filmov

tv

Here’s how you do the rental property LLC thing

Показать описание

I’m not your lawyer & these are just preferences 👉

But I prefer to hold a rental property in an LLC formed in one of the business friendly states mentioned, hold that LLC under a management company, and own interests in that management company under a self settled trust.

📊Rental Calc & More 👉 Link in Bio

🏘8-hr training program👉Link in Bio

💬DM your deal if you want a video on it!

#cashflowtrain #multifamily #businesswomen

#cashbuyers #buildwealth #investor

#wealthcreators #realestateexpert #commercialrealestate

#retirementplanning #realestateinvestors #entrepreneurship

#investorhub #wealthylife #businesstips

#wealthgenerators #realestateinvestment #financial

#retireyoung #realestatetips #businessowner

#multifamilyrealestate #realestateexperts #businessowners

#financialmanagement #financialmarkets #realestatesales

But I prefer to hold a rental property in an LLC formed in one of the business friendly states mentioned, hold that LLC under a management company, and own interests in that management company under a self settled trust.

📊Rental Calc & More 👉 Link in Bio

🏘8-hr training program👉Link in Bio

💬DM your deal if you want a video on it!

#cashflowtrain #multifamily #businesswomen

#cashbuyers #buildwealth #investor

#wealthcreators #realestateexpert #commercialrealestate

#retirementplanning #realestateinvestors #entrepreneurship

#investorhub #wealthylife #businesstips

#wealthgenerators #realestateinvestment #financial

#retireyoung #realestatetips #businessowner

#multifamilyrealestate #realestateexperts #businessowners

#financialmanagement #financialmarkets #realestatesales

Jamie Miller - Here's Your Perfect (Official Music Video)

Kris Kristofferson - Here comes that rainbow again (1982)

Here Is The Beehive | Count To Five | Super Simple Songs

Here Comes The Fire Truck | Kids Songs | Super Simple Songs

Halestorm - 'Here's To Us' captured in The Live Room

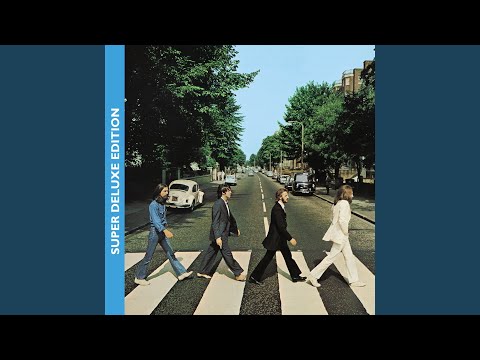

Here Comes The Sun (Remastered 2009)

Here Comes the Sun - The Petersens (LIVE)

'Here Comes a Thought' | Steven Universe | Cartoon Network

Here Is The Beehive | featuring Caitie | Nursery Rhymes from Caitie's Classroom

Here You Are Song | Kids Funny Songs

The Tremeloes - Here Comes My Baby (1967)

Here Comes The Fire Truck | Songs from Caitie's Classroom

Here Is Your Paradise - Chris de Burgh

Neelix, Ghost Rider, The Gardener & The Tree - Here Is Your Song (Official Music Video)

Here Comes The Sun (2019 Mix)

YOU DO NOT NEED A NAS - And Here is Why...

heres a tutorial for the people wondering how to do this!✨ #trending #viralvideo #comedy #shorts

Here Is My Heart (Live) – ICF Worship

Here's My Life | Planetshakers Official Lyric Video

FAKE WEIGHTS PRANK... | ANATOLY pretended to be a Beginner in a Gym #15

Huge ACH and XCN News Before Binance Gets There

Mauve - Here Comes the Sun

Here is a perfect tool for slicing pizza !

Here As In Heaven | Live | Elevation Worship

Комментарии

0:02:50

0:02:50

0:02:56

0:02:56

0:02:06

0:02:06

0:02:51

0:02:51

0:03:17

0:03:17

0:03:06

0:03:06

0:03:11

0:03:11

0:03:33

0:03:33

0:02:00

0:02:00

0:01:53

0:01:53

0:03:07

0:03:07

0:03:14

0:03:14

0:03:29

0:03:29

0:05:41

0:05:41

0:03:06

0:03:06

0:10:12

0:10:12

0:00:17

0:00:17

0:07:13

0:07:13

0:06:53

0:06:53

0:16:03

0:16:03

0:13:01

0:13:01

0:02:41

0:02:41

0:00:25

0:00:25

0:08:18

0:08:18