filmov

tv

Net Income Formula (Example) | How to Calculate Net Income?

Показать описание

In this video on Net Income Formula, here we discuss the formula to calculate net income along with practical example and downloadable excel template.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐍𝐞𝐭 𝐈𝐧𝐜𝐨𝐦𝐞 ?

--------------------------------------

Net income or net profit is calculated to allow investors to measure the amount by which the total income exceeds the Company's total expenses.

𝐍𝐞𝐭 𝐈𝐧𝐜𝐨𝐦𝐞 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

-------------------------------------

Net Income Formula = Total Revenues – Total Expenses

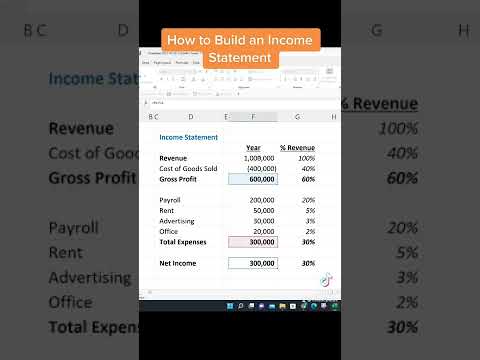

𝐄𝐱𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐍𝐞𝐭 𝐈𝐧𝐜𝐨𝐦𝐞 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

-------------------------------------------------------

Company BDA Inc. had income from the sale of $ 200,000 for the year 2016. It paid $ 30,000 as employee wages, $ 60,000 for raw materials and goods, $ 6,000 for other office and factory maintenance expenses.

The Company had interest income of $ 4000 and paid $ 2700 in taxes. What is the net income of the Company BDA Inc.?

From above data we need to first calculate total revenue and total expense.

Total Revenue

Total Revenue = 200000 + 4000 = 204,000.

Total Expenses = Employee wages + raw materials + office and factory maintenance + interest income + taxes

Total expenses = 30000 + 60000 + 6000 + 4000 + 2700 = $102700.

By using above formula we get net income as follows,

Net Income = Total revenue – total expenses

Net Income = 204,000 – 102700

Net Income = $101300

Connect with us!

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐍𝐞𝐭 𝐈𝐧𝐜𝐨𝐦𝐞 ?

--------------------------------------

Net income or net profit is calculated to allow investors to measure the amount by which the total income exceeds the Company's total expenses.

𝐍𝐞𝐭 𝐈𝐧𝐜𝐨𝐦𝐞 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

-------------------------------------

Net Income Formula = Total Revenues – Total Expenses

𝐄𝐱𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐍𝐞𝐭 𝐈𝐧𝐜𝐨𝐦𝐞 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

-------------------------------------------------------

Company BDA Inc. had income from the sale of $ 200,000 for the year 2016. It paid $ 30,000 as employee wages, $ 60,000 for raw materials and goods, $ 6,000 for other office and factory maintenance expenses.

The Company had interest income of $ 4000 and paid $ 2700 in taxes. What is the net income of the Company BDA Inc.?

From above data we need to first calculate total revenue and total expense.

Total Revenue

Total Revenue = 200000 + 4000 = 204,000.

Total Expenses = Employee wages + raw materials + office and factory maintenance + interest income + taxes

Total expenses = 30000 + 60000 + 6000 + 4000 + 2700 = $102700.

By using above formula we get net income as follows,

Net Income = Total revenue – total expenses

Net Income = 204,000 – 102700

Net Income = $101300

Connect with us!

Комментарии

0:11:45

0:11:45

0:02:27

0:02:27

0:00:20

0:00:20

0:08:17

0:08:17

0:00:29

0:00:29

0:01:29

0:01:29

0:01:46

0:01:46

0:00:32

0:00:32

1:16:12

1:16:12

0:16:55

0:16:55

0:01:42

0:01:42

0:02:32

0:02:32

0:05:09

0:05:09

0:00:20

0:00:20

0:01:22

0:01:22

0:02:34

0:02:34

0:04:18

0:04:18

0:03:16

0:03:16

0:00:18

0:00:18

0:12:40

0:12:40

0:10:25

0:10:25

0:12:32

0:12:32

0:06:07

0:06:07

0:00:32

0:00:32