filmov

tv

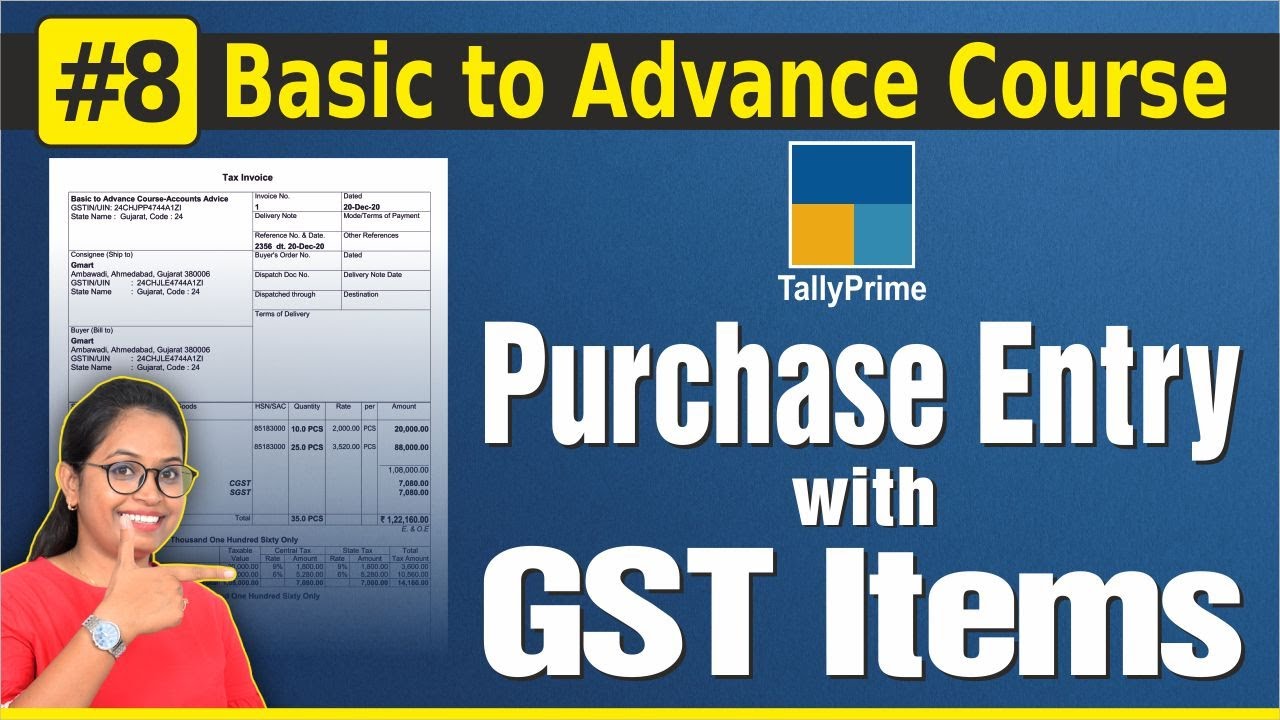

#8 Tally Prime- Purchase Entry With GST in Tally Prime | Purchase Bill Entry with Multiple GST rate

Показать описание

#accountsadvice #learntallyprime

A Purchase Invoice is a bill you receive from your supplier against which you need to make the payment. It is a confirmation given by supplier that the sale has occurred. Purchase invoice shows the contents of a specific transaction. It indicates the amount of goods as well as their prices. The purchases expenses can be recognized as soon as the purchase invoice is accounted.

Purchase invoice is created in response to the purchase order. It generally includes date of issue, invoice number, name & address of buyer as well as seller, PO number, quantity of goods purchased, price of each item purchased, discounts if any, taxes and total amount due.

Before making purchase entry in tally, we must create following types of purchase ledgers:

1] Purchase A/c

2] Supplier A/c

3] CGST

4] SGST

5] IGST

Now to be more specific you can create different ledgers for CGST, SGST and IGST as per GST rates like CGST @9%, SGST @9% and IGST @18% etc.

