filmov

tv

It's Just Not Sustainable in the Long Term

Показать описание

📱 Watch the full episode for free in the Ramsey Network app. ⮕

Next Steps:

Support our Sponsors:

Watch more from Ramsey Network:

Ramsey Solutions Privacy Policy

Next Steps:

Support our Sponsors:

Watch more from Ramsey Network:

Ramsey Solutions Privacy Policy

Sustainable business: It's not just about the why | Jeremy Moon | TEDxScottBase

Why our Economic System in not Sustainable | Christian Kreiss | TEDxTUBerlin

A song by Children for sustainable development (SDG's) _ AGFUND

Trump Ally LASHES OUT At Elon Musk In CRAZY RANT!

Sustainability in everyday life | Sustainability

things you THOUGHT were sustainable but actually are NOT

CERATIZIT Sustainability: It's not a Goal, it's a Mission.

Cheap Petrol Price Does Not Come Cheap - Dan Kunle

Nova Formworks l Sustainable, Easy-to-Use & Reusable Solutions for Construction

I Made a Secret YouTube Channel to Prove its Not Luck

Something Struck the Moon Last Night—And It's Not What You Think!

Arizona Iced Tea Owner Won’t Raise the 99-Cent Price

Electric Cars are Not Sustainable and they're Terrible

This is just sad #relationships #gymgirl #rizz #funny #funnyshorts

Are Fungi More Sustainable than other Psychoactive Substances?

Is Sustainability a Lie?

Against Defeatism: Israel Is Not Sustainable and Will Not Win, w/ Susan Abulhawa

Volume 8: “Facing Complex Sustainability Checks” 🕵️♂️

Why it's not sustainability vs. regeneration - Bill Baue & Daniel Wahl in dialogue

BIC: Two minutes to understand sustainable development

This Is Not Sustainable. 😟

Building society on databases is 'not sustainable and not safe'.

#starbucks #redcup #sustainability #consciousconsumer #ecofriendly #sustainableliving

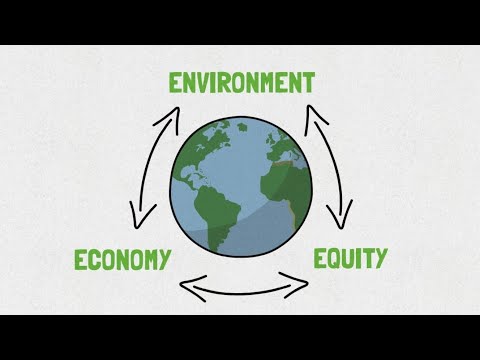

What is Sustainability

Комментарии

0:16:40

0:16:40

0:17:31

0:17:31

0:04:01

0:04:01

0:08:40

0:08:40

0:01:38

0:01:38

0:14:06

0:14:06

0:03:13

0:03:13

0:19:06

0:19:06

0:10:44

0:10:44

0:09:01

0:09:01

0:25:56

0:25:56

0:00:58

0:00:58

0:12:19

0:12:19

0:01:03

0:01:03

0:00:53

0:00:53

0:07:44

0:07:44

0:44:00

0:44:00

0:00:50

0:00:50

0:52:28

0:52:28

0:03:50

0:03:50

0:05:34

0:05:34

0:00:43

0:00:43

0:00:38

0:00:38

0:03:06

0:03:06