filmov

tv

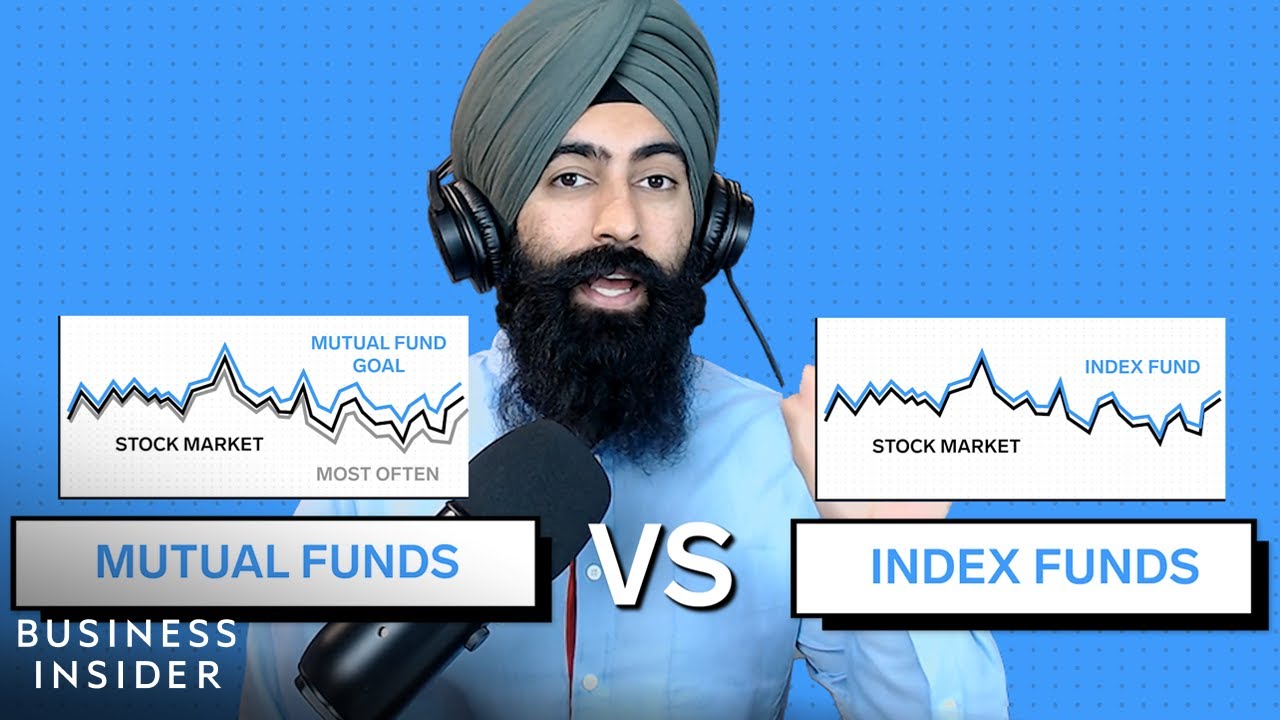

Index Funds vs Mutual Funds

Показать описание

Presented by Fidelity

0:00 Intro

0:12 What are funds

0:43 Mutual funds

2:27 Index funds

4:05 Main difference

4:30 Which one to choose

In this video, Jaspreet Singh breaks down the differences between Index and Mutual Funds, what funds are and gives some basic investing tips.

MORE MASTER YOUR MONEY:

How To Buy A Stock

TO FOLLOW JASPREET:

Minority Mindset YouTube Channel

Minority Mindset Website

------------------------------------------------------

Business Insider tells you all you need to know about business, finance, tech, retail, and more.

Index Funds vs Mutual Funds

0:00 Intro

0:12 What are funds

0:43 Mutual funds

2:27 Index funds

4:05 Main difference

4:30 Which one to choose

In this video, Jaspreet Singh breaks down the differences between Index and Mutual Funds, what funds are and gives some basic investing tips.

MORE MASTER YOUR MONEY:

How To Buy A Stock

TO FOLLOW JASPREET:

Minority Mindset YouTube Channel

Minority Mindset Website

------------------------------------------------------

Business Insider tells you all you need to know about business, finance, tech, retail, and more.

Index Funds vs Mutual Funds

Index Funds vs ETFs vs Mutual Funds - What's the Difference & Which One You Should Choose?

Index Funds vs Mutual Funds vs ETF (WHICH ONE IS THE BEST?!)

Index Funds vs. ETFs vs. Mutual Funds: Which Is Best?

Mutual Funds VS Market Index Funds

Mutual Funds vs. ETFs - Which Is Right for You?

ETFs vs Mutual Funds--Here's why mutual funds are the better choice

3 Fidelity Index Funds That Will Make You RICH!

The Best 5 Index Funds To Own For Life (2024 Edition)

4 Best Fidelity Index Funds To Triple Your Money

FIDELITY IS BETTER THAN VANGUARD AND IT’S NOT EVEN CLOSE!

Mutual Funds vs ETFs - Which One is the Best?

Which is Best? Mutual Fund vs Index Fund vs ETF Explained

What If You Invest 100k in the BEST 5 Fidelity Index Funds

💰The Best Vanguard Index Fund Tip‼️

Passive Investing: Deciding between ETFs and Index Funds | NerdWallet

Why Mutual Funds Over Index Funds?

ETF vs Index Funds vs Mutual Funds - Which is best?

Fidelity Index Funds For Beginners | The Ultimate Guide

Mutual Fund vs Index Fund - Which one is best investment?

Index Fund vs Mutual Fund vs ETF | The Difference & The Best Option

Mutual Funds vs Index Funds vs ETFs | Ultimate Guide

Index Funds vs Mutual Funds | What is Best? Index vs Active Funds | Complete Guide

Mutual Funds Vs. Index Funds

Vanguard ETFs and Index Funds - What You Should Know

Комментарии

0:09:13

0:09:13

0:09:54

0:09:54

0:12:34

0:12:34

0:09:35

0:09:35

0:01:40

0:01:40

0:22:03

0:22:03

0:00:51

0:00:51

0:15:50

0:15:50

0:15:21

0:15:21

0:00:52

0:00:52

0:16:22

0:16:22

0:14:20

0:14:20

0:15:08

0:15:08

0:00:50

0:00:50

0:07:11

0:07:11

0:08:05

0:08:05

0:14:24

0:14:24

0:17:21

0:17:21

0:07:10

0:07:10

0:08:06

0:08:06

0:12:24

0:12:24

0:15:30

0:15:30

0:01:01

0:01:01

0:09:28

0:09:28