filmov

tv

Speculation

Показать описание

Speculation is often considered to be morally dubious. But, can speculation actually be useful to the market process? This video shows that speculation can actually smooth prices over time and increase welfare.

Speculators take resources from where they have low value and move them through time to where they have high value. We also take a look at speculation in the futures market — for instance, can orange juice future prices help predict Florida weather? Let’s find out.

00:00 Introduction

00:42 Speculation

02:07 Speculation tends to smoothen prices

04:00 Speculation increases welfare

05:30 Futures market

07:57 The use of information in markets

08:56 Conclusion

Speculators take resources from where they have low value and move them through time to where they have high value. We also take a look at speculation in the futures market — for instance, can orange juice future prices help predict Florida weather? Let’s find out.

00:00 Introduction

00:42 Speculation

02:07 Speculation tends to smoothen prices

04:00 Speculation increases welfare

05:30 Futures market

07:57 The use of information in markets

08:56 Conclusion

The Difference Between Saving, Investing, and Speculating

Warren Buffett Explains Investing vs Speculating

Modals Verbs of Deduction and Speculation - English Grammar Lesson (Upper Intermediate)

Modals of Speculation - rules and examples - (English Grammar)

Bitcoin: Dubious Speculation

🔵 Speculate Speculative Speculator Speculation - Speculate Meaning - Speculation Examples- Business...

What is speculation?

SME IPO Boom: Growth or Speculation? | ithought Advisory

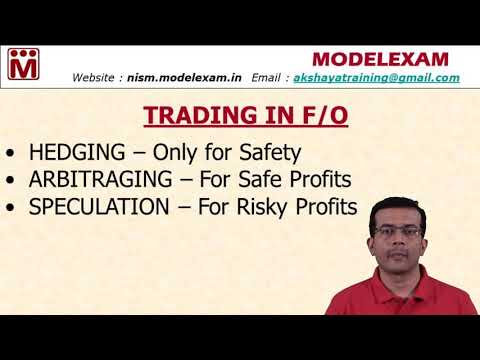

What is the difference between Hedging, Speculation and Arbitraging ?

Speculation Meaning

🎲 Speculation - is it good for the economy?

[IIDX EPOLIS] Speculation / BEMANI Sound Team 'ZAQUVA'

How to use MODALS of Deduction & Speculation in the PRESENT 🕵🏻♀️

What Makes an Investment Speculative?

Kirky - Speculations [Music Video] | GRM Daily

L'économie, mode d'emploi - Qu'est-ce que la spéculation?

2 1 10 Hardware Based Speculation

The Problem with Real Estate Speculation

Investing vs Speculation, Are you Gambling or Investing? 🎲

Speculation

Beatmania IIDX 31 EPOLIS Speculation SPA

Speculative attack on a currency | Foreign exchange and trade | Macroeconomics | Khan Academy

You're Speculation

Hedging vs. Speculating?

Комментарии

0:02:49

0:02:49

0:01:32

0:01:32

0:02:42

0:02:42

0:06:04

0:06:04

0:32:49

0:32:49

0:05:37

0:05:37

0:02:06

0:02:06

0:01:00

0:01:00

0:02:39

0:02:39

0:00:45

0:00:45

0:08:48

0:08:48

![[IIDX EPOLIS] Speculation](https://i.ytimg.com/vi/fqx46agM94w/hqdefault.jpg) 0:02:01

0:02:01

0:09:25

0:09:25

0:10:29

0:10:29

0:03:10

0:03:10

0:02:48

0:02:48

0:13:52

0:13:52

0:08:36

0:08:36

0:05:31

0:05:31

0:10:51

0:10:51

0:02:20

0:02:20

0:07:49

0:07:49

0:03:42

0:03:42

0:10:08

0:10:08