filmov

tv

Bonds vs Stocks vs Mutual Funds: What You Need to Know

Показать описание

Everyone knows you shouldn’t keep all your eggs in one basket. Right? Bonds, stocks, and mutual funds are powerful components of a well diversified portfolio. That’s why it’s important to understand what these investments are and how they differ.

Bonds are investments designed to help governments or corporations raise money to finance projects. The investor does not receive stock ownership in the company, but they do receive an interest payment. Bonds are “fixed income” assets, which means they pay interest at regular intervals until they reach maturity.

Bond issuers can be cities and states (municipal bonds), the US Treasury (government bonds), or government-affiliated organizations such as the FHA or SBA (agency bonds). When governments and government agencies need to raise money to finance debt, they can only issue bonds, which is a unique characteristic of bonds vs stocks vs mutual funds.

Unlike bonds, when you buy stock, you buy ownership in a company and in effect tie your financial future to theirs. If the business does well by selling more of their products and services, you may benefit by seeing the value of your stock increase; if it does poorly, you risk losing some or all of your investment.

Stocks tend to be riskier than bonds because you are not guaranteed that the stock will do well, and companies sell stock for a lot of reasons. They may want to expand into a new market, develop new products, or even pay off debt. The first time a company sells stock, it’s called an initial public offering or IPO.

Determining a “good” price for an individual stock is far from a precise science. That’s why you see wildly different analyst forecasts for the same stock. Diversification is choosing different investments within each asset class to spread the risk and boost returns. That’s why it's important to diversify your portfolio.

Mutual funds may own stocks, but they’re not the same as stocks. When you buy shares in a mutual fund, you don’t actually own shares of the stock it invests in, you own a piece of the fund itself. A mutual fund share price is called the net asset value (NAV), and it’s calculated by dividing the total value of the assets in the fund’s portfolio by the number of outstanding shares.

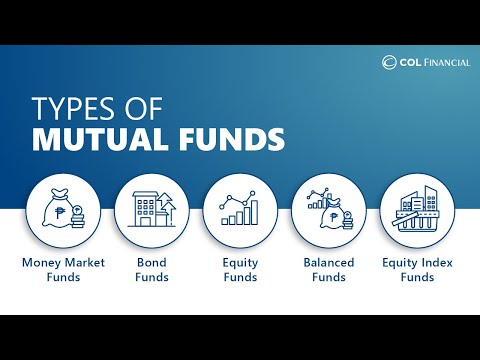

Mutual funds can invest in any asset class, so you can find bond funds, stock funds, money market funds, funds that invest in commodities such as precious metals or oil and gas, foreign exchange (forex) funds, real estate funds, and even cryptocurrency mutual funds. If you’re interested in exploring growth opportunities in markets with high barriers to entry, a mutual fund is a great way to get your feet wet.

It takes time and effort to build a well-diversified portfolio; there are over 10,000 stocks available worldwide and 8,000 different mutual funds. It’s a huge task to compare them all and find the ones that align with your values, goals, and investment objectives.

And once you build your portfolio, it needs regular attention.

Bonds are investments designed to help governments or corporations raise money to finance projects. The investor does not receive stock ownership in the company, but they do receive an interest payment. Bonds are “fixed income” assets, which means they pay interest at regular intervals until they reach maturity.

Bond issuers can be cities and states (municipal bonds), the US Treasury (government bonds), or government-affiliated organizations such as the FHA or SBA (agency bonds). When governments and government agencies need to raise money to finance debt, they can only issue bonds, which is a unique characteristic of bonds vs stocks vs mutual funds.

Unlike bonds, when you buy stock, you buy ownership in a company and in effect tie your financial future to theirs. If the business does well by selling more of their products and services, you may benefit by seeing the value of your stock increase; if it does poorly, you risk losing some or all of your investment.

Stocks tend to be riskier than bonds because you are not guaranteed that the stock will do well, and companies sell stock for a lot of reasons. They may want to expand into a new market, develop new products, or even pay off debt. The first time a company sells stock, it’s called an initial public offering or IPO.

Determining a “good” price for an individual stock is far from a precise science. That’s why you see wildly different analyst forecasts for the same stock. Diversification is choosing different investments within each asset class to spread the risk and boost returns. That’s why it's important to diversify your portfolio.

Mutual funds may own stocks, but they’re not the same as stocks. When you buy shares in a mutual fund, you don’t actually own shares of the stock it invests in, you own a piece of the fund itself. A mutual fund share price is called the net asset value (NAV), and it’s calculated by dividing the total value of the assets in the fund’s portfolio by the number of outstanding shares.

Mutual funds can invest in any asset class, so you can find bond funds, stock funds, money market funds, funds that invest in commodities such as precious metals or oil and gas, foreign exchange (forex) funds, real estate funds, and even cryptocurrency mutual funds. If you’re interested in exploring growth opportunities in markets with high barriers to entry, a mutual fund is a great way to get your feet wet.

It takes time and effort to build a well-diversified portfolio; there are over 10,000 stocks available worldwide and 8,000 different mutual funds. It’s a huge task to compare them all and find the ones that align with your values, goals, and investment objectives.

And once you build your portfolio, it needs regular attention.

0:03:15

0:03:15

0:07:26

0:07:26

0:02:14

0:02:14

0:01:40

0:01:40

0:09:13

0:09:13

0:09:35

0:09:35

0:07:44

0:07:44

0:09:54

0:09:54

0:13:18

0:13:18

0:45:01

0:45:01

0:12:37

0:12:37

0:05:05

0:05:05

0:03:42

0:03:42

0:10:29

0:10:29

0:06:17

0:06:17

0:11:53

0:11:53

0:15:02

0:15:02

0:22:03

0:22:03

0:14:06

0:14:06

0:03:22

0:03:22

0:06:17

0:06:17

0:12:34

0:12:34

0:08:43

0:08:43

0:08:08

0:08:08