filmov

tv

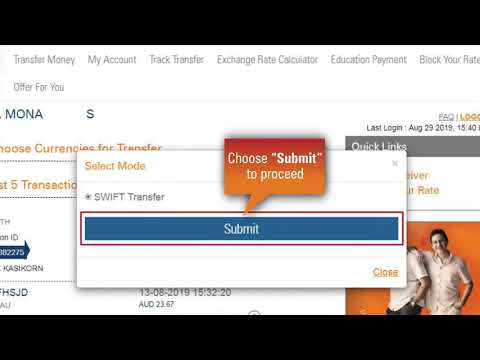

Moving Money Overseas and Back: What Every Nonprofit Operating Internationally Needs to Know

Показать описание

Operating internationally has never been more popular, or more complicated. The new administration has expressed a preference to support domestic operations; therefore, it is anticipated that the scrutiny associated with the cross-border movement of money and services will remain a focal point for enforcement. In addition to understanding and observing the critical legal and tax implications and associated formation and reporting obligations, nonprofit entities must also operate in line with the complex and ever-evolving anti-corruption and sanctions programs. Compliance (US and local) for international operations are of critical importance from a legal and day-to-day operational perspective. Cash movement across borders have consequences ranging from foreign currency control issues to local language requirements. Moreover, for those organizations engaging in international grant-making, the IRS continues to closely scrutinize grant-making practices to ensure compliance with regulatory requirements and recommended best practices. If you are interested in enhancing your knowledge of the associated formation, taxation, accounting, and regulated trade issues and concerns, this program is for you.

Using practical examples, this panel will discuss the tips and traps associated with a nonprofit’s movement of money to and from the United States and, of course, provide an opportunity for you to ask the difficult questions facing your organization.

Using practical examples, this panel will discuss the tips and traps associated with a nonprofit’s movement of money to and from the United States and, of course, provide an opportunity for you to ask the difficult questions facing your organization.

1:31:00

1:31:00

0:09:05

0:09:05

0:03:56

0:03:56

0:12:34

0:12:34

0:03:16

0:03:16

0:20:27

0:20:27

0:05:39

0:05:39

0:08:40

0:08:40

0:02:58

0:02:58

0:06:51

0:06:51

0:11:07

0:11:07

0:01:36

0:01:36

0:16:26

0:16:26

0:02:22

0:02:22

0:01:41

0:01:41

0:09:48

0:09:48

0:11:13

0:11:13

0:03:19

0:03:19

0:05:16

0:05:16

0:00:16

0:00:16

0:01:57

0:01:57

0:03:30

0:03:30

0:09:18

0:09:18

0:37:31

0:37:31