filmov

tv

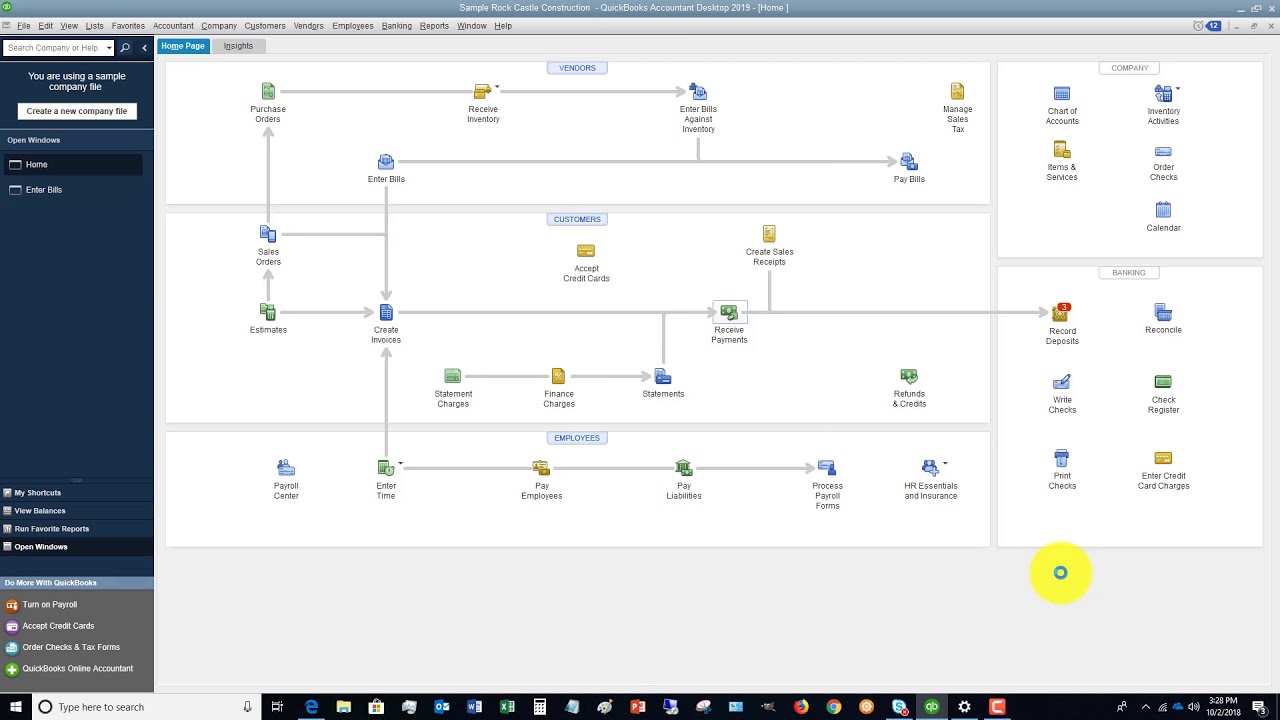

Quickbooks 2019 Tutorial - How to Receive Payments

Показать описание

-~-~~-~~~-~~-~-

-~-~~-~~~-~~-~-

QuickBooks Tutorial: QuickBooks 2019 Course for Beginners - QuickBooks Desktop

Quickbooks 2019 Tutorial New Features - Should You Upgrade to Quickbooks Desktop 2019?

Quickbooks 2019 Tutorial for Beginners - How & When to Use Your Check Register

QUICKBOOKS DESKTOP 2019 Tutorial: 'COMPLETE SETUP' in 25 Minutes by Certified ProAdvisor

Quickbooks 2019 Tutorial for Beginners - How to Receive Payments

Quickbooks 2019 Tutorial for Beginners - How to Set-Up & Use Class Tracking

QuickBooks Pro 2019 Tutorial Part 1: Setting up a Company File

Quickbooks 2019 Tutorial for Beginners - How to Customize Reports

Quickbooks 2019 Tutorial for Beginners - Working With Your Items List

Quickbooks 2019 Tutorial for Beginners - How to Write a Check in Quickbooks Desktop

Quickbooks 2019 Tutorial - How to Enter a Bill the Right Way

Quickbooks 2019 Tutorial for Beginners - How to Make Deposits Correctly

Quickbooks 2019 Tutorial for Beginners - How to Correctly Record Loan Payments

Quickbooks 2019 Tutorial for Beginners - How to Set-Up & Use Price Levels

Introduction to QuickBooks Desktop - 4hr Full Tutorial

Quickbooks 2019 Tutorial for Beginners - How & Why to Use Sales Orders

Quickbooks 2019 Tutorial for Beginners - How to Enter a Bill for Inventory

Quickbooks 2019 Tutorial for Beginners - How to Find Transactions in Quickbooks Desktop

Quickbooks 2019 Tutorial for Beginners - How to Update Multiple List Items in Seconds

QuickBooks 2019 Training Tutorial Part 2: How to Update Your Company Information

Quickbooks 2019 Tutorial for Beginners - How to Record Split Transactions

Quickbooks 2019 Tutorial for Beginners - How to Understand Your Balance Sheet

QuickBooks 2019 Training Tutorial Part 1: How to Create Your Company File

Quickbooks 2019 Tutorial for Beginners - How to Create an Invoice from an Estimate

Комментарии

4:44:15

4:44:15

0:11:27

0:11:27

0:08:57

0:08:57

0:21:20

0:21:20

0:05:48

0:05:48

0:06:36

0:06:36

0:44:14

0:44:14

0:11:36

0:11:36

0:05:43

0:05:43

0:06:16

0:06:16

0:04:42

0:04:42

0:07:56

0:07:56

0:07:14

0:07:14

0:06:06

0:06:06

3:46:02

3:46:02

0:07:04

0:07:04

0:06:25

0:06:25

0:03:48

0:03:48

0:05:50

0:05:50

0:03:47

0:03:47

0:05:26

0:05:26

0:07:55

0:07:55

0:18:11

0:18:11

0:04:39

0:04:39