filmov

tv

#Quad 4 Update: Consensus Shifting On Mega-Cap Tech

Показать описание

In this clip from The Macro Show, Hedgeye CEO Keith McCullough breaks down how to analyze Implied Volatility Premium to further understand Q1 mega-cap earnings within a #Quad4 environment.

“A month ago, if you look at implied vol data you can see Apple’s (AAPL) Implied Vol Premium this morning is 52%. A month ago people thought Apple could do no wrong. It had a deep Implied Vol discount! Two weeks ago people thought Elon could do no wrong, now he’s got a negative 2% discount and he’s got the big target on his head because he’s the last mega-cap to not properly implode alongside Apple.”

"I always say:

A. Is the stock, currency, or macro position at the low end of its range?

B. Is the Implied Volatility Premium towards the top end of where it’s been?

That is definitely a cover-some signal, so there is no surprise at all to me that Facebook (FB) bounced. I definitely wouldn’t be shorting something at the low end of the range with a ballooning implied vol premium into an event.”

“A month ago, if you look at implied vol data you can see Apple’s (AAPL) Implied Vol Premium this morning is 52%. A month ago people thought Apple could do no wrong. It had a deep Implied Vol discount! Two weeks ago people thought Elon could do no wrong, now he’s got a negative 2% discount and he’s got the big target on his head because he’s the last mega-cap to not properly implode alongside Apple.”

"I always say:

A. Is the stock, currency, or macro position at the low end of its range?

B. Is the Implied Volatility Premium towards the top end of where it’s been?

That is definitely a cover-some signal, so there is no surprise at all to me that Facebook (FB) bounced. I definitely wouldn’t be shorting something at the low end of the range with a ballooning implied vol premium into an event.”

#Quad 4 Update: Consensus Shifting On Mega-Cap Tech

The $200,000,000 Skull and Bones Disaster

What Happened To 2-Strokes?

When Poker Cheaters Get Caught

🚨 President Biden EXCLUSIVE Interview with MeidasTouch

A Near-Optimal Finite-Time Sliding-Mode Consensus Control of Multi-Agent System under Dynamic Events

Quad Training Guide | How to Squat, Lunge & Leg Extension for Mass

NOW Neocons Are READY: Make Taiwan The Ukraine Of Asia | Jeffrey Sachs & Joanna Lei

Local AI Hardware and Software Trends in 2025

'Stagflation' Crisis: The Best & Worst Assets In High Inflation, Low Growth | Keith Mc...

Synology vs UGREEN - Who makes the BEST NAS??

Building is started but I have MAJOR problems!

Higher Light Decree: Quadruple Grids Technique (Spacial)

Start With Ponga, Lucas Or Marzhew In Your 2025 NRL Fantasy Team?

using SCIENCE to ELIMINATE exhaust drone: I FINALLY did it!

Quad4: Realm of Your Highest Impact and Highest Risk: Chris McGoff at TEDxRockCreekPark

PM Anthony Albanese takes to world stage for the first time in Japan for Quad meeting | 7NEWS

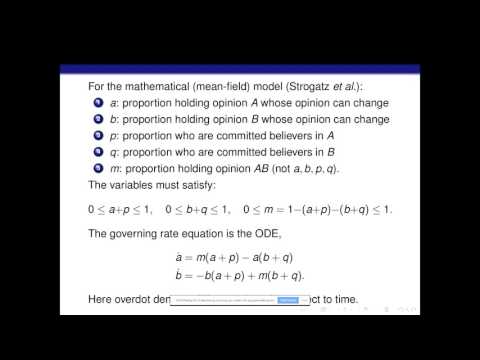

Todd Kapitula - Consensus and clustering in opinion formation on small-world models

2020 BEST ATV at EVERY BUDGET! Yamaha Kodiak Polaris Sportsman Can Am Outlander Honda Foreman!

Why 99% of Golfers Should Shorten Their Driver Like Rory McIlroy

This Is BIG: Podhoretz, Ferguson, and Olsen Discuss the Meaning of the Election and What’s Next

Could Kiki Iriafen Fall Outside The Lottery In 2025 WNBA Draft?

Biden and Asia: Perspectives From the Region

iPad 10 Long-Term Review: Why YouTubers were wrong..

Комментарии

0:02:55

0:02:55

0:22:11

0:22:11

0:06:25

0:06:25

0:10:32

0:10:32

0:29:41

0:29:41

0:01:01

0:01:01

0:06:35

0:06:35

0:41:31

0:41:31

0:24:59

0:24:59

0:30:12

0:30:12

0:19:52

0:19:52

1:04:12

1:04:12

0:12:01

0:12:01

0:24:54

0:24:54

0:20:37

0:20:37

0:10:03

0:10:03

0:04:02

0:04:02

1:06:17

1:06:17

0:09:25

0:09:25

0:06:23

0:06:23

1:17:44

1:17:44

0:15:31

0:15:31

1:29:34

1:29:34

0:08:49

0:08:49