filmov

tv

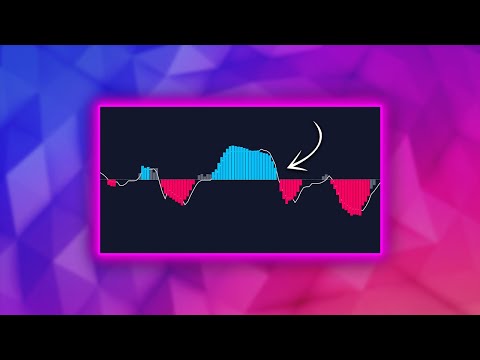

Algorithmic Trading Strategy Using Three Moving Averages & Python

Показать описание

#Python #Stocks #StockTrading #AlgorithmicTrading

Algorithmic Trading Strategy Using Three Moving Averages & Python

⭐Please Subscribe !⭐

⭐Get the code and data sets by becoming a supporter on Patreon:

⭐Website:

⭐Support the channel on Patreon:

⭐Helpful Programming Books

► Python (Hands-Machine-Learning-Scikit-Learn-TensorFlow):

► Learning Python:

►Head First Python:

► C-Programming :

► Head First Java:

Algorithmic Trading Strategy Using Three Moving Averages & Python

⭐Please Subscribe !⭐

⭐Get the code and data sets by becoming a supporter on Patreon:

⭐Website:

⭐Support the channel on Patreon:

⭐Helpful Programming Books

► Python (Hands-Machine-Learning-Scikit-Learn-TensorFlow):

► Learning Python:

►Head First Python:

► C-Programming :

► Head First Java:

Algorithmic Trading Strategy Using Three Moving Averages & Python

Three Critical Problems With Algorithmic Trading Strategies

How to Develop Algo Trading Strategies Quickly - 3 Tips

I Found An AMAZING Trend Following Strategy #shorts

The Truth Behind Wall Street's Algorithmic Trading

The Heikin Ashi Trading Strategy (Simple & Effective)

ChatGPT Trading Strategy Made 19527% Profit ( FULL TUTORIAL )

BEST MACD Trading Strategy [86% Win Rate]

Best Ripple Arbitrage Strategy: Ripple Crypto Guide | New XRP Trading Strategy Today #ripple #xrp

This Algo Strategy Has Only 3 rules and 62% Win Rate

I Tested This Trading Strategy & It Made 310%

Price Action Trading Strategy That Works (Must Watch)

BEST Trend Line Breakout Strategy on TradingView 📈

Unveiling this CEO Quant Trader's Algo Trading Bot Strategy Secrets Part 1

ICT Trader explains why 90% lose in Forex Trading. | Words of Rizdom EP.45 #shorts #ICTTrader #forex

Algorithmic Trading – Machine Learning & Quant Strategies Course with Python

My 3 Biggest Algo Trading Lessons

Genius Trader Doesn't Believe in Technical Analysis #trading

I Found A Trading Strategy With a 225% Profit Rate #shorts

Live algo trading Profit #quanytiplyalgotrading #finvasia #finvaisaalgo

BEST 1 MINUTE SCALPING STRATEGY

I Tested The 3 Moving Average Crossover Strategy with an Expert Advisor - SURPRISING RESULTS

3 Advanced Algo Trading Entries

5 EMA + 8 EMA Trading Strategy | Moving Average Trading Strategy | Moving average crossover

Комментарии

0:31:46

0:31:46

0:16:37

0:16:37

0:07:19

0:07:19

0:00:54

0:00:54

0:00:59

0:00:59

0:06:05

0:06:05

0:08:12

0:08:12

0:07:06

0:07:06

0:06:31

0:06:31

0:07:08

0:07:08

0:01:00

0:01:00

0:00:54

0:00:54

0:00:47

0:00:47

0:00:52

0:00:52

0:00:35

0:00:35

2:59:20

2:59:20

0:15:12

0:15:12

0:00:18

0:00:18

0:01:00

0:01:00

0:00:15

0:00:15

0:00:43

0:00:43

0:10:04

0:10:04

0:42:54

0:42:54

0:00:59

0:00:59