filmov

tv

Milton Friedman - Deficits and Government Spending

Показать описание

Milton Friedman - Deficits and Government Spending

Milton Friedman on Keynesian Economics

Milton Friedman on Elections, Debt and Sugar

Economics 101: Friedman SCHOOLS Leftists On Deficit Spending

Milton Friedman on taxing the rich to help the poor

Milton Friedman: Spending is the True Tax | The Heritage Foundation

Debt: Paul Krugman and Milton Friedman are BOTH WRONG.

Friedman Fundamentals: How To Control Big Government

Milton Friedman best argument on free trade

Milton Friedman FORTELLS COLLAPSE of the UNITED STATES DOLLAR

Trump vs Friedman - Trade Policy Debate

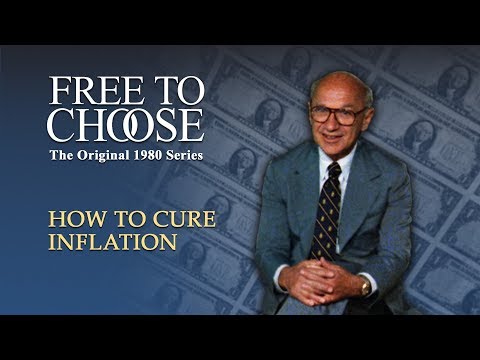

Free To Choose 1980 - Vol. 09 How to Cure Inflation - Full Video

Milton Friedman - The Lesson of the Federal Reserve

Milton Friedman on Free Trade

AOC Debates Economist Milton Friedman

Milton Friedman describes his opposition to Keynes

Milton Friedman explains the direct link between inflation and economic recession

MILTON FRIEDMAN THROW BACK:TRADE DEFICIT

Milton Friedman: there's only one solution to the nation's fiscal situation

Milton Friedman - The Expanding Nature of Government

Testing Milton Friedman - Government Control - Healthcare

Who Really Pays Business Taxes?

Friedman Fundamentals: Giving Politicians An Excuse To Spend More Money

Game of Theories: The Monetarists

Комментарии

0:05:05

0:05:05

0:04:49

0:04:49

0:03:00

0:03:00

0:00:36

0:00:36

0:09:41

0:09:41

0:00:43

0:00:43

0:18:34

0:18:34

0:01:15

0:01:15

0:00:43

0:00:43

0:00:21

0:00:21

0:08:03

0:08:03

0:57:51

0:57:51

0:04:54

0:04:54

0:02:34

0:02:34

0:07:42

0:07:42

0:09:08

0:09:08

0:02:08

0:02:08

0:02:57

0:02:57

0:05:31

0:05:31

0:02:17

0:02:17

0:01:00

0:01:00

0:01:43

0:01:43

0:01:38

0:01:38

0:06:28

0:06:28