filmov

tv

Introduction to Auditing | Auditing and Attestation . CPA Exam AUD

Показать описание

In this video, I explain introduction to auditing.

#accountingmajor #accountingstudent #auditcourse

Auditing is the accumulation and evaluation of evidence about information to determine and report on the degree of correspondence between the information and established criteria. Auditing should be done by a competent, independent person.

To do an audit, there must be information in a verifiable form and some standards (criteria) by which the auditor can evaluate the information. This information can take many forms. Auditors routinely perform audits of quantifiable information, including companies’ financial statements and individuals’ federal income tax returns. Auditors also audit more subjective information, such as the effectiveness of computer systems and the efficiency of manufacturing operations.

The criteria for evaluating information also vary depending on the information being audited. In the audit of historical financial statements by CPA firms, the criteria may be U.S. generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). This means that in an audit of Apple’s financial statements, the CPA firm will determine whether Apple’s financial statements have been prepared in accordance with GAAP. For an audit of internal control over financial reporting, the criteria will be a recognized framework for establishing internal control, such as Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (widely known as COSO).

Evidence is any information used by the auditor to determine whether the information being audited is stated in accordance with the established criteria. Evidence takes many different forms, including:

Electronic and documentary data about transactions

Written and electronic communication with outsiders

Observations by the auditor

Oral testimony of the auditee (client)

To satisfy the purpose of the audit, auditors must obtain a sufficient quality and quantity of evidence. Auditors must determine the types and amount of evidence necessary and evaluate whether the information corresponds to the established criteria.

Auditors strive to maintain a high level of independence to keep the confidence of users relying on their reports. Auditors reporting on company financial statements are often called independent auditors. Even though such auditors are paid fees by the company, they are normally sufficiently independent to conduct audits that can be relied on by users. Even internal auditors—those employed by the companies they audit—usually report directly to top management and the board of directors, keeping the auditors independent of the operating units they audit.

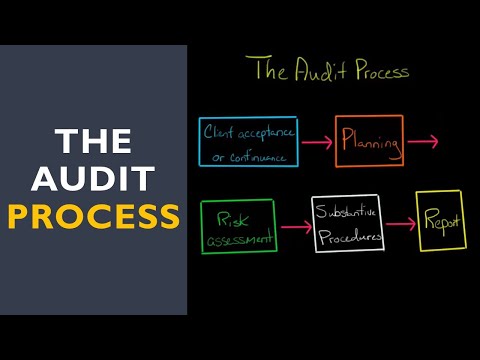

The final stage in the auditing process is preparing the audit report, which communicates the auditor’s findings to users. Reports differ in nature, but all must inform readers of the degree of correspondence between the information audited and established criteria. Reports also differ in form and can vary from the highly technical type usually associated with financial statement audits to a simple oral report in the case of an operational audit of a small department’s effectiveness.o determine whether the tax return was prepared in a manner consistent with the requirements of the federal Internal Revenue Code, the agent examines supporting records provided by the taxpayer and from other sources, such as the taxpayer’s employer. After completing the audit, the internal revenue agent issues a report to the taxpayer assessing additional taxes, advising that a refund is due, or stating that there is no change in the status of the tax return.

Accounting is the recording, classifying, and summarizing of economic events in a logical manner for the purpose of providing financial information for decision making. To provide relevant information, accountants must have a thorough understanding of the principles and rules that provide the basis for preparing the accounting information. In addition, accountants must develop a system to make sure that the entity’s economic events are properly recorded on a timely basis and at a reasonable cost.

#accountingmajor #accountingstudent #auditcourse

Auditing is the accumulation and evaluation of evidence about information to determine and report on the degree of correspondence between the information and established criteria. Auditing should be done by a competent, independent person.

To do an audit, there must be information in a verifiable form and some standards (criteria) by which the auditor can evaluate the information. This information can take many forms. Auditors routinely perform audits of quantifiable information, including companies’ financial statements and individuals’ federal income tax returns. Auditors also audit more subjective information, such as the effectiveness of computer systems and the efficiency of manufacturing operations.

The criteria for evaluating information also vary depending on the information being audited. In the audit of historical financial statements by CPA firms, the criteria may be U.S. generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). This means that in an audit of Apple’s financial statements, the CPA firm will determine whether Apple’s financial statements have been prepared in accordance with GAAP. For an audit of internal control over financial reporting, the criteria will be a recognized framework for establishing internal control, such as Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (widely known as COSO).

Evidence is any information used by the auditor to determine whether the information being audited is stated in accordance with the established criteria. Evidence takes many different forms, including:

Electronic and documentary data about transactions

Written and electronic communication with outsiders

Observations by the auditor

Oral testimony of the auditee (client)

To satisfy the purpose of the audit, auditors must obtain a sufficient quality and quantity of evidence. Auditors must determine the types and amount of evidence necessary and evaluate whether the information corresponds to the established criteria.

Auditors strive to maintain a high level of independence to keep the confidence of users relying on their reports. Auditors reporting on company financial statements are often called independent auditors. Even though such auditors are paid fees by the company, they are normally sufficiently independent to conduct audits that can be relied on by users. Even internal auditors—those employed by the companies they audit—usually report directly to top management and the board of directors, keeping the auditors independent of the operating units they audit.

The final stage in the auditing process is preparing the audit report, which communicates the auditor’s findings to users. Reports differ in nature, but all must inform readers of the degree of correspondence between the information audited and established criteria. Reports also differ in form and can vary from the highly technical type usually associated with financial statement audits to a simple oral report in the case of an operational audit of a small department’s effectiveness.o determine whether the tax return was prepared in a manner consistent with the requirements of the federal Internal Revenue Code, the agent examines supporting records provided by the taxpayer and from other sources, such as the taxpayer’s employer. After completing the audit, the internal revenue agent issues a report to the taxpayer assessing additional taxes, advising that a refund is due, or stating that there is no change in the status of the tax return.

Accounting is the recording, classifying, and summarizing of economic events in a logical manner for the purpose of providing financial information for decision making. To provide relevant information, accountants must have a thorough understanding of the principles and rules that provide the basis for preparing the accounting information. In addition, accountants must develop a system to make sure that the entity’s economic events are properly recorded on a timely basis and at a reasonable cost.

Комментарии

0:10:56

0:10:56

2:11:39

2:11:39

0:05:42

0:05:42

0:14:18

0:14:18

0:38:34

0:38:34

0:06:42

0:06:42

0:51:48

0:51:48

0:09:58

0:09:58

0:06:01

0:06:01

0:06:08

0:06:08

0:16:26

0:16:26

0:34:28

0:34:28

1:04:07

1:04:07

0:08:45

0:08:45

0:20:08

0:20:08

0:07:37

0:07:37

1:01:21

1:01:21

0:51:16

0:51:16

1:14:01

1:14:01

0:05:28

0:05:28

0:06:07

0:06:07

0:04:53

0:04:53

0:06:12

0:06:12

0:06:56

0:06:56