return

Part 3 - Determining T1 income tax deductions and reporting on the T1 return

Part 4 - Claiming personal tax credits on Schedule 1 and the T1 General Return

Part 5 - Doing a final review and reasonability test of your T1 tax return

You can check out my other YouTube tax videos here along with a detailed outline of the Canadian tax Academy Preparing Personal

Tax Returns – Introductory course.

Course Outline – A detailed breakdown of my Introductory Personal Tax Course

Canadian Personal Tax Returns - The 7 Deadly Sins

Common Tax Filing Errors

Starting Your Own Tax Preparation Business

Below is a link to the school, along with links to the online tax courses that are currently available. You can also enroll on the site for general information and to be put on the mailing list for future course releases.

Canadian Tax Academy - Home

Preparing Canadian Income Tax Returns – Introductory course only $69

Preparing Tax Returns Start to Finish – Best Practices – only $89

Tax Returns for Deceased Taxpayers

Комментарии

0:11:36

0:11:36

0:07:52

0:07:52

0:07:20

0:07:20

0:12:48

0:12:48

0:02:56

0:02:56

0:09:31

0:09:31

0:08:30

0:08:30

0:15:08

0:15:08

0:01:11

0:01:11

0:10:57

0:10:57

0:12:17

0:12:17

0:04:33

0:04:33

0:05:11

0:05:11

1:13:33

1:13:33

0:19:21

0:19:21

0:01:31

0:01:31

0:41:27

0:41:27

0:08:55

0:08:55

0:15:25

0:15:25

0:09:38

0:09:38

0:54:32

0:54:32

0:11:03

0:11:03

0:28:22

0:28:22

0:34:38

0:34:38