Download Excel formats:-

(Payment hone ke bad payment successful page pe hi download ka option aayega waha se download kare)

------------------------------------------------------------------------------------------------------------------

Subscribe our 2nd Channel to learn PF ,ESIC, GST and many more

---------------------------------------------------------------------------------------------------------------------

Tally Prime:- Basic to Advance course:-

#0 Tally Prime- How to Download, Install and Activate | Free & Licence Latest Version of Tally

#1 Tally Prime- Create Company |Tally Prime में कंपनी कैसे बनाये

#2 Tally Prime- Ledger creation | How to Delete & Alter Ledger

#3 Tally Prime- Types of Vouchers |Tally Me konase voucher me konasi entry kare.

#4 Tally Prime- Voucher entry in Tally- “Contra”, “Receipt”, “Payment”

#5 Tally Prime- Voucher entry in Tally- “Journal”, “Sales”, “ Purchase”

#6 Purchase Order processing with GST | Purchase Order कैसे बनाये

#7 Tally Prime- Sales Order processing with GST |Sales Order कैसे बनाये

#8 Tally Prime- Purchase Entry With GST in Tally Prime | Purchase Bill Entry Kaise kare with Multiple GST rate

#9 Tally Prime- Create Sales Invoice with Multiple GST rate | Tally Mai GST Invoice Kaise Banate Hain

#8 Purchase Entry With GST in Tally Prime | Purchase Bill Entry Kaise kare with Multiple GST rate

#9 Create Sales Invoice with Multiple GST rate | Tally Mai GST Invoice Kaise Banate Hain

#10 Automatic Round off Invoice Value in Tally Prime with GST

#11 Bill Wise accounting in Tally | What is the use of New Ref, Against Ref,Advance,On Account

#12 Tally Prime- Outstanding Reports, Bills Payable & Receivable Reports | O/S कैसे चेक करे

#13 Tally Prime- All Bank Transaction Entries

#14 Tally Prime-How to take Backup of Tally DATA? Explain in Hindi

#15 Tally Prime- Voucher Mode का use कैसे करे.

#16-Tally Prime: Accounts with Inventory |Stock Group, Category, Item, Units, Godown | Stock mgt

#17 Tally Prime: Stock Summary Report |Accounts with Inventory Report

#18 Tally Prime- Debit note entry करने का सबसे आसान तरीका | Debit note with GST

Other videos related to PF and ESIC

ESIC Nil Returns in 2020 | Generate Nil ESIC challan online

EPF Nil Returns-2020 | Generate Nil EPF challan online |How To File EPF Nil Returns?

ESIC Monthly Challan 2020 | How to generate ESIC Challan online.

PF Registration(2020) in Shram Suvidha Portal|How to do PF Registration online in hindi

#tally #tallyprime #netally #activetally #updatetally #PurchaseOrder #salerorder #allabouttally #generatesaleinvoice #basictallycourse #newtally #tallyprimesikhe #tallyfeature #allabouttally #tricksoftally #tallyshortcuts

Connect with us:-

============================================================

Please like, comment, share and subscribe for more latest updates like-PF,PT,GST,BANKING,ACCOUNTING,ALL TYPE OF REGISTRATION etc..

Thank you

A Purchase Invoice is a bill you receive from your supplier against which you need to make the payment. It is a confirmation given by supplier that the sale has occurred. Purchase invoice shows the contents of a specific transaction. It indicates the amount of goods as well as their prices. The purchases expenses can be recognized as soon as the purchase invoice is accounted.

Purchase invoice is created in response to the purchase order. It generally includes date of issue, invoice number, name & address of buyer as well as seller, PO number, quantity of goods purchased, price of each item purchased, discounts if any, taxes and total amount due.

Before making purchase entry in tally, we must create following types of purchase ledgers:

1] Purchase A/c

2] Supplier A/c

3] CGST

4] SGST

5] IGST

Now to be more specific you can create different ledgers for CGST, SGST and IGST as per GST rates like CGST @9%, SGST @9% and IGST @18% etc.

