filmov

tv

Read the Charts!! Medicare Supplement Plan G vs N

Показать описание

Read the Charts!! Medicare Supplement Plan G vs N

Call Now: 1-844-552-7426

----------------------------------------------------------------------------------------------------

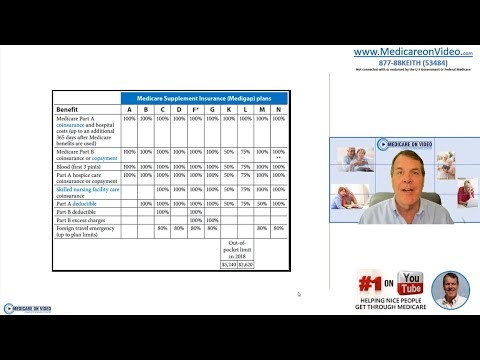

Medicare supplement plans, often referred to as Medigap, play a crucial role in helping beneficiaries cover expenses not included in traditional Medicare. As we approach 2024, it's important to understand the nuances of these plans, particularly the popular options like Plan G and Plan N.

Medigap Plan G has been widely chosen by those seeking comprehensive coverage. It covers most out-of-pocket costs except for the Medicare Part B deductible. In contrast, Medigap Plan N is often more budget-friendly, offering slightly less coverage. It requires small copayments for doctor visits and emergency room trips and doesn't cover the Part B excess charges. When comparing Plan N vs Plan G, the decision often boils down to the individual's health needs and financial considerations.

Another aspect to consider is the difference between Medicare Advantage and Medicare Supplement plans. Medicare Advantage plans are an alternative to Original Medicare, offering an all-in-one solution that often includes Part D prescription drug coverage. In contrast, Medicare Supplement plans are add-ons to Original Medicare, designed to fill the coverage gaps. They do not include prescription drug coverage, which is where Medicare Part D comes into play. Part D plans are standalone plans that cover prescription drugs, and they can be paired with either Original Medicare or Medigap plans.

The High Deductible Plan G is an option for those seeking lower premiums in exchange for a higher deductible. This plan offers the same benefits as the standard Plan G but requires beneficiaries to pay a higher deductible before coverage kicks in. This can be a cost-effective solution for those who don’t anticipate frequent medical services but still want comprehensive coverage once the deductible is met.

Cigna and Aetna are major health service companies providing Medicare Advantage and Medicare Supplement plans. Their coverage options can differ significantly from state to state. For instance, a Medicare Advantage plan available in Florida might offer different benefits or provider networks compared to a similar plan in Texas or California. This regional variation is crucial for beneficiaries to consider.

Pharmacies like CVS and Walgreens play a pivotal role in Medicare, especially concerning Medicare Part D, which covers prescription drugs. These pharmacies often have preferred status in certain Part D plans, potentially offering lower copays in states like New York, Pennsylvania, and Texas. In major cities like Los Angeles, Dallas, and Houston, access to these pharmacies can influence the choice of Medicare Part D plans.

In states like Florida and California, where there is a high population of retirees, Medicare plans offered by these providers might have more options and competitive pricing due to the higher demand. Cities like Tampa and Los Angeles might see more customized plans catering to diverse urban populations with specific healthcare needs.

Watch these other great videos from other channels:

Related Tags:

medicare supplement plans, medicare, medicare plan g, medicare supplement plans 2023, high deductible G plans, medicare advantage vs medicare supplement, medicare explained, top medicare plans, best medicare plans, High Deductible, High Deductible Medicare Plan, High Deductible Medicare Plan G,High Deductible Plan G, Medicare Plan G, Medigap Plan G, Medigap Plan G vs. High Deductible Plan G, Medigap plan, Plan G, high deductible g, high deductible medigap, high plan g, medicare supplement plan g, medicare supplement, medigap plan g, medigap high deductible g, high deductible plan g, medicare advantage or medicare supplement, which medicare plan is best, medicare supplement plan, medicare supplemental plan, medicare medigap plan, medigap plan, supplemental medicare plan, medigap plans 2024, medigap plans 2023, medicare supplemental insurance, medicare supplement plan g, medicare supplement plans, supplemental plan, medigap plan g,

Disclaimer: This video is for entertainment purposes only. If you want advice on Medicare or any of its plans, please speak to a licensed agent, whether it is me or another licensed agent. No advice should be taken from this video. If you don't speak to me about your individual concerns, I can't give you my 100% opinion. Brian Monahan and Medicare 365 are not responsible for any actions that you take.

