filmov

tv

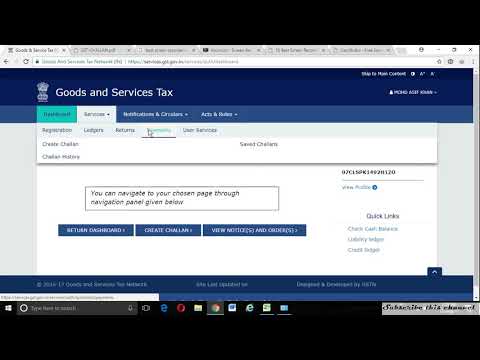

How To Create GST Challan Online | GST Challan Create | How To Create GST Challan Offline | GST Tax

Показать описание

How To Create GST Challan Online | GST Challan Create | How To Create GST Challan Offline | GST Tax | GST me challan kaise banaya jata h | QRMP Scheme me challan kaise banaya jata h | gst me late fees ka challan kaise bnaye | 35% challan kya hota h | 35% challan kaise banaye

DON'T FORGET TO

LIKE / SHARE & SUBSCRIBE ============================================================

FOR MORE VIDEOS.............

All about GSTR 3B tables

TALLY SE GSTR1 KAISE FILE KARE

GST ME NIL RETURN FILE KAISE KARE

how to create groups

how to create Ledger

tally Erp9 ke data ko tally prime me kaise open kare

#GstChallan

#gstchallanCreation

#HowToCreateGstChallan

#HowToCreateRCMgstChallan

#gstChallanCreateOnline

#GSTchallanCreateOffline

QUERY SOLVED............

1. GST me challan kaise banaye

2. QRMP scheme me gst challan kaise banaye

3. offline gst me challan kaise banaye

4. gst bina login kiye chalan ko kaise banaye

5. 35% gst challan kya hota h

6. 35% gst challan kise banana hota h

7. regular scheme gst challan kaise banaye

8. how to make gst challan

9. gst me late fees ka challan kaise banaya jata h

10. gst me NEFT challan kaise banaye

11. gst me tax ko kaise payment kare

12. gst me challan creation ki sabhi baate

13. gst me challan kise banana hota h

15. gst me cash ka challan kaise banaya jata h

16. gst me challan status kaha se dekhe

17. gst me challan paid hua ki nhi kaha se dekhe

18. gst me challan payment status ko kaha se dekha jata h

19. all about gst challan

20. gst me challan history kaise dekhe

DISCLAIMER ***********

TALLY CATALYST does not agree or disagree with the views expressed in the video. This video is merely a general guide meant for learning purpose only. All the instructions, references, content or documents are for educational purpose only and do not constitute a legal advice. we do not accept any liabilities whatsoever for any losses caused directly or indirectly by the use/reliance of any information contained in this video or for any conclusion of the information. Prior to acting upon this video. you're suggested to seek the advise of your financial, legal , tax or professional advisors as to the risks involved may be obtained and necessary due diligence, etc may be done at your end.

-----------------------------------------------------------------------------------------------------------------------

DON'T FORGET TO

LIKE / SHARE & SUBSCRIBE ============================================================

FOR MORE VIDEOS.............

All about GSTR 3B tables

TALLY SE GSTR1 KAISE FILE KARE

GST ME NIL RETURN FILE KAISE KARE

how to create groups

how to create Ledger

tally Erp9 ke data ko tally prime me kaise open kare

#GstChallan

#gstchallanCreation

#HowToCreateGstChallan

#HowToCreateRCMgstChallan

#gstChallanCreateOnline

#GSTchallanCreateOffline

QUERY SOLVED............

1. GST me challan kaise banaye

2. QRMP scheme me gst challan kaise banaye

3. offline gst me challan kaise banaye

4. gst bina login kiye chalan ko kaise banaye

5. 35% gst challan kya hota h

6. 35% gst challan kise banana hota h

7. regular scheme gst challan kaise banaye

8. how to make gst challan

9. gst me late fees ka challan kaise banaya jata h

10. gst me NEFT challan kaise banaye

11. gst me tax ko kaise payment kare

12. gst me challan creation ki sabhi baate

13. gst me challan kise banana hota h

15. gst me cash ka challan kaise banaya jata h

16. gst me challan status kaha se dekhe

17. gst me challan paid hua ki nhi kaha se dekhe

18. gst me challan payment status ko kaha se dekha jata h

19. all about gst challan

20. gst me challan history kaise dekhe

DISCLAIMER ***********

TALLY CATALYST does not agree or disagree with the views expressed in the video. This video is merely a general guide meant for learning purpose only. All the instructions, references, content or documents are for educational purpose only and do not constitute a legal advice. we do not accept any liabilities whatsoever for any losses caused directly or indirectly by the use/reliance of any information contained in this video or for any conclusion of the information. Prior to acting upon this video. you're suggested to seek the advise of your financial, legal , tax or professional advisors as to the risks involved may be obtained and necessary due diligence, etc may be done at your end.

-----------------------------------------------------------------------------------------------------------------------

Комментарии

0:02:41

0:02:41

0:05:25

0:05:25

0:04:43

0:04:43

0:00:48

0:00:48

0:11:59

0:11:59

0:03:32

0:03:32

0:00:07

0:00:07

0:10:28

0:10:28

0:02:59

0:02:59

0:00:56

0:00:56

0:07:16

0:07:16

0:05:29

0:05:29

0:04:41

0:04:41

0:03:48

0:03:48

0:02:06

0:02:06

0:07:30

0:07:30

0:00:39

0:00:39

0:00:20

0:00:20

0:07:32

0:07:32

0:02:26

0:02:26

0:08:06

0:08:06

0:05:25

0:05:25

0:07:49

0:07:49

0:10:00

0:10:00