filmov

tv

The Impact of Tariffs on High Yield Dividend Stocks

Показать описание

In a massive intensification of his trade war, Donald Trump on Wednesday announced large additional tariffs after the market closed. These tariff amounts caught the world by surprise as they turned out to be much higher than what was expected. Trump declared 10% tariffs on all imports into the US, and even higher duties on items from roughly 60 nations or trading blocs that have a significant trade deficit with the US. This includes levied new duties of 34% and 20% imposed on China and the European Union, respectively. And the tariff rate on Beijing comes in addition to existing 20% tariffs on Chinese imports, meaning the tariff rate on China is 54%.

Impact of Trump tariffs on global trade: Here's what to know

Impact of Trump's tariffs on U.S. ports

What to know about the effect of Trump’s tariffs on globalization

'HORRIBLE MOMENTS': CEO opens up about impact of tariffs

The impact Trump's tariffs are already having on global supply chains and U.S. businesses

How Trump's tariffs will impact the global economy | DW News

What's the impact of President Trump's tariffs worldwide?

How Trump's tariffs will affect the U.S. economy

Ship to Shelf: The Impact of Tariff Tensions -- Part 2

Economic forecasts show Trump's tariffs having major global impact

New Yorkers feel the effects of Trump's tariffs

Trump tariffs: What will the impact be on Canadians' wallets?

Trump Official Shocked by Tariff Impact

What Trump's new tariffs mean for the world economy and the stock market | DW News

‘Just the beginning’: Trump tariffs force online retailers to raise prices

What Trump's Tariffs Mean for The World

'A major escalation': Matt Egan on potential impact of tariffs

How Trump's tariffs could impact your wallet

Flexport CEO on the Impact of Tariffs on Prices

How could tariffs impact Americans and the economy?

Trump’s Auto Tariffs: We Broke Down an F-150 to Explain Industry Impact | WSJ

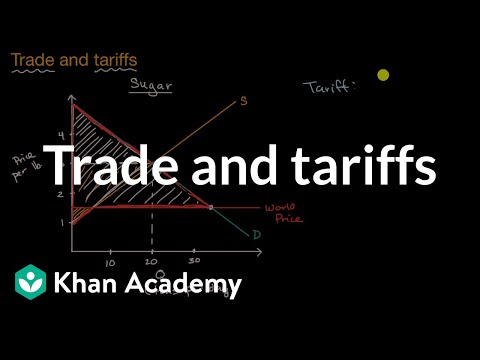

Trade and tariffs | APⓇ Microeconomics | Khan Academy

Why Trump’s tariffs are a massive mistake

The impact of tariffs on the dollar #shorts

Комментарии

0:07:49

0:07:49

0:03:58

0:03:58

0:05:32

0:05:32

0:07:53

0:07:53

0:11:42

0:11:42

0:12:43

0:12:43

0:03:23

0:03:23

0:05:32

0:05:32

0:09:31

0:09:31

0:07:52

0:07:52

0:00:33

0:00:33

0:01:41

0:01:41

0:00:17

0:00:17

0:12:33

0:12:33

0:03:07

0:03:07

0:09:12

0:09:12

0:10:48

0:10:48

0:03:21

0:03:21

0:01:19

0:01:19

0:05:32

0:05:32

0:08:00

0:08:00

0:07:05

0:07:05

0:02:57

0:02:57

0:00:56

0:00:56