filmov

tv

Coding Debt | The Laws of Capitalism Episode 2

Показать описание

The question is not just how the law codes debt, but also why. Our legal code has been essential in the transformation of humble IOUs into elaborate financial contracts, and the creation of an entire finance industry.

Prof. Pistor examines how the law has accompanied the evolution of negotiable debt instruments, from the simple IOU, to bills of exchange in Medieval Genoa, to securitized assets in the modern day and on to derivatives. She examines the securitization of mortgage debt in the modern United States in the lead-up to the financial crisis of 2008.

Prof. Pistor examines how the law has accompanied the evolution of negotiable debt instruments, from the simple IOU, to bills of exchange in Medieval Genoa, to securitized assets in the modern day and on to derivatives. She examines the securitization of mortgage debt in the modern United States in the lead-up to the financial crisis of 2008.

Coding Debt | The Laws of Capitalism Episode 2

Those bills you get in the mail is NOT your debt !!

The Truth About Technical Debt: What It Is and How to Avoid It

Prioritizing Technical Debt as If Time & Money Matters • Adam Tornhill • GOTO 2022

A Framework for Managing Technical Debt – Alex Moldovan, TechLeadConf 2023

How One Law Accidentally Started A Debt Nightmare

Donald Trump On Tax Loophole: I Absolutely Used It | CNBC

DEBT COLLECTOR FACTS THEY DON'T WANT YOU TO KNOW ABOUT

Germany’s Government Falls Amid Severe Economic Downturn—Global Debt Warning

#AdamTornhill Technical Debt on 15yo Code Base • Link to Full Video in Description

Pre-Marital Debt Laws In Telugu | Civil Procedure Code Act In Telugu | Advocate Srinivas Chauhan

Prioritizing Technical Debt as if Time and Money Matters • Adam Tornhill • GOTO 2020

Client Payment Coupon UCC Laws Success Bill Paid With Laws Debt Discharge Coupon

Uniform Commercial Code - NOT a Key to Debt Defense - Myths and Facts about the UCC

Why debt is tax free - Robert Kiyosaki

Say THIS to the judge when you get sued for old debt

Bankruptcy EXPLAINED, will it wipe All your Debt? 😳 #shorts

Prioritizing Technical Debt as if Time and Money Matters — Adam Tornhill

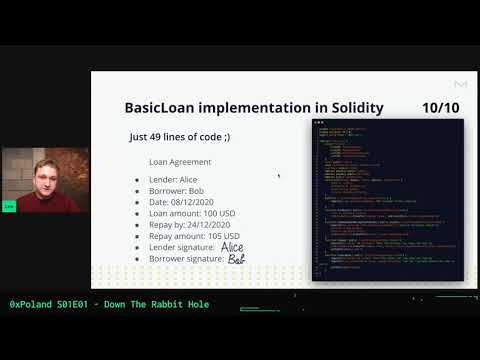

Let's code debt! Basic Loan smart contract implementation - by Leonid Logvinov (MakerDAO)

IF YOU TYPE 'HESOYAM' WHEN YOU'RE IN DEBT IN GTA SAN ANDREAS

The bank accepted our Promissory Note/ UCC laws work! Debt is paid, Now what?

New Debt Collection Law - Regulation F

The MOST effective way to DISCHARGE Debts and be DEBT FREE

Tutorial: Prioritizing Technical Debt with Hotspots

Комментарии

0:17:04

0:17:04

0:07:19

0:07:19

0:04:46

0:04:46

0:28:43

0:28:43

0:27:41

0:27:41

0:15:34

0:15:34

0:02:26

0:02:26

0:00:59

0:00:59

0:07:36

0:07:36

0:01:01

0:01:01

0:03:01

0:03:01

0:19:41

0:19:41

0:09:24

0:09:24

0:05:01

0:05:01

0:00:37

0:00:37

0:00:24

0:00:24

0:00:23

0:00:23

0:49:15

0:49:15

0:51:52

0:51:52

0:00:23

0:00:23

0:09:12

0:09:12

0:04:04

0:04:04

0:13:19

0:13:19

0:01:51

0:01:51