filmov

tv

Introduction to Depreciation | Depreciation | A level Accounting 9706

Показать описание

This video lesson is our comprehensive guide on depreciation methods, designed for CAIE AS Level Accounting students. In this video, we delve into the essential concepts and calculations surrounding depreciation, crucial for understanding asset management and financial reporting.

1. Understanding Non-Current Assets:

Explore non-current assets and their long-term nature within business operations. Learn how depreciation applies to these assets over their economic life span.

2. Exploring Economic Life and Obsolescence:

Delve into economic life, which defines the expected duration a non-current asset remains operational. Understand how factors such as obsolescence, wear and tear, and technological advancements impact asset depreciation.

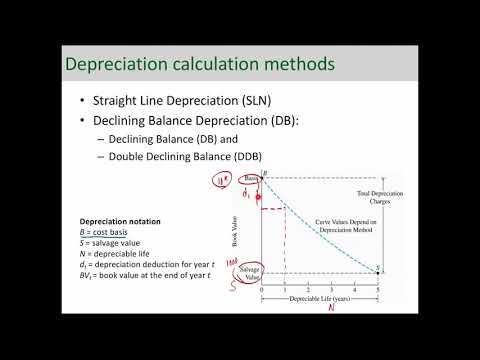

3. Types of Depreciation Methods:

Explore various depreciation methods including:

- Straight-Line Method: Learn how this method evenly allocates depreciation expense over an asset's useful life.

- Reducing Balance Method: Understand how this method applies a higher depreciation charge in the early years, reflecting faster asset wear and tear.

- Revaluation Method: Explore how revaluation adjusts an asset's value based on market changes, impacting depreciation calculations.

4. Calculating Depreciation and Net Book Value:

Gain practical insights into calculating depreciation using different methods. Understand how these calculations affect the asset's net book value, influencing financial statements and decision-making.

5. Practical Examples and Applications:

Enhance your understanding with practical examples illustrating how depreciation methods are applied in business scenarios. We'll walk you through calculations and demonstrate their impact on financial reporting.

-------------------------------------------------------------------------------------------------------------------------------------------------

Do you want an A in A Level Accounting? Get on Alt Academy to gain access to our treasure trove of resources. You’ll get:

1. Video lessons covering the full AS & A2 syllabus

2. Expert Academic Support

3. Past paper video solutions that explain how to answer each question step by step

4. A readymade study plan to complete the AS or A2 Accounts syllabus in 60 or 90 days

5. Topical skill-checks and chapter worksheets for extensive practice

6. Global Community of learners

7. Revision guides and flashcards

8. Written past paper solutions going all the way back to 2016

Not just for Accounts, but also other commerce and science subjects (and even Psychology), making 8 in total!

So what are you waiting for? Join Alt now!

Check out our main YouTube channel for videos on exam tips, past paper video solutions, intros to our other subject experts & more!

Want to buy Alt for Chemistry, Business or another subject? Check out our other channels for what kind of lessons to expect:

Follow us on:

1. Understanding Non-Current Assets:

Explore non-current assets and their long-term nature within business operations. Learn how depreciation applies to these assets over their economic life span.

2. Exploring Economic Life and Obsolescence:

Delve into economic life, which defines the expected duration a non-current asset remains operational. Understand how factors such as obsolescence, wear and tear, and technological advancements impact asset depreciation.

3. Types of Depreciation Methods:

Explore various depreciation methods including:

- Straight-Line Method: Learn how this method evenly allocates depreciation expense over an asset's useful life.

- Reducing Balance Method: Understand how this method applies a higher depreciation charge in the early years, reflecting faster asset wear and tear.

- Revaluation Method: Explore how revaluation adjusts an asset's value based on market changes, impacting depreciation calculations.

4. Calculating Depreciation and Net Book Value:

Gain practical insights into calculating depreciation using different methods. Understand how these calculations affect the asset's net book value, influencing financial statements and decision-making.

5. Practical Examples and Applications:

Enhance your understanding with practical examples illustrating how depreciation methods are applied in business scenarios. We'll walk you through calculations and demonstrate their impact on financial reporting.

-------------------------------------------------------------------------------------------------------------------------------------------------

Do you want an A in A Level Accounting? Get on Alt Academy to gain access to our treasure trove of resources. You’ll get:

1. Video lessons covering the full AS & A2 syllabus

2. Expert Academic Support

3. Past paper video solutions that explain how to answer each question step by step

4. A readymade study plan to complete the AS or A2 Accounts syllabus in 60 or 90 days

5. Topical skill-checks and chapter worksheets for extensive practice

6. Global Community of learners

7. Revision guides and flashcards

8. Written past paper solutions going all the way back to 2016

Not just for Accounts, but also other commerce and science subjects (and even Psychology), making 8 in total!

So what are you waiting for? Join Alt now!

Check out our main YouTube channel for videos on exam tips, past paper video solutions, intros to our other subject experts & more!

Want to buy Alt for Chemistry, Business or another subject? Check out our other channels for what kind of lessons to expect:

Follow us on:

0:11:24

0:11:24

0:37:32

0:37:32

0:09:11

0:09:11

0:08:28

0:08:28

0:23:08

0:23:08

0:06:03

0:06:03

0:19:06

0:19:06

0:08:19

0:08:19

0:05:29

0:05:29

0:52:31

0:52:31

0:31:45

0:31:45

0:01:00

0:01:00

0:04:18

0:04:18

0:27:18

0:27:18

0:49:14

0:49:14

1:02:47

1:02:47

0:05:32

0:05:32

0:00:56

0:00:56

0:08:37

0:08:37

0:14:56

0:14:56

0:04:48

0:04:48

0:11:41

0:11:41

0:06:52

0:06:52

0:50:19

0:50:19