filmov

tv

Master Your Money: Top Money Management Tips for Smart Saving and Spending

Показать описание

💰 Seeking financial balance? 🌟 Discover essential money management tips that will empower you to save with purpose and spend wisely, paving the way to a healthier financial future!

📈 In this video, we dive into the art of effective money management, offering actionable insights to help you take control of your finances. Learn how to strike the right balance between saving for your goals and enjoying life's pleasures responsibly.

🔑 Uncover key strategies:

Create a Budget That Works: Develop a budget that aligns with your financial goals and priorities.

Automate Savings: Learn how to effortlessly save a portion of your income with automated transfers.

Prioritize Debt Management: Strategies to tackle and manage your debts effectively.

Distinguish Needs from Wants: Develop a discerning eye to differentiate between essential expenses and discretionary spending.

Set Realistic Financial Goals: Create clear, achievable objectives to keep your financial journey on track.

Plan for Emergencies: Understand the importance of building an emergency fund for unexpected situations.

Research Before Big Purchases: Make informed decisions by researching and comparing options before major expenses.

💡 By implementing these money management tips, you'll be equipped with the knowledge and tools to make wise financial choices and build a stronger financial foundation.

🌈 Ready to take charge of your finances? Hit play now and embark on your journey toward smart saving and responsible spending!

👍 If you find this video valuable, give it a thumbs up, subscribe for more financial wisdom, and hit the notification bell to stay informed. Share this video with friends and family who are ready to achieve better financial health!

#MoneyManagementTips #SmartSaving #ResponsibleSpending #FinancialWellness #BudgetingInsights

0:00 Intro

0:26 Do you know how to budget your money?

2:04 This is why it's so important to learn how to manage your money and spending

2:52 You have to make sure that you don't get into credit card debt

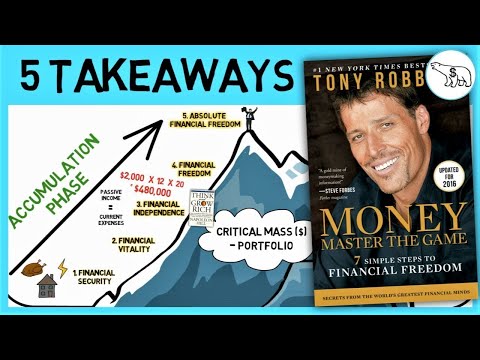

5:02 First Jar – Necessities (55%)

5:24 Second Jar – Long-Term Savings (10%)

5:48 Third Jar – Financial Freedom Account (10%)

6:06 Forth Jar – Education (10%)

6:44 Fifth Jar – Fun (10%)

7:07 Sixth Jar – Contribution (5%)

7:32 When it comes to budgeting, it is not the amount that matters. Rather it's the habit

📈 In this video, we dive into the art of effective money management, offering actionable insights to help you take control of your finances. Learn how to strike the right balance between saving for your goals and enjoying life's pleasures responsibly.

🔑 Uncover key strategies:

Create a Budget That Works: Develop a budget that aligns with your financial goals and priorities.

Automate Savings: Learn how to effortlessly save a portion of your income with automated transfers.

Prioritize Debt Management: Strategies to tackle and manage your debts effectively.

Distinguish Needs from Wants: Develop a discerning eye to differentiate between essential expenses and discretionary spending.

Set Realistic Financial Goals: Create clear, achievable objectives to keep your financial journey on track.

Plan for Emergencies: Understand the importance of building an emergency fund for unexpected situations.

Research Before Big Purchases: Make informed decisions by researching and comparing options before major expenses.

💡 By implementing these money management tips, you'll be equipped with the knowledge and tools to make wise financial choices and build a stronger financial foundation.

🌈 Ready to take charge of your finances? Hit play now and embark on your journey toward smart saving and responsible spending!

👍 If you find this video valuable, give it a thumbs up, subscribe for more financial wisdom, and hit the notification bell to stay informed. Share this video with friends and family who are ready to achieve better financial health!

#MoneyManagementTips #SmartSaving #ResponsibleSpending #FinancialWellness #BudgetingInsights

0:00 Intro

0:26 Do you know how to budget your money?

2:04 This is why it's so important to learn how to manage your money and spending

2:52 You have to make sure that you don't get into credit card debt

5:02 First Jar – Necessities (55%)

5:24 Second Jar – Long-Term Savings (10%)

5:48 Third Jar – Financial Freedom Account (10%)

6:06 Forth Jar – Education (10%)

6:44 Fifth Jar – Fun (10%)

7:07 Sixth Jar – Contribution (5%)

7:32 When it comes to budgeting, it is not the amount that matters. Rather it's the habit

0:02:46

0:02:46

0:00:15

0:00:15

0:24:00

0:24:00

0:10:52

0:10:52

0:02:28

0:02:28

0:19:22

0:19:22

0:01:11

0:01:11

0:01:53

0:01:53

0:13:26

0:13:26

0:13:55

0:13:55

0:10:32

0:10:32

0:09:12

0:09:12

0:04:04

0:04:04

0:01:03

0:01:03

0:02:42

0:02:42

0:28:57

0:28:57

0:07:51

0:07:51

0:08:06

0:08:06

0:04:26

0:04:26

0:01:58

0:01:58

0:11:22

0:11:22

0:25:28

0:25:28

0:03:56

0:03:56

0:03:33

0:03:33