filmov

tv

Revenue Recognition for SaaS Contracts under ASC 606

Показать описание

Dan Kullback, CPA and Director of Solutions Engineering at Ordway, explains the importance of revenue recognition for SaaS businesses. Audited GAAP financials are a critical requirement for raising growth equity, venture debt, and securing other credit arrangements. Transitioning from cash to accrual accounting is one of the big transitions early-stage SaaS companies need to make as they scale up.

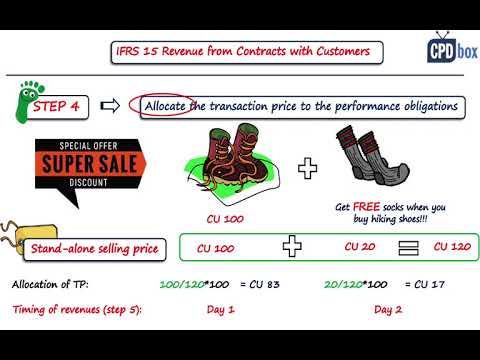

In this episode, Dan shares the background and rationale for the recently introduced ASC 606 standard for US GAAP. He also explores concepts such as deferred revenue, performance obligations, standalone selling prices, and the other complexities accountants at software companies must consider when making judgments about how to apply the standards.

In this episode, Dan shares the background and rationale for the recently introduced ASC 606 standard for US GAAP. He also explores concepts such as deferred revenue, performance obligations, standalone selling prices, and the other complexities accountants at software companies must consider when making judgments about how to apply the standards.

0:14:39

0:14:39

0:02:46

0:02:46

0:09:08

0:09:08

0:03:08

0:03:08

0:12:59

0:12:59

0:03:21

0:03:21

0:03:03

0:03:03

0:02:52

0:02:52

0:09:57

0:09:57

0:08:47

0:08:47

0:03:26

0:03:26

0:01:50

0:01:50

0:52:45

0:52:45

0:01:17

0:01:17

0:04:28

0:04:28

0:02:51

0:02:51

0:18:24

0:18:24

0:08:39

0:08:39

0:11:03

0:11:03

0:04:49

0:04:49

0:27:51

0:27:51

0:45:26

0:45:26

0:01:05

0:01:05

0:06:54

0:06:54