filmov

tv

SWIFT Payment System Explained

Показать описание

What is SWIFT?

SWIFT, also called Society for Worldwide Interbank Financial Telecommunications, is a message network which is used by financial organizations such as banks and money brokers to communicate with each other using predefined messages and instructions. Put it simple, SWIFT is just working like a social network in which the users are all financial institutions. Each user will have a unique SWIFT id, and they can securely send and receive information between each other for their daily business, such as money transfer etc. This will enable the payee to transfer money to an account located in another bank in other countries. To uniquely identify a financial institution, SWIFT assigns every financial organization a unique code which usually has 8 or 11 characters. As for the 11-character SWIFT code, the first 8 characters will be the same as the 8-character SWIFT code and the last 3 codes are usually used to identify individual branches. In the classical 8-character SWIFT code, the first 4 characters are the institute code, which is used to identify the financial institution. The next 2 characters indicate the country code, and the last 2 characters represent the location or city code.

How does SWIFT work?

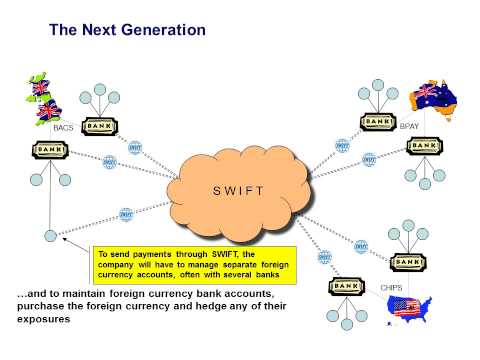

Let's take a look at this example about how the SWIFT system works during a transaction. Let's assume that Alice wants to transfer $100 from her US bank account to Bob's bank account in Australia. A simple scenario is that the two banks both have a commercial account with each other, which means they do have an established relationship. If that is the case, Alice's bank will send a SWIFT message or payment instructions to Patrick's bank within a few minutes. Then Alice's bank will deduct $100 from her account, and Bob's bank will credit $100 in its commercial account. The last step is to credit $100 to Bob's personal account, minus any fees charged for the transfer. A complex scenario is that both banks do not have a commercial bank account with each other. If that is the case, they need to find a third bank which both banks have commercial accounts with. This third bank will act as the bank in the middle to handle the transaction, and the step will be like the following: Alice's bank will deduct $100 from her personal bank. Alice's bank will notify the bank in the middle to debit their commercial account by $100 and credit the commercial account of Bob's bank for the same amount. The bank in the middle will credit the money to Bob's bank's commercial account. Bob's bank will then credit the money to Bob's personal account. In this scenario, since there are more steps involved in the whole process, more fees might be charged and more processing time will be needed than the previous simple scenario. A more complex scenario is that more different currencies are involved during the transaction. As mentioned in the previous example, some extra time and fee might be needed for the currency exchange.

How does SWIFT make profits?

Since SWIFT can be considered a social network which is owned by its members, a fixed income of SWIFT is coming from all these members paying a one-time joining fee and annual charges each year. Also, for each message sent in the SWIFT network, the sender will be paying a small fee for it. Usually different financial organizations will be in different charge tiers based on the volumes of messages they will be sending in a year. Also, some extra services provided by SWIFT such as business intelligence, reference data, and compliance services can also provide revenue for this network.

SWIFT, also called Society for Worldwide Interbank Financial Telecommunications, is a message network which is used by financial organizations such as banks and money brokers to communicate with each other using predefined messages and instructions. Put it simple, SWIFT is just working like a social network in which the users are all financial institutions. Each user will have a unique SWIFT id, and they can securely send and receive information between each other for their daily business, such as money transfer etc. This will enable the payee to transfer money to an account located in another bank in other countries. To uniquely identify a financial institution, SWIFT assigns every financial organization a unique code which usually has 8 or 11 characters. As for the 11-character SWIFT code, the first 8 characters will be the same as the 8-character SWIFT code and the last 3 codes are usually used to identify individual branches. In the classical 8-character SWIFT code, the first 4 characters are the institute code, which is used to identify the financial institution. The next 2 characters indicate the country code, and the last 2 characters represent the location or city code.

How does SWIFT work?

Let's take a look at this example about how the SWIFT system works during a transaction. Let's assume that Alice wants to transfer $100 from her US bank account to Bob's bank account in Australia. A simple scenario is that the two banks both have a commercial account with each other, which means they do have an established relationship. If that is the case, Alice's bank will send a SWIFT message or payment instructions to Patrick's bank within a few minutes. Then Alice's bank will deduct $100 from her account, and Bob's bank will credit $100 in its commercial account. The last step is to credit $100 to Bob's personal account, minus any fees charged for the transfer. A complex scenario is that both banks do not have a commercial bank account with each other. If that is the case, they need to find a third bank which both banks have commercial accounts with. This third bank will act as the bank in the middle to handle the transaction, and the step will be like the following: Alice's bank will deduct $100 from her personal bank. Alice's bank will notify the bank in the middle to debit their commercial account by $100 and credit the commercial account of Bob's bank for the same amount. The bank in the middle will credit the money to Bob's bank's commercial account. Bob's bank will then credit the money to Bob's personal account. In this scenario, since there are more steps involved in the whole process, more fees might be charged and more processing time will be needed than the previous simple scenario. A more complex scenario is that more different currencies are involved during the transaction. As mentioned in the previous example, some extra time and fee might be needed for the currency exchange.

How does SWIFT make profits?

Since SWIFT can be considered a social network which is owned by its members, a fixed income of SWIFT is coming from all these members paying a one-time joining fee and annual charges each year. Also, for each message sent in the SWIFT network, the sender will be paying a small fee for it. Usually different financial organizations will be in different charge tiers based on the volumes of messages they will be sending in a year. Also, some extra services provided by SWIFT such as business intelligence, reference data, and compliance services can also provide revenue for this network.

Комментарии

0:03:50

0:03:50

0:09:51

0:09:51

0:05:00

0:05:00

0:05:51

0:05:51

0:02:55

0:02:55

0:20:18

0:20:18

0:01:40

0:01:40

0:09:14

0:09:14

0:19:10

0:19:10

0:44:18

0:44:18

0:03:30

0:03:30

1:51:08

1:51:08

0:00:50

0:00:50

0:03:07

0:03:07

0:08:57

0:08:57

0:15:20

0:15:20

0:08:01

0:08:01

0:06:27

0:06:27

0:02:14

0:02:14

0:01:25

0:01:25

0:09:37

0:09:37

0:05:42

0:05:42

0:06:10

0:06:10

2:01:27

2:01:27