filmov

tv

Debt Avalanche vs Debt Snowball Real Life Example | Debt Payoff Calculator in Excel or Google Sheets

Показать описание

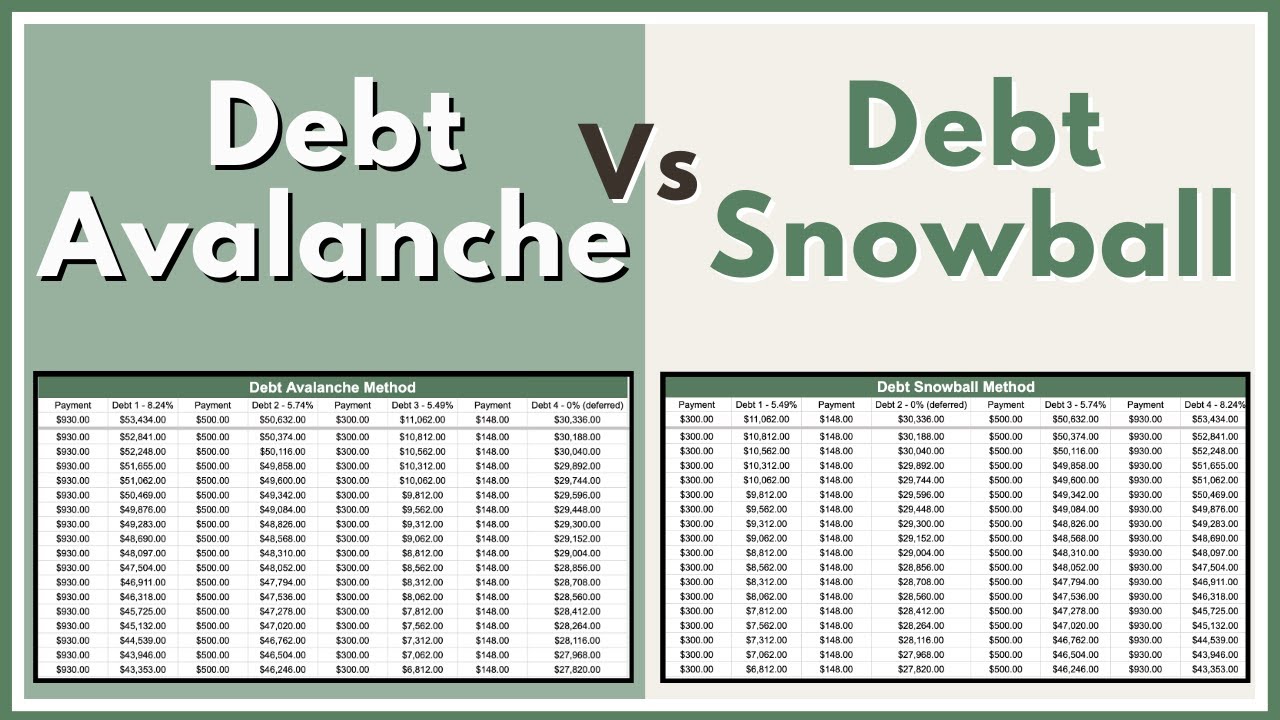

Which debt payoff calculator will get you out of debt faster? The debt snowball method or the debt avalanche method? In this video I use a real life example and compare the debt snowball vs debt avalanche spreadsheets to see which one helps this family get out of debt faster.

Choosing the right debt payoff calculator in excel or google sheets depends on how much debt you have, your debt interest rates, and your minimum payments. You can use this video comparing the debt avalanche and debt snowball, and other tutorials mentioned to see which debt calculator helps you get out of debt the fastest.

Mentioned in this Video:

Video Chapters - jump to what you want to watch:

0:00 Debt Avalanche vs Debt Snowball

0:23 Debt Avalanche Method in Excel or Google Sheets

4:33 Debt Snowball Method in Excel or Google Sheets

6:12 Results: Debt Snowball vs Debt Avalanche

6:26 Make Your Own Debt Snowball and Debt Avalanche

Related Videos

Help Getting Out of Debt

Debt Snowball Spreadsheet (free download) -

Budgeting Tips and Resources

Read more on how to budget, save money and get debt free:

Let’s Connect

#debtavalanchevsdebtsnowball #debtsnowballmethod #debtavalanche

Choosing the right debt payoff calculator in excel or google sheets depends on how much debt you have, your debt interest rates, and your minimum payments. You can use this video comparing the debt avalanche and debt snowball, and other tutorials mentioned to see which debt calculator helps you get out of debt the fastest.

Mentioned in this Video:

Video Chapters - jump to what you want to watch:

0:00 Debt Avalanche vs Debt Snowball

0:23 Debt Avalanche Method in Excel or Google Sheets

4:33 Debt Snowball Method in Excel or Google Sheets

6:12 Results: Debt Snowball vs Debt Avalanche

6:26 Make Your Own Debt Snowball and Debt Avalanche

Related Videos

Help Getting Out of Debt

Debt Snowball Spreadsheet (free download) -

Budgeting Tips and Resources

Read more on how to budget, save money and get debt free:

Let’s Connect

#debtavalanchevsdebtsnowball #debtsnowballmethod #debtavalanche

Комментарии

0:10:14

0:10:14

0:13:02

0:13:02

0:07:36

0:07:36

0:08:19

0:08:19

0:08:46

0:08:46

0:08:07

0:08:07

0:04:10

0:04:10

0:03:42

0:03:42

0:38:33

0:38:33

0:08:01

0:08:01

0:06:46

0:06:46

0:06:23

0:06:23

0:05:41

0:05:41

0:05:55

0:05:55

0:04:15

0:04:15

0:06:41

0:06:41

0:04:46

0:04:46

0:07:29

0:07:29

0:02:35

0:02:35

0:04:29

0:04:29

0:05:18

0:05:18

0:33:21

0:33:21

0:03:44

0:03:44

0:09:36

0:09:36