filmov

tv

🔴8 Common Payroll & Salary Calculation Mistakes that Companies & HRs Do

Показать описание

.....................................................

.....................................................

.....................................................

We are coving common payroll mistakes which are done by companies and HRs. If you are into payroll compliances or running a company you should watch this video.

.....................................................

Chapters:

00:00 introduction

01:09 1. CTC Based contracts

03:18 2. Too Many Allowances

05:11 3. Monthly Bonus & Gratuity

06:43 4. Not Knowing applicable acts

08:11 5. Not knowing calculation & rules

09:00 6. Delay in filing

09:42 7. Relying on Softwares Only

11:00 8. Lack of Record Keeping

12:30 Learn Payroll Processing

.....................................................

Telegram: @JoinLLA

.....................................................

#LLA #Payroll #Compliance

.....................................................

.....................................................

We are coving common payroll mistakes which are done by companies and HRs. If you are into payroll compliances or running a company you should watch this video.

.....................................................

Chapters:

00:00 introduction

01:09 1. CTC Based contracts

03:18 2. Too Many Allowances

05:11 3. Monthly Bonus & Gratuity

06:43 4. Not Knowing applicable acts

08:11 5. Not knowing calculation & rules

09:00 6. Delay in filing

09:42 7. Relying on Softwares Only

11:00 8. Lack of Record Keeping

12:30 Learn Payroll Processing

.....................................................

Telegram: @JoinLLA

.....................................................

#LLA #Payroll #Compliance

🔴8 Common Payroll & Salary Calculation Mistakes that Companies & HRs Do

How to Calculate Gross Pay

Pay Matrix Table 6, 7, 8 & 9 #7th #paymatrix #pay #govtemployees #govtemployeeslatestnews

Pay Matrix 7th Pay Commission #7th #7thpaycommission #govtemployees #8thpaycommission #increment

Salary entries for beginners | salary advance adjustment entry | Payroll entries

Roblox Games That Are Pay To Win...

Magkano ang Sahod ng Pulis? | PNP Basic Pay and Ranks 2023

The Price We Pay For Quality! #Snapon #MrSubaru1387 #shortvideo

How much does B.TECH pay?

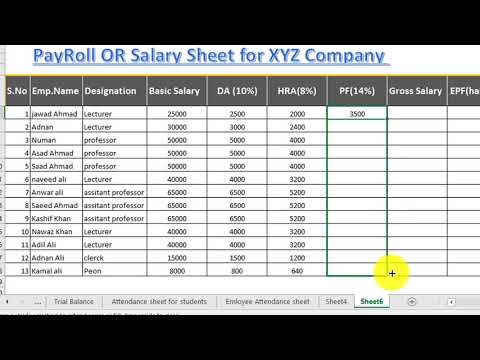

How to make salary sheet || Payroll or Payslip in excel 2016

Why Elon Musk does NOT pay taxes explained by Jaspreet Singh🤓📈💸

Pay Matrix Table as per 7th pay commission #matrixtable7thpaycpc #matrix #7th #govtemployees

Apple Pay | The Dance | Apple

How much does BTECH pay?

10 Difficult Skills that Pay Off Forever

Financial Accounting | Payroll Calculations | Gross Pay | Total Deductions | Take-home | Tax Expense

How much does CHEMICAL ENGINEERING pay?

iPad 8 2020! Why Pay MORE?!

My boss says holiday pay is included within my hourly rate. Is this legal? [LBC Legal Hour]

Back Pay for VA Disability | How far back does VA Disability Pay? | Veterans Benefits | theSITREP

How much does PUBLIC POLICY pay?

What is the most Section 8 will pay?

How much does BBA pay?

8 Dividend Stocks That Pay Me $660+ Per Month

Комментарии

0:13:49

0:13:49

0:05:50

0:05:50

0:00:16

0:00:16

0:00:16

0:00:16

0:08:04

0:08:04

0:01:00

0:01:00

0:09:19

0:09:19

0:00:23

0:00:23

0:00:34

0:00:34

0:05:02

0:05:02

0:00:57

0:00:57

0:00:16

0:00:16

0:00:31

0:00:31

0:00:49

0:00:49

0:08:15

0:08:15

0:13:50

0:13:50

0:00:56

0:00:56

0:07:24

0:07:24

0:03:42

0:03:42

0:03:17

0:03:17

0:00:47

0:00:47

0:03:44

0:03:44

0:00:38

0:00:38

0:13:18

0:13:18