filmov

tv

Calculating KO's WACC | Coca-Cola DCF Walkthrough Part 3

Показать описание

Timestamps:

00:00 Part 0: Recapping the Model

14:30 Part 1: Cost of Debt

32:00 Part 2: Cost of Equity | Introducing Beta and MRP

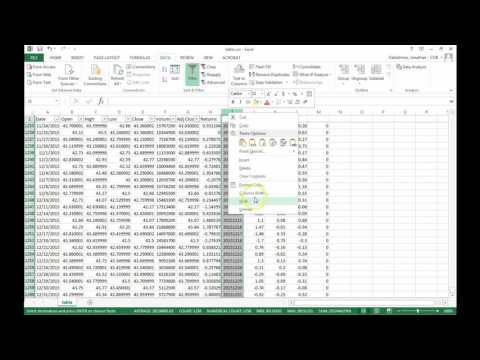

49:00 Part 3: Cost of Equity | Calculating Beta

1:12:25 Part 4: Final WACC Calculation

00:00 Part 0: Recapping the Model

14:30 Part 1: Cost of Debt

32:00 Part 2: Cost of Equity | Introducing Beta and MRP

49:00 Part 3: Cost of Equity | Calculating Beta

1:12:25 Part 4: Final WACC Calculation

Coca Cola Stock | Should You Buy COKE Now? | KO Stock Analysis

Earnings Power Value Model [Step-by-Step Calculation & Spreadsheet]

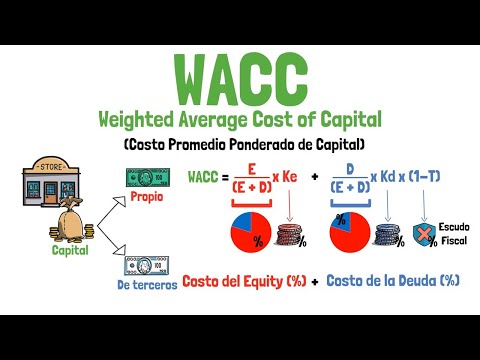

Cost of Capital WACC

BUFN June 28 KO Valuation Part 1

Coca Cola Financial Stock Review: This may be the greatest stock ever: $KO

Determining Stock Price in Under 5 Minutes - Apple Example

Dividend Discount and Free Cash Flow Models

BUFN June 28 KO Valuation As Is and Final

(Step by Step) How to Calculate the Intrinsic Value of a Stock like Warren Buffet | DCF Model

IS COCA-COLA (KO) A BUY?! | FULL STOCK ANALYSIS

Cost of Capital

Qué es el WACC (CPPC) y cómo se calcula - Finanzas corporativas - Explicado para principiantes!

How to Value a Dividend Stock! (Dividend Discount Model Example)

nux020 w05 v06

Session 19: Pricing Examples

BMGT 443 Oct 20 KO Valuation

Estimate CAPM Beta in Excel

unit 7 cost of capital

Cost of Capital Part 6 - PE Ratio, Cost of Capital, Inflation and Value Driver Formula

BUFN 760 June 21 KO Valuation Part 1

Akamai Financial Stock Valuation in Excel: This stock may double any day! Solid biz model! - $AKAM

Super Micro's discounted cash flow model: Great price to sales and price book ratios!

Coke may be Buffett's baby but pour me Pepsi anytime! $PEP

Marathon Patent Group Financial Stock Review: Extremely liquid and popular stock: $MARA

Комментарии

0:09:32

0:09:32

0:14:01

0:14:01

0:35:41

0:35:41

1:06:11

1:06:11

0:12:54

0:12:54

0:05:01

0:05:01

1:27:55

1:27:55

0:56:58

0:56:58

0:20:55

0:20:55

0:18:51

0:18:51

0:56:53

0:56:53

0:06:46

0:06:46

0:10:57

0:10:57

0:12:26

0:12:26

0:59:14

0:59:14

1:10:24

1:10:24

0:09:04

0:09:04

0:50:28

0:50:28

0:21:30

0:21:30

1:49:25

1:49:25

0:11:58

0:11:58

0:09:14

0:09:14

0:10:14

0:10:14

0:09:08

0:09:08