filmov

tv

What are the rules for UTMAs and how are they taxed?

Показать описание

*Comments have been disabled as of 06/06/2025. The SEC mandates that Youtube Comments be automatically archived (like emails) which we don't have a solution for at this time. If you have further questions or wish to set up an engagement, please don't hesitate to reach out on the website. Thanks!

In this video we breakdown how UTMAs/UGMAs are funded, how they grow, and then ultimately how money is distributed. We will talk about in which situations the kiddo will need to file their own return vs when the parents can just file these proceeds on their behalf.

00:00 - Intro

00:54 - UTMA Overview

02:48 - Funding and Compounding

03:39 - Gifting Overview

05:31 - How to treat gains/income from UTMA

09:19 - Using Losses in UTMA

10:29 - Calls to Action

#financialplanning #wealthmanagement #financialservices #taxes #retirement #retirementplanning #stocks #edmonds #seattle #cfp #tax #kiddie #investing #education

In this video we breakdown how UTMAs/UGMAs are funded, how they grow, and then ultimately how money is distributed. We will talk about in which situations the kiddo will need to file their own return vs when the parents can just file these proceeds on their behalf.

00:00 - Intro

00:54 - UTMA Overview

02:48 - Funding and Compounding

03:39 - Gifting Overview

05:31 - How to treat gains/income from UTMA

09:19 - Using Losses in UTMA

10:29 - Calls to Action

#financialplanning #wealthmanagement #financialservices #taxes #retirement #retirementplanning #stocks #edmonds #seattle #cfp #tax #kiddie #investing #education

What are the Rules - Always Sunny - Full song with video

Laws and Rules for Kids | What is the difference between a rule and a law?

What rules do you have? #toddlermom #motherhood #kids #rules

What are the rules for riding the Xpulse 200?

How the Rule of Three Will Change Your Life

What Are the Rules for Veterans' Individual Unemployability?

What are the rules to fly your drone in 2025?

What are the Rules of War? | The Laws of War | ICRC

🚨 Chase Just Changed the Rules for Business Funding (June 2025) | What You Need to Know

5 Secret Chess Rules

WORD STRESS in English - What are the rules for Word Stress in English?

What are the rules for when Trump can use political contributions to pay his legal fees?

What are the Rules for Local Government contracts?

What Are The Three Rules Of The Rogues!?

What are the Body Safety Rules for Children?

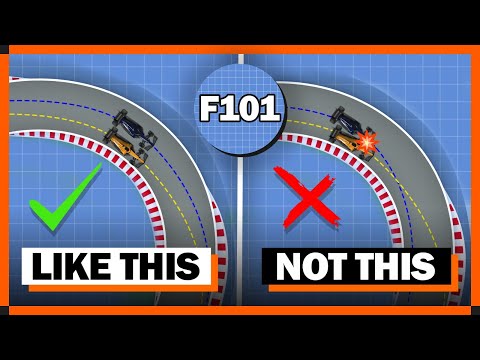

What Are The Overtaking Rules In F1?

Changes To UK Visa And Settlement Rules After The 2025 Immigration White Paper

What are the Rules for Preparing a Ledger Account? Rules for Ledger

What's the most stupid rule in your school. #shorts #school #rules #comments #relateable

U.S. Immigration COLLAPSE? Trump’s 2025 Green Card Rules SHOCK the World!

What Are the Rules of War? Just War Theory

What Are The Hidden Rules Of The Universe?

What are the actual rules of Brahmacharya? #devotional #hanuman

Magic Question: What are the 'RULES' of Performing Magic?

Комментарии

0:01:26

0:01:26

0:07:11

0:07:11

0:00:16

0:00:16

0:00:16

0:00:16

0:00:40

0:00:40

0:02:04

0:02:04

0:08:51

0:08:51

0:04:44

0:04:44

0:06:55

0:06:55

0:00:35

0:00:35

0:15:01

0:15:01

0:29:05

0:29:05

0:07:38

0:07:38

0:01:00

0:01:00

0:03:31

0:03:31

0:04:53

0:04:53

0:12:32

0:12:32

0:03:00

0:03:00

0:00:06

0:00:06

0:08:28

0:08:28

0:12:06

0:12:06

0:49:00

0:49:00

0:00:14

0:00:14

0:08:20

0:08:20