filmov

tv

How Do You Compare Financially to The Average American?

Показать описание

We’ve done some research on the average debt in America, and guys, the results are wild! In this video, find out if you fall above or below the average American when it comes to money. Plus, learn how to start tackling debt today!

Next Steps:

Offer From Our Sponsor:

Explore More From Ramsey Network:

Ramsey Solutions Privacy Policy:

Products:

How Do You Compare Financially to The Average American?

These Financial Statistics Of The Average Person Are Eye-Opening

US Government Unveils Average Financial Statistics for Americans | How do YOU Compare?

Average Retiree Savings, Net Worth, & Income from SS - How Do You Compare?

Warren Buffett Brilliantly Explains Levels Of Wealth

4 Reasons You Need To Stop Comparing Your Finances (This Year)

Stock Multiples: How to Tell When a Stock is Cheap/Expensive

Signs You're Doing Better Than You Think Financially (How You Compare To Average)

Is the U.S. Economy About to COLLAPSE?

How Do You Compare Financially to Others Your Age?

Comparing My Finances with 'The Average Aussie' - Income, Debt, Net Worth, Savings & S...

This Is an Easy Way to See How You Compare Financially

How Do YOU Compare Financially To Your Peers?

How to Analyze an Income Statement Like a Hedge Fund Analyst

Signs You’re Doing Well Financially

Assess Your Finances, Calculate Your Net Worth & See How You Compare l Ep 24

How I Stopped Comparing Myself to Others Financially

Do you compare yourself to your friends financially? #personalfinancepodcast #finance

Unlocking Your Net Worth Are You Financially Healthy

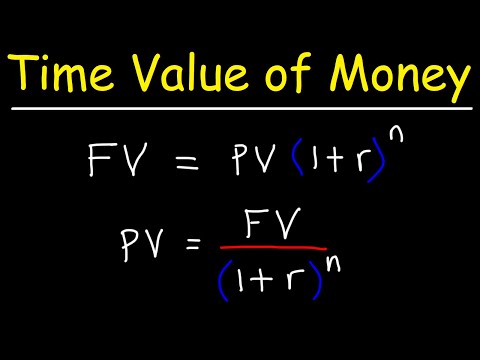

Time Value of Money - Present Value vs Future Value

How Tim Walzs personal finances compare to JD Vance other politicians

How to Read Company Financial Statements (Basics Explained)

HOW DO YOUR FINANCES COMPARE?

How Do YOU Compare Financially To Your Peers (Repost)

Комментарии

0:12:28

0:12:28

0:08:57

0:08:57

0:07:21

0:07:21

0:16:14

0:16:14

0:03:59

0:03:59

0:08:58

0:08:58

0:09:47

0:09:47

0:10:42

0:10:42

0:37:57

0:37:57

0:08:16

0:08:16

0:12:16

0:12:16

0:00:29

0:00:29

0:19:32

0:19:32

0:11:24

0:11:24

0:08:14

0:08:14

0:08:42

0:08:42

0:16:30

0:16:30

0:00:47

0:00:47

0:00:18

0:00:18

0:05:14

0:05:14

0:00:36

0:00:36

0:11:33

0:11:33

0:00:06

0:00:06

0:19:32

0:19:32