filmov

tv

Jim Cramer: Toast is a good company, but its stock is too expensive right now to buy

Показать описание

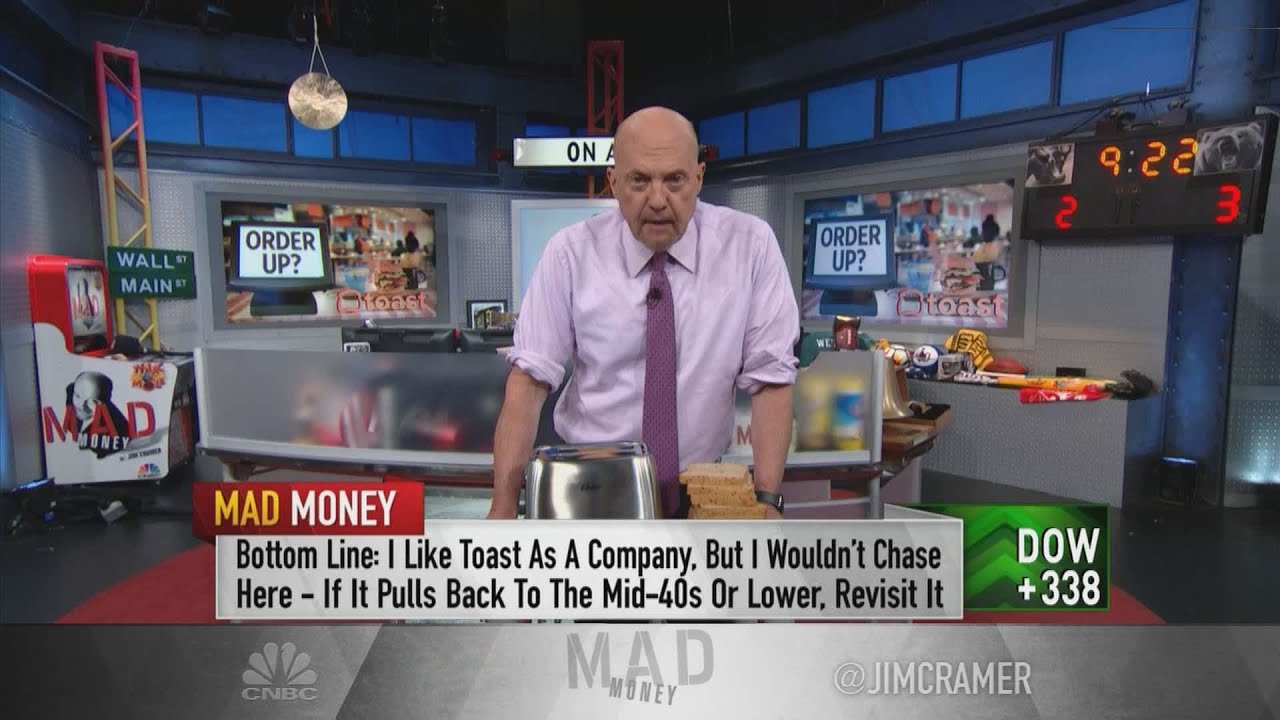

CNBC’s Jim Cramer advised investors to hold off on buying shares of Toast after the restaurant technology company’s public markets debut Wednesday.

The “Mad Money” host said he believes Toast is a “great company,” noting he understands the importance of its tech offerings such as point-of-sale hardware because he’s a restaurant owner himself.

However, “I can’t recommend the stock up here, not with this valuation and it’s kind of somewhat minor moat,” Cramer said, pointing to competition from the likes of Square and Lightspeed.

“Not only do Toast’s customers lack loyalty, they often can’t even afford to pay their bills. That is not the best clientele,” he added, referring to the financial struggles many restaurants have experienced during the Covid crisis.

“Again, that’s no knock on Toast. .. It’s just that this thing has been bid up to ludicrous levels. ... At a much lower price, I’d be telling you to buy it hand over fist,” Cramer said.

Shares of Toast closed at $62.51 on Wednesday, putting the company’s market cap to over $31 billion. Toast sold shares at $40 each in its IPO, above its expected range, to raise $870 million.

“Here’s the bottom line: I like Toast the company, but don’t chase Toast the stock,” Cramer said. “There’s too much risk, too much competition, not enough earnings and most of all, take it from me, they’re dealing with the worst set of clients in the world: struggling restaurateurs.”

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Комментарии

0:02:57

0:02:57

0:04:09

0:04:09

0:00:19

0:00:19

0:13:21

0:13:21

0:00:29

0:00:29

0:00:25

0:00:25

0:09:45

0:09:45

0:03:03

0:03:03

0:03:20

0:03:20

0:01:58

0:01:58

0:03:28

0:03:28

0:05:24

0:05:24

0:03:28

0:03:28

0:10:41

0:10:41

0:01:03

0:01:03

0:01:43

0:01:43

0:04:14

0:04:14

0:03:09

0:03:09

0:03:31

0:03:31

0:01:40

0:01:40

0:04:19

0:04:19

0:03:19

0:03:19

0:03:09

0:03:09

0:03:56

0:03:56