Download Excel formats:-

(Payment hone ke bad payment successful page pe hi download ka option aayega waha se download kare)

------------------------------------------------------------------------------------------------------------------

Subscribe our 2nd Channel to learn PF ,ESIC, GST and many more

---------------------------------------------------------------------------------------------------------------------

Tally Prime:- Basic to Advance course:-

#0 Tally Prime- How to Download, Install and Activate | Free & Licence Latest Version of Tally

#1 Tally Prime- Create Company |Tally Prime में कंपनी कैसे बनाये

#2 Tally Prime- Ledger creation | How to Delete & Alter Ledger

#3 Tally Prime- Types of Vouchers |Tally Me konase voucher me konasi entry kare.

#4 Tally Prime- Voucher entry in Tally- “Contra”, “Receipt”, “Payment”

#5 Tally Prime- Voucher entry in Tally- “Journal”, “Sales”, “ Purchase”

#6 Purchase Order processing with GST | Purchase Order कैसे बनाये

#7 Tally Prime- Sales Order processing with GST |Sales Order कैसे बनाये

#8 Tally Prime- Purchase Entry With GST in Tally Prime | Purchase Bill Entry Kaise kare with Multiple GST rate

#9 Tally Prime- Create Sales Invoice with Multiple GST rate | Tally Mai GST Invoice Kaise Banate Hain

#8 Purchase Entry With GST in Tally Prime | Purchase Bill Entry Kaise kare with Multiple GST rate

#9 Create Sales Invoice with Multiple GST rate | Tally Mai GST Invoice Kaise Banate Hain

#10 Automatic Round off Invoice Value in Tally Prime with GST

#11 Bill Wise accounting in Tally | What is the use of New Ref, Against Ref,Advance,On Account

#12 Tally Prime- Outstanding Reports, Bills Payable & Receivable Reports | O/S कैसे चेक करे

#13 Tally Prime- All Bank Transaction Entries

#14 Tally Prime-How to take Backup of Tally DATA? Explain in Hindi

#15 Tally Prime- Voucher Mode का use कैसे करे.

#16-Tally Prime: Accounts with Inventory |Stock Group, Category, Item, Units, Godown | Stock mgt

#17 Tally Prime: Stock Summary Report |Accounts with Inventory Report

#18 Tally Prime- Debit note entry करने का सबसे आसान तरीका | Debit note with GST

Other videos related to PF and ESIC

ESIC Nil Returns in 2020 | Generate Nil ESIC challan online

EPF Nil Returns-2020 | Generate Nil EPF challan online |How To File EPF Nil Returns?

ESIC Monthly Challan 2020 | How to generate ESIC Challan online.

PF Registration(2020) in Shram Suvidha Portal|How to do PF Registration online in hindi

#tally #tallyprime #netally #activetally #updatetally #PurchaseOrder #salerorder #allabouttally #generatesaleinvoice #basictallycourse #newtally #tallyprimesikhe #tallyfeature #allabouttally #tricksoftally #tallyshortcuts

Connect with us:-

============================================================

Please like, comment, share and subscribe for more latest updates like-PF,PT,GST,BANKING,ACCOUNTING,ALL TYPE OF REGISTRATION etc..

Thank you

Комментарии

0:19:38

0:19:38

0:00:19

0:00:19

0:00:16

0:00:16

0:00:13

0:00:13

0:05:49

0:05:49

0:19:27

0:19:27

0:00:15

0:00:15

0:00:15

0:00:15

0:17:34

0:17:34

0:00:24

0:00:24

0:01:01

0:01:01

0:21:05

0:21:05

0:00:46

0:00:46

0:00:26

0:00:26

0:00:59

0:00:59

0:00:13

0:00:13

0:00:41

0:00:41

0:23:11

0:23:11

0:00:22

0:00:22

1:42:24

1:42:24

0:07:15

0:07:15

0:20:17

0:20:17

0:08:31

0:08:31

0:12:16

0:12:16