filmov

tv

How to do Vertical Analysis

Показать описание

In this video, we will explore how to apply vertical analysis, also known as common-size analysis, to financial statement items.

Vertical analysis provides a unique perspective, comparing financial items up and down, rather than side to side like in horizontal analysis. A critical component of vertical analysis is computing common-size percentages, which we will cover thoroughly in this video.

Through a practical and clear example involving current assets and total assets, we'll explain how to compute common-size percentages. We'll also demonstrate how this computation can be applied to all balance sheet items, using total assets or total liabilities plus equity as the base amount for the current and prior years.

We'll dissect these common-size percentages to see how they can reveal important financial insights, such as a company's main financing sources and changes in retained earnings due to reinvestment of net income.

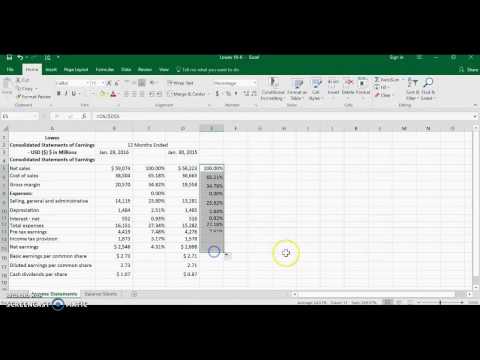

The tutorial will also extend to applying vertical analysis to the income statement. By looking at common-size percentages for items like cost of goods sold relative to net sales, we will see how we can identify important trends and changes in a company's financial performance.

We'll wrap up the tutorial by emphasizing how vertical analysis can help identify cost increases that need monitoring and control.

This video will enhance your understanding of vertical analysis and its importance in accounting and finance. Don't forget to like, share, and subscribe to keep up with all our videos!

Jonathan M. Wild

#accounting #accountingstudent #financialstatements #financialstatementanalysis #accountingbasics

Vertical analysis provides a unique perspective, comparing financial items up and down, rather than side to side like in horizontal analysis. A critical component of vertical analysis is computing common-size percentages, which we will cover thoroughly in this video.

Through a practical and clear example involving current assets and total assets, we'll explain how to compute common-size percentages. We'll also demonstrate how this computation can be applied to all balance sheet items, using total assets or total liabilities plus equity as the base amount for the current and prior years.

We'll dissect these common-size percentages to see how they can reveal important financial insights, such as a company's main financing sources and changes in retained earnings due to reinvestment of net income.

The tutorial will also extend to applying vertical analysis to the income statement. By looking at common-size percentages for items like cost of goods sold relative to net sales, we will see how we can identify important trends and changes in a company's financial performance.

We'll wrap up the tutorial by emphasizing how vertical analysis can help identify cost increases that need monitoring and control.

This video will enhance your understanding of vertical analysis and its importance in accounting and finance. Don't forget to like, share, and subscribe to keep up with all our videos!

Jonathan M. Wild

#accounting #accountingstudent #financialstatements #financialstatementanalysis #accountingbasics

0:05:53

0:05:53

0:05:34

0:05:34

0:04:14

0:04:14

0:11:52

0:11:52

0:17:01

0:17:01

0:10:50

0:10:50

0:06:01

0:06:01

0:09:04

0:09:04

0:03:58

0:03:58

0:04:14

0:04:14

0:03:11

0:03:11

0:05:28

0:05:28

0:11:41

0:11:41

0:04:00

0:04:00

0:05:47

0:05:47

0:06:47

0:06:47

0:05:52

0:05:52

0:08:42

0:08:42

0:00:59

0:00:59

0:12:06

0:12:06

0:10:49

0:10:49

0:06:54

0:06:54

0:04:43

0:04:43

0:11:01

0:11:01