filmov

tv

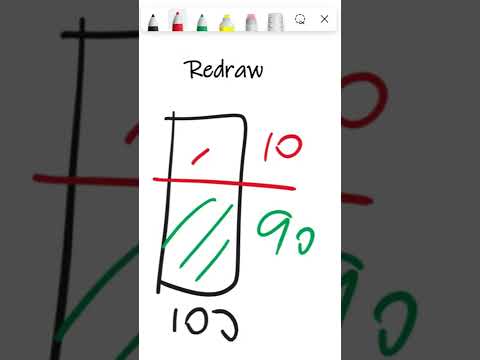

Offset vs redraw explained

Показать описание

Have you thought about getting an offset account for your home loan?

Watch our video to learn which option is better suited to you and your personal financial goals. To book an appointment with out team and have a chat about your finances please contact us today.

T: 1300 090 298

Watch our video to learn which option is better suited to you and your personal financial goals. To book an appointment with out team and have a chat about your finances please contact us today.

T: 1300 090 298

Offset vs redraw explained

REDRAW vs OFFSET ACCOUNTS: Which Is Better For Paying Your Home Loan Fast?

Offset vs Redraw? Avoid the $11,850 cost!

Offset Vs Redraw Account

Offset vs. Redraw Explained: Mortgage Broker's Guide for Homeowners in Australia

Offset and Redraw Explained

Offset Account VS Redraw Account: What's the Difference?

Offset vs Redraw Explained with #LEGO: Save Money on Your Home Loan!

Why having an offset account with your home loan could be costing you dearly

Redraw Facility TRAPS (for EVERY AUSSIE with a loan)

Offset vs Redraw

Redraw Facility vs Offset Account: Which Should You Go With? (Australia)

Redraw Facilities Explained (Australia)

Redraw Facility vs Offset Account: The Difference Explained | Home Loans Made Simple by Unloan

Offset Vs. Redraw Explained

How do offset accounts really work?

Redraw vs Offset Account - Avoid the $60,000 Home Loan Trap

Offset vs Redraw

Pay Less Interest - Offset vs Redraw?

REDRAW vs OFFSET Home Loan

Offset Account vs Home Loan

Offset vs. Redraw: Maximise Your Investment Portfolio! 💼📈

Offset vs Redraw | Australia | What is the difference?

The Ultimate Guide to Paying Off Your Mortgage Faster in Australia

Комментарии

0:04:20

0:04:20

0:02:48

0:02:48

0:00:40

0:00:40

0:00:58

0:00:58

0:02:14

0:02:14

0:06:07

0:06:07

0:00:40

0:00:40

0:03:02

0:03:02

0:03:24

0:03:24

0:08:10

0:08:10

0:08:47

0:08:47

0:04:21

0:04:21

0:02:18

0:02:18

0:00:48

0:00:48

0:05:29

0:05:29

0:03:36

0:03:36

0:10:47

0:10:47

0:04:17

0:04:17

0:12:07

0:12:07

0:12:27

0:12:27

0:02:53

0:02:53

0:00:42

0:00:42

0:03:36

0:03:36

0:07:08

0:07:08