filmov

tv

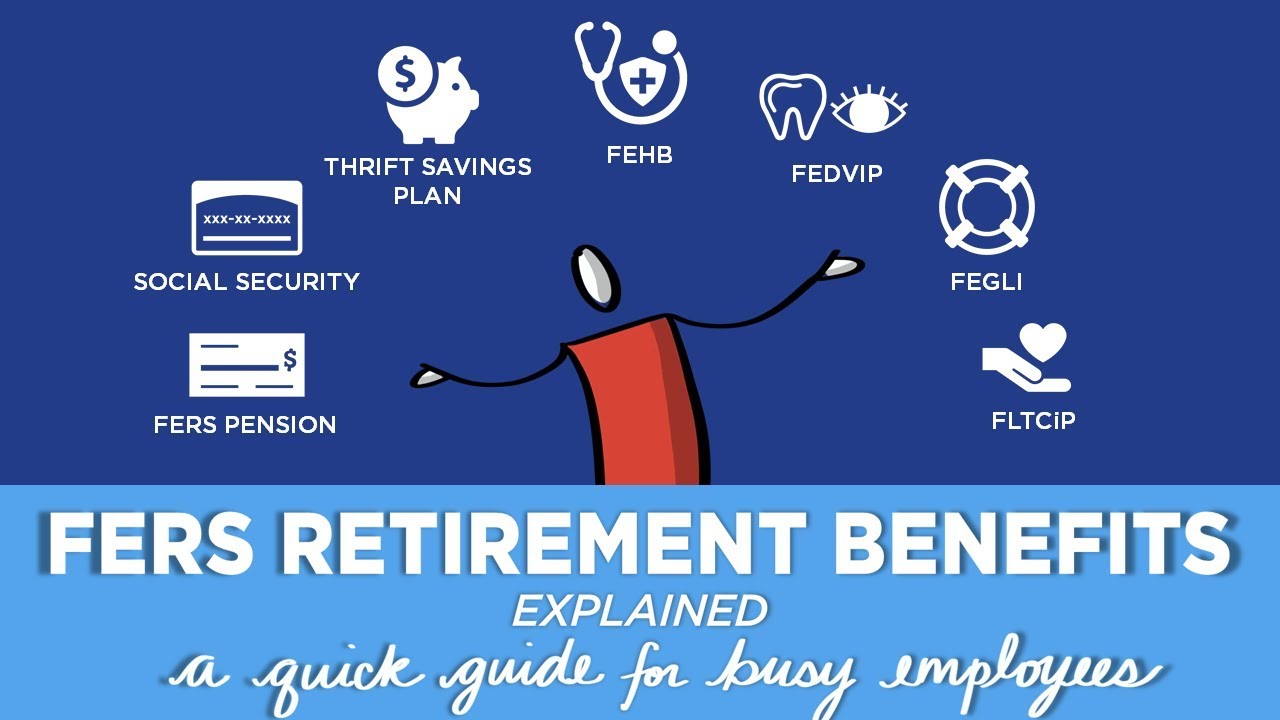

FERS Retirement Benefits Explained (A quick guide for busy employees)

Показать описание

“You work for the government. You must have a great retirement!”

As a FERS employee, you have 7 distinct retirement benefits to help you retire comfortably! Here's a quick guide to help you understand more about each benefit.

______________

It’s helpful to think of the benefits in terms of what they do for you in retirement. The first three benefits are income-based, which means money in your pocket. The next four benefits are insurance-based, which means “rainy day” protection for you and your family. Each benefit is subject to eligibility requirements.

1 FERS PENSION. You can get a monthly check from the FERS pension for as long as you live in retirement. Plus, there’s a benefit for your spouse if you pass away first. The amount you get in retirement is based upon how long you worked for the Federal government, what age you retire and how much you earned.

There is an additional benefit that you may receive called FERS Supplement (sometimes it’s referred to as the “Social Security” Supplement). It’s only for eligible, long-term employees who retire under age 62. This is a separate benefit from FERS pension.

2 SOCIAL SECURITY. You can get a monthly check for as long as you live, with a potential benefit for your spouse if you pass away first. The amount you receive from Social Security is based upon how much money you earned over your entire work history (not just Federal employment) and at what age you are when you start receiving your benefit. You can start receiving your benefit as young as 62, but your benefit will be permanently reduced. The older you are, the more you’ll receive each month (maximum at age 70).

3 THRIFT SAVINGS PLAN. TSP is a different from FERS and Social Security. That’s because it’s a retirement savings plan—the amount you get from TSP is based upon how much you saved, your FERS Match and how the investments performed. You can choose to receive a monthly check from TSP, but there are also many other ways to set up income from TSP in retirement. Keep in mind that there are IRS age requirements. TSP offers a Traditional TSP and a Roth TSP. The investment options remain the same in retirement.

4 FEDERAL EMPLOYEES HEALTH BENEFITS (FEHB). This benefit provides health insurance for you, your spouse and eligible dependents that you can take into retirement. The share of cost and choices stay the same in retirement. You, as the employee, must meet eligibility requirements.

5 FEDERAL EMPLOYEES DENTAL AND VISION INSURANCE PROGRAM (FEDVIP). This benefit provides dental and/or vision insurance for you, your spouse and eligible dependents that you can take into retirement. The share of cost and choices stay the same in retirement.

6 FEDERAL EMPLOYEES GROUP LIFE INSURANCE (FEGLI). This benefit provides life insurance for you, your spouse and eligible dependents that you can take into retirement. The share of cost may change; however, there are flexible choices to suit your needs. Some options may even be free of charge in retirement. You, your spouse, and eligible dependents must meet eligibility requirements.

