filmov

tv

Bank Guarantee (BG) vs Letter of Credit (LC) - Hindi

Показать описание

-----------------------------------------------------------------------------------

Time Stamps

00:00 Introduction

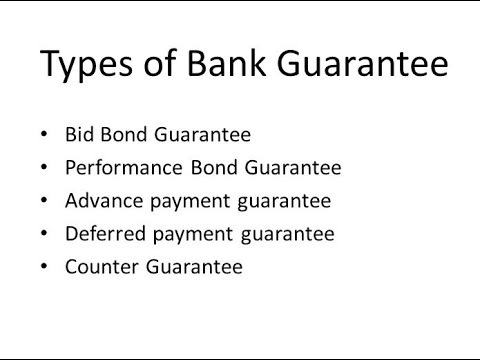

01:30 Meaning of Bank Guarantee (BG)

04:02 Meaning of Letter of Credit (LOC)

05:15 Comparison Between BG and LOC

06:25 Summary

Related Videos:

Bank guarantees are more popular in infrastructure and real estate projects while letters of credit are used mainly in international trade.

बैंक गारंटी और लेटर ऑफ़ क्रेडिट दोनों का उपयोग ट्रेडिंग फाइनेन्स में किया जाता है। लेकिन दोनों अलग-अलग फाइनेंशियल इंस्ट्रूमेंट्स हैं। इस वीडियो में, हम BGऔर LC के बीच अंतर को समझेंगे।

बैंक गारंटी इंफ्रास्ट्रक्चर और रियल एस्टेट प्रोजेक्ट्स में उपयोग की जाती है जबकि लेटर ऑफ़ क्रेडिट का इस्तेमाल मुख्य रूप से इंटरनेशनल ट्रेड में किया जाता है।

Share this Video:

Subscribe To Our Channel and Get More Property and Real Estate Tips:

In this video, we have explained:

What is bank guarantee?

What is a letter of credit?

What is the difference between bank guarantee and letter of credit?

How bank guarantee is different from the letter of credit?

What is the main difference in bank guarantee and letter of credit?

Is bank guarantee and letter of credit is same?

When should you use bank guarantee and when should you use a letter of credit?

What is the difference in the concepts of bank guarantee and letter of credit?

How should you differentiate between bank guarantee and letter of credit?

How the process of bank guarantee is different from the process of the letter of credit?

How bank guarantee and letter of credit used?

What are the similarities between bank guarantee and letter of credit?

How to differentiate between BG and LC?

Why bank guarantee can't be used in place of letter of credit?

Can you use letter of credit instead of bank guarantee for business?

Make sure to Like and Share this video.

Other Great Resources

Follow Us:

Hope you liked this video in Hindi on “Bank Guarantee vs Letter of Credit”.

Time Stamps

00:00 Introduction

01:30 Meaning of Bank Guarantee (BG)

04:02 Meaning of Letter of Credit (LOC)

05:15 Comparison Between BG and LOC

06:25 Summary

Related Videos:

Bank guarantees are more popular in infrastructure and real estate projects while letters of credit are used mainly in international trade.

बैंक गारंटी और लेटर ऑफ़ क्रेडिट दोनों का उपयोग ट्रेडिंग फाइनेन्स में किया जाता है। लेकिन दोनों अलग-अलग फाइनेंशियल इंस्ट्रूमेंट्स हैं। इस वीडियो में, हम BGऔर LC के बीच अंतर को समझेंगे।

बैंक गारंटी इंफ्रास्ट्रक्चर और रियल एस्टेट प्रोजेक्ट्स में उपयोग की जाती है जबकि लेटर ऑफ़ क्रेडिट का इस्तेमाल मुख्य रूप से इंटरनेशनल ट्रेड में किया जाता है।

Share this Video:

Subscribe To Our Channel and Get More Property and Real Estate Tips:

In this video, we have explained:

What is bank guarantee?

What is a letter of credit?

What is the difference between bank guarantee and letter of credit?

How bank guarantee is different from the letter of credit?

What is the main difference in bank guarantee and letter of credit?

Is bank guarantee and letter of credit is same?

When should you use bank guarantee and when should you use a letter of credit?

What is the difference in the concepts of bank guarantee and letter of credit?

How should you differentiate between bank guarantee and letter of credit?

How the process of bank guarantee is different from the process of the letter of credit?

How bank guarantee and letter of credit used?

What are the similarities between bank guarantee and letter of credit?

How to differentiate between BG and LC?

Why bank guarantee can't be used in place of letter of credit?

Can you use letter of credit instead of bank guarantee for business?

Make sure to Like and Share this video.

Other Great Resources

Follow Us:

Hope you liked this video in Hindi on “Bank Guarantee vs Letter of Credit”.

Комментарии

0:02:45

0:02:45

0:02:17

0:02:17

0:09:40

0:09:40

0:01:34

0:01:34

0:01:53

0:01:53

0:01:35

0:01:35

0:02:52

0:02:52

0:31:25

0:31:25

0:04:49

0:04:49

0:18:51

0:18:51

0:01:32

0:01:32

0:06:13

0:06:13

0:00:45

0:00:45

0:02:02

0:02:02

0:00:52

0:00:52

0:01:12

0:01:12

0:03:32

0:03:32

0:00:42

0:00:42

0:01:08

0:01:08

0:00:19

0:00:19

0:09:29

0:09:29

0:00:29

0:00:29

0:01:43

0:01:43

0:01:15

0:01:15