filmov

tv

Mastering Options: The Art of Scaling In and Out of Positions

Показать описание

If you enjoyed this video, leave a like and subscribe. Let me know in the comments what other videos you want me to make.

DISCLAIMER: This channel is strictly for education and entertainment purposes, and ALWAYS remember to do your own research and have full conviction in your set up's. I am not a financial advisor and information given in this video is NOT financial advice.

DISCLAIMER: This channel is strictly for education and entertainment purposes, and ALWAYS remember to do your own research and have full conviction in your set up's. I am not a financial advisor and information given in this video is NOT financial advice.

Buy or Sell? Price Action Strategy

Mastering Options: The Art of Scaling In and Out of Positions

Small Investment, Big Returns: Mastering the Art of Call Options

Mastering Options Trading: The Art of Balancing Risk and Reward

Mastering the Art of Trading Options Tips for Small Accounts

Mastering the Art of Theta: How to Use it to Your Advantage 🔎

Mastering the Art of Options Trading: Essential Skills and Techniques

Options Trading Decoded: Mastering the Art of Reading Options Chains! 💡📈

Mastering the 'Reason Why' Candle: A Key to Successful Trading

📉 MASTERING THE ART OF PUT OPTIONS 💼💥

Mastering the Art of Option Trading 2024

Mastering Options Writing Unlocking Profit Potential in Any Market

Mastering Option Trading with Siva's INSIGHTS | Trading ki Baat ft. @OptionsScalping

Mastering the art of trading..

Mastering the Art of Quick Trades: Fire and Profit

Mastering the art of presenting options! 🎯

MASTERING OPTION MOOD: THE ART OF VOLATILITY IN OPTIONS TRADING!( Part 1)

“Mastering the Trading Game:Strategies for Success in Stocks, Options” #shorts #trading #motivation...

Trading Strategy With 92% Success Rate

What's the Secret to MASTERING Option Trading with Greeks?

Mastering the Art of trading | Option trading for beginners | Mindset of Successful Trader #forex

Option Trading In Depth Guide To Mastering The Marketing

Mastering the Art of Making Money in the Stock Market: My Proven Strategies Revealed! #THESTRAT #spy

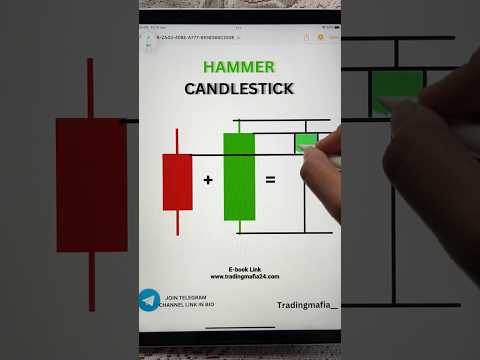

Mastering Candlestick Wicks - Best Trading Strategy

Комментарии

0:01:00

0:01:00

0:13:04

0:13:04

0:01:01

0:01:01

0:00:27

0:00:27

0:10:46

0:10:46

0:00:30

0:00:30

0:21:28

0:21:28

0:00:58

0:00:58

0:00:35

0:00:35

0:01:12

0:01:12

0:04:37

0:04:37

0:00:57

0:00:57

0:51:46

0:51:46

0:00:23

0:00:23

0:00:23

0:00:23

0:00:42

0:00:42

0:24:00

0:24:00

0:00:14

0:00:14

0:00:56

0:00:56

0:00:23

0:00:23

0:00:42

0:00:42

0:08:00

0:08:00

0:00:10

0:00:10

0:01:00

0:01:00