7 FEDERAL LONG TERM CARE INSURANCE PROGRAM (FLTCiP). This benefit provides long term care insurance coverage for you, your spouse and eligible family members. You can take existing coverage with you into retirement; or apply for coverage after you retire. Coverage subject to underwriting approval at time of application

______________________________

PROJECT Prepare2Retire is an educational division of The Monroe Team, Inc. DUNS Number: 032 057260. CAGE Code: 735L3. NAICS Code: 611710 Educational Support Services. Woman-owned, small business.

PROJECT Prepare2Retire and FERS Blueprint are not affiliated with, endorsed or sponsored by the Federal Government or any US Government agency. PROJECT Prepare2Retire and FERS Blueprint are educational only. No specific financial, retirement nor tax advice is being offered. The material presented is as current as possible, but is necessarily generalized. Facts and opinions are based on research and experience, but are not endorsed by the Federal Government. It is recommended to consult with your personnel office and/or the Office of Personnel Management (OPM) Retirement Office, Thrift Savings Plan, Social Security, Medicare, Internal Revenue Service, your legal, tax and/or other advisor(s).

© 2017. The Monroe Team, Inc.

As a FERS employee, you have 7 distinct retirement benefits to help you retire comfortably! Here's a quick guide to help you understand more about each benefit.

______________

It’s helpful to think of the benefits in terms of what they do for you in retirement. The first three benefits are income-based, which means money in your pocket. The next four benefits are insurance-based, which means “rainy day” protection for you and your family. Each benefit is subject to eligibility requirements.

1 FERS PENSION. You can get a monthly check from the FERS pension for as long as you live in retirement. Plus, there’s a benefit for your spouse if you pass away first. The amount you get in retirement is based upon how long you worked for the Federal government, what age you retire and how much you earned.

There is an additional benefit that you may receive called FERS Supplement (sometimes it’s referred to as the “Social Security” Supplement). It’s only for eligible, long-term employees who retire under age 62. This is a separate benefit from FERS pension.

2 SOCIAL SECURITY. You can get a monthly check for as long as you live, with a potential benefit for your spouse if you pass away first. The amount you receive from Social Security is based upon how much money you earned over your entire work history (not just Federal employment) and at what age you are when you start receiving your benefit. You can start receiving your benefit as young as 62, but your benefit will be permanently reduced. The older you are, the more you’ll receive each month (maximum at age 70).

3 THRIFT SAVINGS PLAN. TSP is a different from FERS and Social Security. That’s because it’s a retirement savings plan—the amount you get from TSP is based upon how much you saved, your FERS Match and how the investments performed. You can choose to receive a monthly check from TSP, but there are also many other ways to set up income from TSP in retirement. Keep in mind that there are IRS age requirements. TSP offers a Traditional TSP and a Roth TSP. The investment options remain the same in retirement.

4 FEDERAL EMPLOYEES HEALTH BENEFITS (FEHB). This benefit provides health insurance for you, your spouse and eligible dependents that you can take into retirement. The share of cost and choices stay the same in retirement. You, as the employee, must meet eligibility requirements.

5 FEDERAL EMPLOYEES DENTAL AND VISION INSURANCE PROGRAM (FEDVIP). This benefit provides dental and/or vision insurance for you, your spouse and eligible dependents that you can take into retirement. The share of cost and choices stay the same in retirement.

6 FEDERAL EMPLOYEES GROUP LIFE INSURANCE (FEGLI). This benefit provides life insurance for you, your spouse and eligible dependents that you can take into retirement. The share of cost may change; however, there are flexible choices to suit your needs. Some options may even be free of charge in retirement. You, your spouse, and eligible dependents must meet eligibility requirements.

7 FEDERAL LONG TERM CARE INSURANCE PROGRAM (FLTCiP). This benefit provides long term care insurance coverage for you, your spouse and eligible family members. You can take existing coverage with you into retirement; or apply for coverage after you retire. Coverage subject to underwriting approval at time of application

______________________________

PROJECT Prepare2Retire is an educational division of The Monroe Team, Inc. DUNS Number: 032 057260. CAGE Code: 735L3. NAICS Code: 611710 Educational Support Services. Woman-owned, small business.

PROJECT Prepare2Retire and FERS Blueprint are not affiliated with, endorsed or sponsored by the Federal Government or any US Government agency. PROJECT Prepare2Retire and FERS Blueprint are educational only. No specific financial, retirement nor tax advice is being offered. The material presented is as current as possible, but is necessarily generalized. Facts and opinions are based on research and experience, but are not endorsed by the Federal Government. It is recommended to consult with your personnel office and/or the Office of Personnel Management (OPM) Retirement Office, Thrift Savings Plan, Social Security, Medicare, Internal Revenue Service, your legal, tax and/or other advisor(s).

© 2017. The Monroe Team, Inc.

Комментарии

0:09:25

0:09:25

0:09:40

0:09:40

0:09:24

0:09:24

0:13:32

0:13:32

0:16:09

0:16:09

0:05:31

0:05:31

0:47:25

0:47:25

0:05:56

0:05:56

0:28:30

0:28:30

0:02:55

0:02:55

0:13:16

0:13:16

0:07:43

0:07:43

0:01:18

0:01:18

0:04:49

0:04:49

0:03:50

0:03:50

0:06:21

0:06:21

0:05:30

0:05:30

0:07:01

0:07:01

0:03:29

0:03:29

0:05:58

0:05:58

0:12:17

0:12:17

0:10:16

0:10:16

0:20:02

0:20:02

0:03:56

0:03:56