filmov

tv

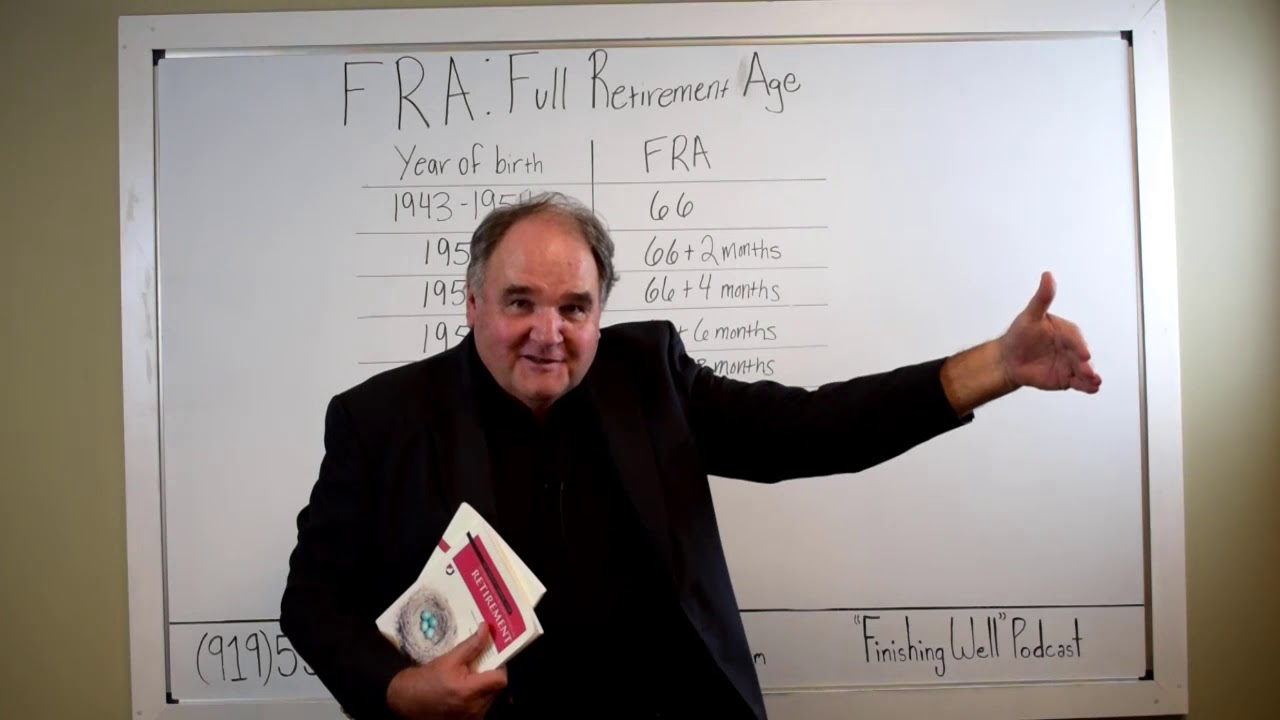

Social Security: Full Retirement Age Explained

Показать описание

Social Security makes up a huge portion of most retirees income. Taking your check at the right time can mean the difference between tens of thousands of dollars during your lifetime in benefits.

If you want to get Social Security timing right, the first thing you absolutely need to know is your full retirement age. While many people believe that they get their full retirement benefit at 65, that is not the case anymore.

If you want to get Social Security timing right, the first thing you absolutely need to know is your full retirement age. While many people believe that they get their full retirement benefit at 65, that is not the case anymore.

What You Need to Know About Social Security's Full Retirement Age | When to File For Social Sec...

What is the Full Retirement Age for Social Security?

Social Security: Full Retirement Age Explained

Working while Receiving Social Security

Full Retirement Age for Social Security

Social Security & Age 70 - The New Full Retirement Age Explained

Social Security First Check If I File at Full Retirement Age

What Happens if You Work Past Your Full Retirement Age?

3 Big Social Security Changes Coming in 2025: What Retirees Need to Know & How It Affects You!

How Much Can You Make on Social Security in 2023 | Full Retirement Age

What Happens At Full Retirement Age With Social Security Disability Benefits

Working While Receiving Social Security (The New 2024 Rules)

Social Security Timing: Age 62 vs. 70

How to Apply for Social Security: Step-by-Step Guide

What's the Best Age to Start Collecting Social Security?

When Filing for Social Security at Full Retirement Age (or Later!) Is Your Best Choice

Benefits of Taking Social Security at Your Full Retirement Age

What is my Full Retirement Age according to Social Security?

8 GOOD REASONS to File for Social Security at Age 62

Early vs. Full Retirement - What is the breakeven age for SSA Benefits?

Social Security Full Retirement Age

Collecting Social Security at 62; How They Feel About It Now

When Is The Best Time To Start Collecting Social Security? - Dave Ramsey Rant

Collecting Social Security after 67; How They Feel About It Now

Комментарии

0:05:09

0:05:09

0:01:27

0:01:27

0:04:05

0:04:05

0:14:21

0:14:21

0:01:15

0:01:15

0:09:46

0:09:46

0:03:52

0:03:52

0:04:45

0:04:45

0:08:28

0:08:28

0:03:56

0:03:56

0:01:16

0:01:16

0:11:09

0:11:09

0:11:49

0:11:49

0:01:30

0:01:30

0:03:41

0:03:41

0:08:44

0:08:44

0:02:43

0:02:43

0:01:53

0:01:53

0:20:18

0:20:18

0:08:49

0:08:49

0:01:00

0:01:00

0:02:39

0:02:39

0:05:01

0:05:01

0:02:04

0:02:04