filmov

tv

Sampling Approaches in Auditing

Показать описание

We've just uploaded brand-new "auditing" videos on our channel!

Make sure to check out our latest content. Don't forget to like, subscribe, and hit the bell icon to stay updated with all our future uploads. Thanks for watching!

Introduction to the principles and concepts of the audit as an attestation service offered by the accounting profession. Primary emphasis is placed on Generally Accepted Auditing Standards, the role of the CPA/auditor in evidence collection, analytical review procedures and reporting, the CPA/auditor's ethical and legal responsibilities, the role of the Securities and Exchange Commission as well as other constituencies. Audit testing, including statistical sampling, internal control issues, and audit programs are discussed. --

Description:

Sampling is used when exact information is not needed, and when a large population is being dealt with. It trades effectiveness for efficiency. Sampling [in auditing] is used for study and evaluation of internal control (selecting control procedures to verify compliance, attributes sampling), and substantive procedures (selecting components or transactions of account balances for verification & variables sampling).

Sampling risk is the risk that an auditor reaches an incorrect conclusion because the sample is not representative of the population (inherent part of audit sampling). It is controlled by determining an appropriate sample size, ensuring that all items have an equal opportunity of selection, and mathematically evaluating sample results. Non sampling risk is the risk that audit tests do not uncover existing exceptions in the sample. It results from the auditor's failure to recognize exceptions due to inappropriate or ineffective audit procedures. It is controlled by training, supervision, reasonable working conditions, and effort.

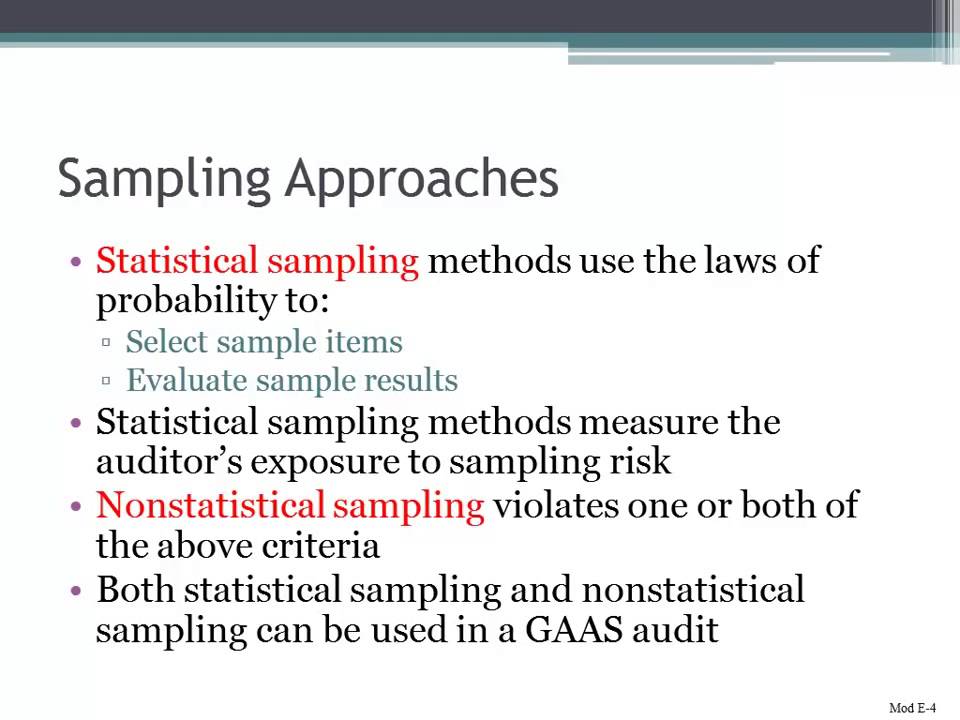

Statistical sampling methods use the laws of probability to select sample items and evaluate sample results. Statistical sampling methods measure the auditor's exposure to sampling risk. Nonstatistical sampling violates one or both of the above criteria. Both statistical sampling and non statistical sampling can be used in a GAAS audit.

A represenative sample is one in which the characteristics in the sample of audit interest are approximately the same as those of the population (the sample accurately represents the total population). An auditor can increase the likelihood of a representative sample by using care in designing the sampling process and selection, and evaluating the results.

