filmov

tv

Session 14: Valuations at last

Показать описание

This is a direct recording from Zoom. I am sorry for the sound quality, but with broadband issues, and three people in the house all on Zoom at the same time, it is what it is.

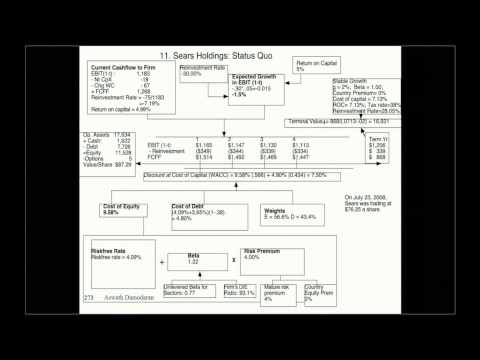

In this session we started on valuing entire companies finally, by first valuing Con Ed in 2008 and following up with 3M pre and post 2008 crisis. We valued the S&P 500 at the start of 2020 and then moved on to valuing young companies, with a valuation of Amazon in 2000,.

In this session we started on valuing entire companies finally, by first valuing Con Ed in 2008 and following up with 3M pre and post 2008 crisis. We valued the S&P 500 at the start of 2020 and then moved on to valuing young companies, with a valuation of Amazon in 2000,.

Session 14: Valuations at last

Session 14: Last loose end and story telling in valuation

Session 14: Last Loose Ends and Story to Numbers - Part 1

Session 14: Relative Valuation - First Principles

Session 14: DCF Valuations - Training Wheels

Session 14: More on stories & numbers and first valuations!

Session 14: Valuing markets and young companies

Session 14: Valuing the Market and Young Companies

Portland Housing Bureau N/NE Oversight Committee Meeting 11/14/24

Session 14: The Dark Side of Valuation (Young companies)

Session 14: Value Investing - The Contrarians

Session 14: Acquisition Analysis and Investment Decision Rules

Session 14: Valuing Young Companies

Session 14: Valuation during crises and Valuing Young Companies

Session 13: Last loose ends plus Stories & Numbers

Session 14: Investment Returns - Equity Analysis and Acquisitions

Session 12: Last Loose Ends and Story Telling

Session 12: Loose Ends in Valuation

Session 25: Closing Thoughts

Session 14: More on the Dark Side (Emerging Market, Financial Service and Transition Companies)

Session 14 (MBA): To NPV and beyond..

Session 15: Storytelling and Valuation (Continued)

Session 14: Investment Returns I- Setting the Table

Session 12: Last Loose Ends and First Steps on Storytelling

Комментарии

1:23:26

1:23:26

1:19:02

1:19:02

1:17:50

1:17:50

0:18:10

0:18:10

1:22:05

1:22:05

1:27:53

1:27:53

1:25:16

1:25:16

1:27:23

1:27:23

2:16:21

2:16:21

1:27:06

1:27:06

0:12:14

0:12:14

1:26:08

1:26:08

1:27:48

1:27:48

1:24:03

1:24:03

1:19:57

1:19:57

1:19:54

1:19:54

1:22:58

1:22:58

1:20:05

1:20:05

0:09:02

0:09:02

1:30:06

1:30:06

1:27:06

1:27:06

1:16:59

1:16:59

0:23:12

0:23:12

1:22:29

1:22:29