filmov

tv

Step By Step | How To Setup a LTD COMPANY For PROPERTY Investments

Показать описание

How to set up a limited company for property. A step by step guide showing you how to setup a LTD company for BTL, property investing, flips and development. There are a lot of video's on the pro's and cons of setting up a company for your property investments, however this video is purely a guide on how to do it

#property #btl #propertyinvesting #j9property #jasonchesters

#property #btl #propertyinvesting #j9property #jasonchesters

Step by Step Anleitung: Schulranzen richtig einstellen

Monet192 – Step By Step (Official Video)

Der Step by Step Modellvergleich

How to Do a Simple Step for Beginners | Step Dance

How To French Braid Step By Step For Beginners - 1 Of 2 Ways To Add Hair To The Braid (PART 1) [CC]

How To Two Step Dance - Basic 2 Step

Learn How to do Flares - Step-By-Step Tutorial

The Next Step - How to do a Pirouette

Step by Step Schulranzen - 2IN1 PLUS „Der Schulrucksack im Schulranzen“

Learn to Dance with Three Easy Steps

Step-by-step dance tutorial shared on my channel! ❤️#byebyebye #deadpool

Whitney Houston - Step By Step (S.Martin Remix 2019)

Step by Step Schulranzen - 2in1 „Der Alleskönner“ – die Besonderheiten im Überblick

Step by Step - How to Build a House

T-Step (Beginner) | Shuffle Dance Tutorial

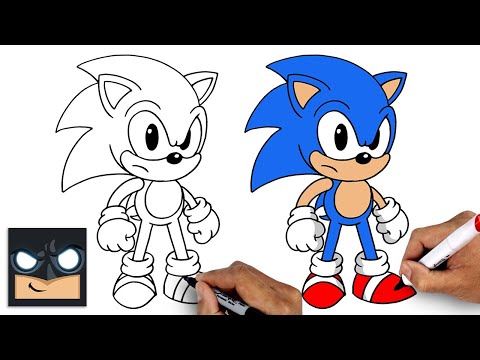

How To Draw Sonic the Hedgehog | Step By Step Tutorial

Step by Step Cloud, Details und Anprobe / Koffer-Kopf Online ABC Party

Learn How to Windmill - Complete Step by Step - Breakdance Tutorial

How to Breakdance | 6 Step | Footwork 101

How To Waltz Dance For Beginners - Waltz Box Step

Beginner Technical Step Combo | Step Dance

How to Step-by-Step Organize ANY Space

How to Two Step with The King & Queen of Country Swing

Step by Step - All Intros - Eine starke Familie

Комментарии

0:01:56

0:01:56

0:02:43

0:02:43

0:06:10

0:06:10

0:02:21

0:02:21

0:03:20

0:03:20

0:05:13

0:05:13

0:09:44

0:09:44

0:01:08

0:01:08

0:02:52

0:02:52

0:03:09

0:03:09

0:00:31

0:00:31

0:04:44

0:04:44

0:01:40

0:01:40

0:21:41

0:21:41

0:07:36

0:07:36

0:11:47

0:11:47

0:03:22

0:03:22

0:10:26

0:10:26

0:03:08

0:03:08

0:04:15

0:04:15

0:03:33

0:03:33

0:10:59

0:10:59

0:05:26

0:05:26

0:02:58

0:02:58