Overall, effectiveness losses can include risk of overreliance (assessing control risk too low) and risk of incorrect acceptance. Efficiency losses include risk of underreliance (assessing control risk too high) and the risk of incorrect rejection.

To plan the sample, the auditor must state the objectives of the audit test (test operating effectiveness of internal control), decide whether audit sampling applies, define attributes and exception conditions, define the population (significance of completeness), define the sampling unit (must be consistent with audit objective), specify the tolerable rate of deviation, specify acceptable risk of assessing control risk too low, estimate the population exception rate, and determine the initial sample size. To select the sample and perform the audit procedures, the auditor must select the sample and perform the audit procedures. To evaluate the results, the auditor must generalize from the sample to the population, analyze exceptions, and decide the acceptability of the population.

To receive additional updates regarding our library please subscribe to our mailing list using the following link:

Make sure to check out our latest content. Don't forget to like, subscribe, and hit the bell icon to stay updated with all our future uploads. Thanks for watching!

Introduction to the principles and concepts of the audit as an attestation service offered by the accounting profession. Primary emphasis is placed on Generally Accepted Auditing Standards, the role of the CPA/auditor in evidence collection, analytical review procedures and reporting, the CPA/auditor's ethical and legal responsibilities, the role of the Securities and Exchange Commission as well as other constituencies. Audit testing, including statistical sampling, internal control issues, and audit programs are discussed. --

Description:

Sampling is used when exact information is not needed, and when a large population is being dealt with. It trades effectiveness for efficiency. Sampling [in auditing] is used for study and evaluation of internal control (selecting control procedures to verify compliance, attributes sampling), and substantive procedures (selecting components or transactions of account balances for verification & variables sampling).

Sampling risk is the risk that an auditor reaches an incorrect conclusion because the sample is not representative of the population (inherent part of audit sampling). It is controlled by determining an appropriate sample size, ensuring that all items have an equal opportunity of selection, and mathematically evaluating sample results. Non sampling risk is the risk that audit tests do not uncover existing exceptions in the sample. It results from the auditor's failure to recognize exceptions due to inappropriate or ineffective audit procedures. It is controlled by training, supervision, reasonable working conditions, and effort.

Statistical sampling methods use the laws of probability to select sample items and evaluate sample results. Statistical sampling methods measure the auditor's exposure to sampling risk. Nonstatistical sampling violates one or both of the above criteria. Both statistical sampling and non statistical sampling can be used in a GAAS audit.

A represenative sample is one in which the characteristics in the sample of audit interest are approximately the same as those of the population (the sample accurately represents the total population). An auditor can increase the likelihood of a representative sample by using care in designing the sampling process and selection, and evaluating the results.

Overall, effectiveness losses can include risk of overreliance (assessing control risk too low) and risk of incorrect acceptance. Efficiency losses include risk of underreliance (assessing control risk too high) and the risk of incorrect rejection.

To plan the sample, the auditor must state the objectives of the audit test (test operating effectiveness of internal control), decide whether audit sampling applies, define attributes and exception conditions, define the population (significance of completeness), define the sampling unit (must be consistent with audit objective), specify the tolerable rate of deviation, specify acceptable risk of assessing control risk too low, estimate the population exception rate, and determine the initial sample size. To select the sample and perform the audit procedures, the auditor must select the sample and perform the audit procedures. To evaluate the results, the auditor must generalize from the sample to the population, analyze exceptions, and decide the acceptability of the population.

To receive additional updates regarding our library please subscribe to our mailing list using the following link:

Комментарии

0:04:45

0:04:45

0:10:54

0:10:54

0:13:08

0:13:08

0:01:31

0:01:31

0:12:32

0:12:32

0:01:40

0:01:40

0:08:19

0:08:19

0:04:03

0:04:03

0:00:00

0:00:00

0:55:48

0:55:48

0:21:16

0:21:16

0:01:34

0:01:34

0:33:51

0:33:51

0:07:59

0:07:59

0:13:18

0:13:18

0:13:14

0:13:14

0:21:50

0:21:50

0:01:50

0:01:50

0:02:49

0:02:49

0:01:14

0:01:14

0:11:06

0:11:06

0:00:59

0:00:59

0:03:40

0:03:40

0:03:44

0:03:44