filmov

tv

Monte Carlo Simulation of Investing in S&P 500 w/ Palisade @Risk for Excel

Показать описание

#excel #risk #palisade

Please SUBSCRIBE:

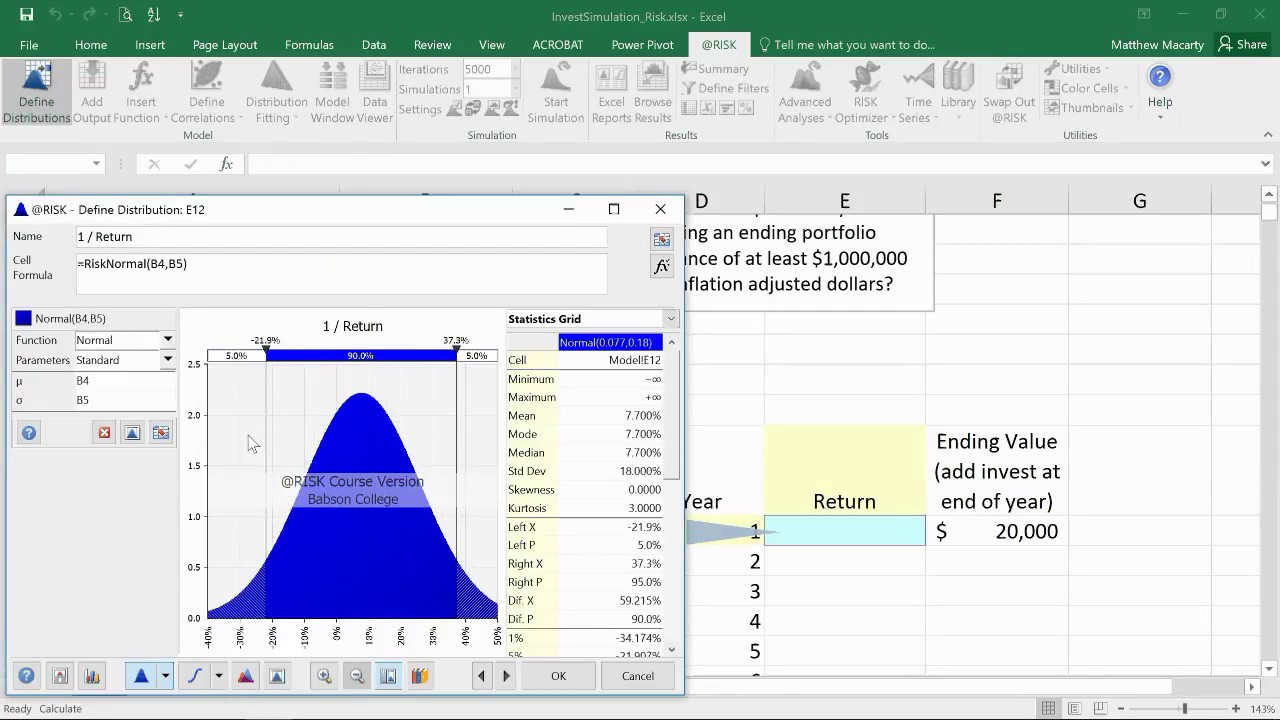

@risk Monte Carlo Simulation in Excel

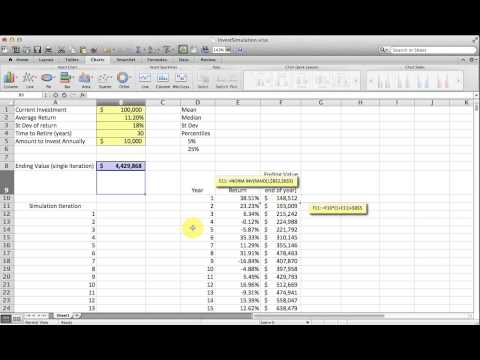

Tutorial demonstration of Palisades @Risk Monte Carlo simulation add-in for Excel. Demonstration covers defining distributions, outputs, various simulation settings, reports and sensitivity analysis.

Provides an overview of the software using an investment in S&P 500 as an example.

Please SUBSCRIBE:

@risk Monte Carlo Simulation in Excel

Tutorial demonstration of Palisades @Risk Monte Carlo simulation add-in for Excel. Demonstration covers defining distributions, outputs, various simulation settings, reports and sensitivity analysis.

Provides an overview of the software using an investment in S&P 500 as an example.

Session 6B: Monte Carlo Simulations in Finance & Investing

What Is Monte Carlo Simulation?

What is Monte Carlo Simulation?

Stock Portfolio Monte Carlo Simulation In Excel

Monte-Carlo Simulations and Financial Planning

Monte Carlo Simulations vs Historical Simulations: Which is Best?

Testing an investment strategy with a Monte Carlo Simulation

How to Stress Test Your Retirement Portfolio Using Monte Carlo Simulation

Using Monte Carlo simulations for valuation

Monte Carlo Simulation and the Impact of AI: A Guide for Investors

How Do Traders Use Monte Carlo Simulations?

Monte Carlo Simulation of Investing in S&P 500 w/ Palisade @Risk for Excel

Monte Carlo Simulations: Run 10,000 Simulations At Once

Excel Monte Carlo Simulation for Investments

A Beginner's Guide to Monte Carlo Simulations

Monte Carlo Simulation of a Stock Portfolio with Python

Why a Monte Carlo Analysis Isn't a Financial Plan

Monte Carlo Technique: How to perform Business Simulations & Assess Projects Profitability | Exc...

Monte Carlo Simulation in Excel - Retirement Savings

Basic Monte Carlo Simulation of a Stock Portfolio in Excel

How to use Monte Carlo simulation to value investment real estate

How to Perform Monte Carlo Simulations for Real Estate in Excel - 30 Second CRE Tutorials

How to Simulate Stock Price Changes with Excel (Monte Carlo)

Basic Monte Carlo Simulation of a Stock Portfolio || Python Programming

Комментарии

0:21:17

0:21:17

0:03:38

0:03:38

0:04:35

0:04:35

0:08:09

0:08:09

0:02:54

0:02:54

0:04:16

0:04:16

0:07:46

0:07:46

0:23:37

0:23:37

0:09:53

0:09:53

0:05:24

0:05:24

0:05:33

0:05:33

0:15:56

0:15:56

0:03:18

0:03:18

0:04:08

0:04:08

0:09:19

0:09:19

0:18:23

0:18:23

0:14:07

0:14:07

0:05:05

0:05:05

0:16:39

0:16:39

0:11:30

0:11:30

0:07:36

0:07:36

0:00:36

0:00:36

0:09:59

0:09:59

0:13:57

0:13:57