filmov

tv

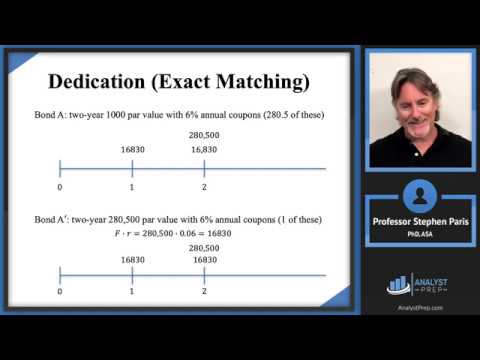

Dedication (Exact Matching) (SOA Exam FM – Financial Mathematics – Module 4, Section 5, Part 1)

Показать описание

AnalystPrep's Actuarial Exams Video Series

SOA Exam FM (Financial Mathematics) Module 4, Section 5, Part 1

After completing this video you should be able to:

- Define and recognize the definitions of the following terms: cash flow matching.

- Construct an investment portfolio to:

• Exactly match a set of liability cash flows.

Example given in the video:

A company has a 95,030 liability due in one year and another 297,330 liability due in two years. The company has the following two types of bonds they can use to exactly match these liabilities:

Bond A is a two year 1000 par value bond with 6% annual coupons

Bond B is a one year zero coupon bond redeemable at 1000

Determine the number of each type of bond the company should buy in order to exactly match the liabilities.

SOA Exam FM (Financial Mathematics) Module 4, Section 5, Part 1

After completing this video you should be able to:

- Define and recognize the definitions of the following terms: cash flow matching.

- Construct an investment portfolio to:

• Exactly match a set of liability cash flows.

Example given in the video:

A company has a 95,030 liability due in one year and another 297,330 liability due in two years. The company has the following two types of bonds they can use to exactly match these liabilities:

Bond A is a two year 1000 par value bond with 6% annual coupons

Bond B is a one year zero coupon bond redeemable at 1000

Determine the number of each type of bond the company should buy in order to exactly match the liabilities.

0:03:43

0:03:43

0:03:55

0:03:55

0:12:28

0:12:28

0:04:42

0:04:42

0:05:04

0:05:04

0:08:56

0:08:56

0:02:09

0:02:09

0:15:38

0:15:38

0:06:49

0:06:49

0:06:33

0:06:33

0:04:03

0:04:03

0:03:55

0:03:55

0:05:25

0:05:25

0:14:38

0:14:38

0:04:51

0:04:51

0:04:35

0:04:35

0:05:48

0:05:48

0:10:59

0:10:59

0:22:07

0:22:07

0:01:58

0:01:58

0:12:01

0:12:01

0:30:01

0:30:01

0:04:15

0:04:15