filmov

tv

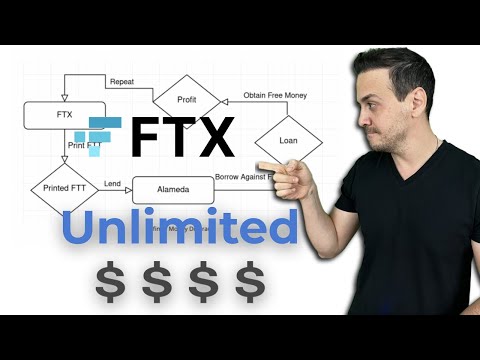

FTX Infinite Money Diagram | Accounting and Collapse Explained

Показать описание

In this video I cover the Accounting & Audit issues with FTX's Collapse

In a nutshell, FTX used its sister company Alameda in these illegal ways:

FTX lent Alameda its made-up crypto "FTT", which Alameda used to borrow money against (free money with a worthless collateral)!

Alameda was a major customer of FTX's FTT token, helping FTX prop up it's fair market value!!

Join 10,000+ professionals who enrolled in the Controller Academy 🚀

[coupon 30OFFCOURSE for 30% discount]

Or

Get my Controller bundle, which includes the Controller Academy

[coupon 30OFFCOURSE for 30% discount]

My Fraud Playlist:

Join me on Patreon and ask me your questions:

------------------------------

My other best selling courses:

🔥Take 30% off when you enroll in my online course “Night Before the Accounting Interview Guide” including All Levels Q&A🔥:

📈Get My “Controller KPI Dashboard” (Excel + Course) with the most important P&L and Balance Sheet KPIs:

---------------------------------------------------------------------

Hang Out with me on social media:

DISCLAIMER: Links included in this description might be affiliate links. If you happen to purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel so I can continue to provide you with free content each week!

All views expressed on my channel are mine alone. Not intended as financial or professional advice

In a nutshell, FTX used its sister company Alameda in these illegal ways:

FTX lent Alameda its made-up crypto "FTT", which Alameda used to borrow money against (free money with a worthless collateral)!

Alameda was a major customer of FTX's FTT token, helping FTX prop up it's fair market value!!

Join 10,000+ professionals who enrolled in the Controller Academy 🚀

[coupon 30OFFCOURSE for 30% discount]

Or

Get my Controller bundle, which includes the Controller Academy

[coupon 30OFFCOURSE for 30% discount]

My Fraud Playlist:

Join me on Patreon and ask me your questions:

------------------------------

My other best selling courses:

🔥Take 30% off when you enroll in my online course “Night Before the Accounting Interview Guide” including All Levels Q&A🔥:

📈Get My “Controller KPI Dashboard” (Excel + Course) with the most important P&L and Balance Sheet KPIs:

---------------------------------------------------------------------

Hang Out with me on social media:

DISCLAIMER: Links included in this description might be affiliate links. If you happen to purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel so I can continue to provide you with free content each week!

All views expressed on my channel are mine alone. Not intended as financial or professional advice

Комментарии

0:11:11

0:11:11

0:00:12

0:00:12

0:05:23

0:05:23

0:00:05

0:00:05

0:14:55

0:14:55

1:47:36

1:47:36

0:00:12

0:00:12

0:00:24

0:00:24

0:01:00

0:01:00

0:00:24

0:00:24

0:00:27

0:00:27

0:04:58

0:04:58

0:00:53

0:00:53

0:11:30

0:11:30

0:00:16

0:00:16

0:00:38

0:00:38

0:00:39

0:00:39

0:13:09

0:13:09

0:03:08

0:03:08

0:00:49

0:00:49

0:00:57

0:00:57

0:28:46

0:28:46

0:00:12

0:00:12

0:09:22

0:09:22