filmov

tv

VIN Foundation | Climbing Mt Debt | ACVIM Candidates

Показать описание

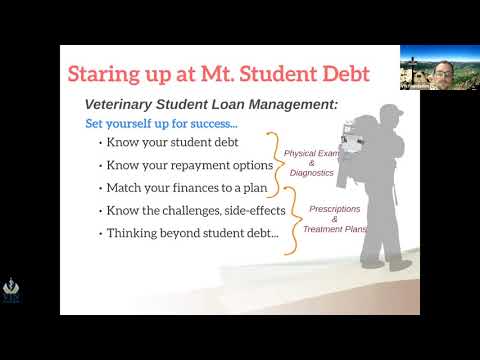

Climbing Mt. Debt: Navigating student loan repayment uncertainty for ACVIM candidates

The student debt roller coaster ride continues. What is going on with federal student loan repayment? A recent court order blocked the SAVE plan (formerly known as REPAYE), but it has impacted other income-driven plans too. Learn the information you need to stay on track with your student loan repayment strategy during and after your training.

ACVIM and VIN Foundation are collaborating on this webinar, presented by VIN and VIN Foundation Student Debt Education team members Tony Bartels DVM, MBA, and Rebecca Mears, DVM. Learn more about the recent student loan repayment changes you need to know, including how those changes may impact your repayment plans.

During this session, Tony and Rebecca help you navigate the recent repayment uncertainty:

1) The latest on the court injunction blocking the SAVE plan

2) Identifying your repayment plan and current repayment status

3) Optimizing your loans for your training

4) Adjusting your repayment strategy as you complete your training

5) Your student loan and repayment questions

The student debt roller coaster ride continues. What is going on with federal student loan repayment? A recent court order blocked the SAVE plan (formerly known as REPAYE), but it has impacted other income-driven plans too. Learn the information you need to stay on track with your student loan repayment strategy during and after your training.

ACVIM and VIN Foundation are collaborating on this webinar, presented by VIN and VIN Foundation Student Debt Education team members Tony Bartels DVM, MBA, and Rebecca Mears, DVM. Learn more about the recent student loan repayment changes you need to know, including how those changes may impact your repayment plans.

During this session, Tony and Rebecca help you navigate the recent repayment uncertainty:

1) The latest on the court injunction blocking the SAVE plan

2) Identifying your repayment plan and current repayment status

3) Optimizing your loans for your training

4) Adjusting your repayment strategy as you complete your training

5) Your student loan and repayment questions

1:50:08

1:50:08

2:05:49

2:05:49

3:31:15

3:31:15

2:37:24

2:37:24

2:18:20

2:18:20

0:35:40

0:35:40

1:45:14

1:45:14

2:44:21

2:44:21

1:56:10

1:56:10

1:32:48

1:32:48

1:55:40

1:55:40

1:35:21

1:35:21

2:04:48

2:04:48

1:46:25

1:46:25

2:08:06

2:08:06

2:05:07

2:05:07

1:59:47

1:59:47

1:44:06

1:44:06

0:45:49

0:45:49

2:56:06

2:56:06

0:36:51

0:36:51

2:18:17

2:18:17

2:01:12

2:01:12

1:59:57

1:59:57