filmov

tv

FA14 - Adjusting Journal Entries EXAMPLES

Показать описание

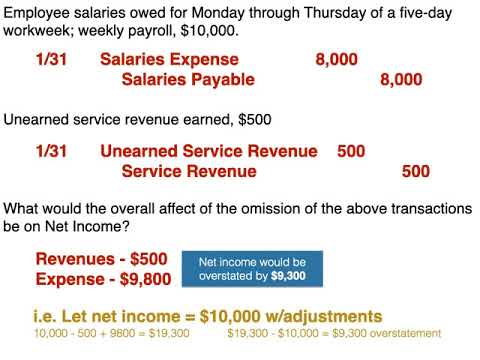

Module 3 examines five types of adjustments: 1.) Depreciation/Amortization, 2.) Prepaid expenses, 3.) Accrued expenses, 4.) Accrued Revenues, and 5.) Unearned Revenues.

We learn how to prepare an adjusted trial balance, closing entries and a post-closing trial balance.

FA14 - Adjusting Journal Entries EXAMPLES

FA13 - Adjusting Journal Entries Explained

Adjusting entries

Adjusting Journal Entries | Examples

FA15 - Adjusting Journal Entries - MORE EXAMPLES

Adjusting Entries Examples

How to Prepare Adjusting Entries

Adjusting Journal Entries (Overview)

How to Prepare Adjusting Journal Entries | Principles of Accounting

Accounting Adjusting Journal Entries - 7 examples

Practice Problem ADJ-02: Adjusting Journal Entries and the Adjusted Trial Balance

Video on Types of Adjusting Journal Entries

Devin Wolf Company has the following balances in selected accounts on December 31

ch 3 adjusting entry recognizing income tax expense and payable

How to Record Adjusting Entries for Accrued Expenses and Accrued Revenue

QuickBooks Adjusting Journal Entry 5: Interest Expense

Preparing an Adjusted Trial Balance

Why are Accounting Adjusting Entries Needed?

Deferrals & Accruals | Deferred Revenue, Deferred Expense, Accrued Revenue & Accrued Expense

Adjusting Journal Entries (Prepaid Expenses)

How to Adjust Journal Entries?

What is the Adjusted Trial Balance and How is it Created?

Adjusting Journal Entry Thought Process How to Record Adjusting Entries 4

Adjusting Entries #shortvideo #youtubeshorts

Комментарии

0:32:43

0:32:43

0:04:34

0:04:34

0:14:17

0:14:17

0:26:03

0:26:03

0:17:22

0:17:22

0:12:55

0:12:55

0:06:25

0:06:25

0:05:16

0:05:16

0:02:45

0:02:45

0:06:56

0:06:56

0:09:46

0:09:46

0:14:24

0:14:24

0:00:41

0:00:41

0:02:30

0:02:30

0:04:21

0:04:21

0:01:52

0:01:52

0:04:48

0:04:48

0:03:57

0:03:57

0:16:02

0:16:02

0:07:40

0:07:40

0:20:26

0:20:26

0:08:41

0:08:41

0:10:31

0:10:31

0:00:28

0:00:28