#medicare #medigap #medicare365 #brianmonahan #highplang #medicarehdg #bestmedicareplans #top3medicare #top3medigap #medicaresupplement #medigapplang

Call Now: 1-844-552-7426

----------------------------------------------------------------------------------------------------

Medicare supplement plans, often referred to as Medigap, play a crucial role in helping beneficiaries cover expenses not included in traditional Medicare. As we approach 2024, it's important to understand the nuances of these plans, particularly the popular options like Plan G and Plan N.

Medigap Plan G has been widely chosen by those seeking comprehensive coverage. It covers most out-of-pocket costs except for the Medicare Part B deductible. In contrast, Medigap Plan N is often more budget-friendly, offering slightly less coverage. It requires small copayments for doctor visits and emergency room trips and doesn't cover the Part B excess charges. When comparing Plan N vs Plan G, the decision often boils down to the individual's health needs and financial considerations.

Another aspect to consider is the difference between Medicare Advantage and Medicare Supplement plans. Medicare Advantage plans are an alternative to Original Medicare, offering an all-in-one solution that often includes Part D prescription drug coverage. In contrast, Medicare Supplement plans are add-ons to Original Medicare, designed to fill the coverage gaps. They do not include prescription drug coverage, which is where Medicare Part D comes into play. Part D plans are standalone plans that cover prescription drugs, and they can be paired with either Original Medicare or Medigap plans.

The High Deductible Plan G is an option for those seeking lower premiums in exchange for a higher deductible. This plan offers the same benefits as the standard Plan G but requires beneficiaries to pay a higher deductible before coverage kicks in. This can be a cost-effective solution for those who don’t anticipate frequent medical services but still want comprehensive coverage once the deductible is met.

Cigna and Aetna are major health service companies providing Medicare Advantage and Medicare Supplement plans. Their coverage options can differ significantly from state to state. For instance, a Medicare Advantage plan available in Florida might offer different benefits or provider networks compared to a similar plan in Texas or California. This regional variation is crucial for beneficiaries to consider.

Pharmacies like CVS and Walgreens play a pivotal role in Medicare, especially concerning Medicare Part D, which covers prescription drugs. These pharmacies often have preferred status in certain Part D plans, potentially offering lower copays in states like New York, Pennsylvania, and Texas. In major cities like Los Angeles, Dallas, and Houston, access to these pharmacies can influence the choice of Medicare Part D plans.

In states like Florida and California, where there is a high population of retirees, Medicare plans offered by these providers might have more options and competitive pricing due to the higher demand. Cities like Tampa and Los Angeles might see more customized plans catering to diverse urban populations with specific healthcare needs.

Watch these other great videos from other channels:

Related Tags:

medicare supplement plans, medicare, medicare plan g, medicare supplement plans 2023, high deductible G plans, medicare advantage vs medicare supplement, medicare explained, top medicare plans, best medicare plans, High Deductible, High Deductible Medicare Plan, High Deductible Medicare Plan G,High Deductible Plan G, Medicare Plan G, Medigap Plan G, Medigap Plan G vs. High Deductible Plan G, Medigap plan, Plan G, high deductible g, high deductible medigap, high plan g, medicare supplement plan g, medicare supplement, medigap plan g, medigap high deductible g, high deductible plan g, medicare advantage or medicare supplement, which medicare plan is best, medicare supplement plan, medicare supplemental plan, medicare medigap plan, medigap plan, supplemental medicare plan, medigap plans 2024, medigap plans 2023, medicare supplemental insurance, medicare supplement plan g, medicare supplement plans, supplemental plan, medigap plan g,

Disclaimer: This video is for entertainment purposes only. If you want advice on Medicare or any of its plans, please speak to a licensed agent, whether it is me or another licensed agent. No advice should be taken from this video. If you don't speak to me about your individual concerns, I can't give you my 100% opinion. Brian Monahan and Medicare 365 are not responsible for any actions that you take.

#medicare #medigap #medicare365 #brianmonahan #highplang #medicarehdg #bestmedicareplans #top3medicare #top3medigap #medicaresupplement #medigapplang

Комментарии

0:20:43

0:20:43

0:12:01

0:12:01

0:20:35

0:20:35

0:05:06

0:05:06

0:08:39

0:08:39

0:10:35

0:10:35

0:13:38

0:13:38

0:11:51

0:11:51

0:12:32

0:12:32

0:21:03

0:21:03

0:08:01

0:08:01

0:11:58

0:11:58

0:13:34

0:13:34

0:09:06

0:09:06

0:02:09

0:02:09

0:05:30

0:05:30

0:03:07

0:03:07

0:10:05

0:10:05

0:06:09

0:06:09

0:14:58

0:14:58

0:26:48

0:26:48

0:30:38

0:30:38

0:01:00

0:01:00

0:04:40

0:04:40