filmov

tv

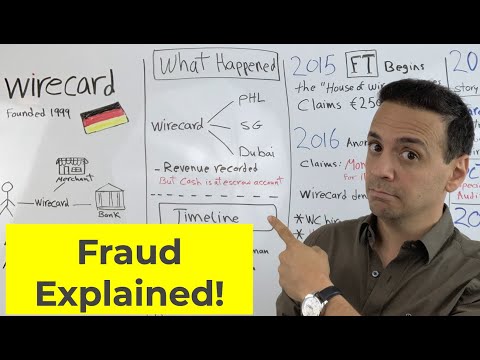

What Happened at Wirecard? | Why did Wirecard go Bust? | Accounting Fraud WDI.DE Scandal

Показать описание

Todays video is all about the Wirecard Scandal. Wirecard a German payments company announced that they are filing for insolvency this morning. We will learn what happened at Wirecard, what Wirecard does, and how they became the new Enron. Why did Wirecard go bust? WDI.DE

Dan McCrum, at the Financial Times, has been reporting that German fintech company Wirecard was faking some of its revenue, and Wirecard has been angrily fighting back, accusing McCrum of conspiring with short sellers to push down its stock.

Last week Wirecard disclosed that some of its cash was missing, and finally this week admitted “that there is a prevailing likelihood that the bank trust account balances in the amount of 1.9 billion EUR do not exist.”

So what is Wirecard? It is a firm launched in the late stages of the dotcom boom in 1999 as a payment processor, helping websites collect credit card payments from customers. They almost went bust and in 2002 Markus Braun, a former KPMG consultant, took over as chief executive.

In March this year, Wirecards auditor was unable to conclude the audit. In April their accounting firm said that they could not verify that arrangements responsible for “the lion’s share” of Wirecard profits reported from 2016 to 2018 were genuine. On June 18th Wirecard announced that 1.9 billion euros was missing and the next day Markus Braun the CEO Resigned.

On June 22nd Wirecard acknowledged that the €1.9bn of cash probably does “not exist”. The next day Markus Braun was arrested and today Wirecard announced that they would file for insolvency.

Freelancers around the world are unable to access their money from their prepaid Payoneer card thanks to a recent Wirecard scandal.

The German audit watchdog has told prosecutors on November 26th that EY may have acted criminally during its work for Wirecard, a step that significantly escalates the legal and reputational risks for the accounting firm.

According to the Financial Times, Apas, the independent government body overseeing Germany’s auditing industry, had sent a report to prosecutors. This is the first time a government agency has said EY may have broken the law during its audits of the German payments group.

Dan McCrum, at the Financial Times, has been reporting that German fintech company Wirecard was faking some of its revenue, and Wirecard has been angrily fighting back, accusing McCrum of conspiring with short sellers to push down its stock.

Last week Wirecard disclosed that some of its cash was missing, and finally this week admitted “that there is a prevailing likelihood that the bank trust account balances in the amount of 1.9 billion EUR do not exist.”

So what is Wirecard? It is a firm launched in the late stages of the dotcom boom in 1999 as a payment processor, helping websites collect credit card payments from customers. They almost went bust and in 2002 Markus Braun, a former KPMG consultant, took over as chief executive.

In March this year, Wirecards auditor was unable to conclude the audit. In April their accounting firm said that they could not verify that arrangements responsible for “the lion’s share” of Wirecard profits reported from 2016 to 2018 were genuine. On June 18th Wirecard announced that 1.9 billion euros was missing and the next day Markus Braun the CEO Resigned.

On June 22nd Wirecard acknowledged that the €1.9bn of cash probably does “not exist”. The next day Markus Braun was arrested and today Wirecard announced that they would file for insolvency.

Freelancers around the world are unable to access their money from their prepaid Payoneer card thanks to a recent Wirecard scandal.

The German audit watchdog has told prosecutors on November 26th that EY may have acted criminally during its work for Wirecard, a step that significantly escalates the legal and reputational risks for the accounting firm.

According to the Financial Times, Apas, the independent government body overseeing Germany’s auditing industry, had sent a report to prosecutors. This is the first time a government agency has said EY may have broken the law during its audits of the German payments group.

Комментарии

0:07:00

0:07:00

0:17:05

0:17:05

0:03:16

0:03:16

0:04:38

0:04:38

0:07:16

0:07:16

0:15:31

0:15:31

0:04:19

0:04:19

0:02:06

0:02:06

0:04:59

0:04:59

0:01:08

0:01:08

0:25:32

0:25:32

0:01:01

0:01:01

0:08:46

0:08:46

0:08:20

0:08:20

0:02:59

0:02:59

0:03:54

0:03:54

0:03:45

0:03:45

0:01:03

0:01:03

0:44:27

0:44:27

0:06:44

0:06:44

0:00:35

0:00:35

0:04:11

0:04:11

0:00:57

0:00:57

0:04:16

0:04:16