filmov

tv

How to Analyze a Single Stock

Показать описание

Maybe a particular stock has caught your eye... but how can you tell if it's a good buy?

sources:

Two Cents is hosted by Philip Olson, CFP® and Julia Lorenz-Olson, AFC®

Directors: Katie Graham & Andrew Matthews

Written by: Philip Olson, CFP® and Julia Lorenz-Olson, AFC®

Executive Producer: Amanda Fox

Produced by: Katie Graham

Edited & Animated by: Sara Roma

Fact checker: Yvonne McGreevy

Images by: Shutterstock

Music by: APM

How to Analyze a Single Stock

How to Analyze a Single Family House Rental Property

How to analyze demographic variables in one table

How to Analyze a Rental Property (No Calculators or Spreadsheets Needed!)

How to analyze single-cell RNA-Seq data in R | Detailed Seurat Workflow Tutorial

How To Analyze A Rental Property For Beginners In 2024

How to Analyze a Single Family Rental Property | Deal of the Day

How To Analyze A Rental Property (The Quick & Dirty Way)

How to analyze single factor RCBD data using Rstudio software

How To Analyze Songs

How to analyze single-cell ATAC-Seq data in R | Detailed Signac Workflow Tutorial

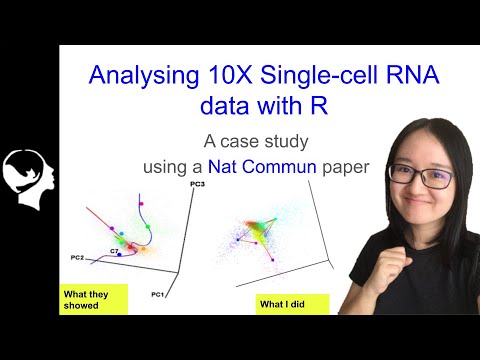

How to analyze 10X Single Cell RNA-seq data with R| Seurat Package Tutorial

How to Analyze Literature

One defense to rule them all - a perfect opening you can play against anything · Training Game

How to Analyze Single Cell RNA Seq Data - Point, Click, Done

How To Analyze Movies – Film Studies 101

How to Analyze a House Hack | 3 Bed 1 Bath Thornton, CO

SPSS: How to enter and analyze data from a questionnaire

How to Analyze Facebook Ads (the right way)

Watch Brad Goh Analyze a Chart UNDER 5 mins !

How to analyze Soccer matches for Over 2.5 Goals (Works 97%🤫🤑)

How to Analyze Music and WHY

How to Analyze Columns-separated Multiple Response Survey Data in Excel Pivot Table

How to Analyze a Duplex Rental Property (Real Life Example)

Комментарии

0:09:12

0:09:12

0:38:48

0:38:48

0:04:05

0:04:05

0:35:11

0:35:11

0:36:18

0:36:18

0:12:02

0:12:02

0:45:47

0:45:47

0:11:31

0:11:31

0:18:19

0:18:19

0:09:07

0:09:07

0:45:11

0:45:11

0:37:26

0:37:26

0:04:21

0:04:21

0:39:39

0:39:39

0:47:44

0:47:44

1:25:27

1:25:27

0:07:38

0:07:38

0:13:38

0:13:38

0:10:25

0:10:25

0:10:12

0:10:12

0:04:57

0:04:57

0:12:19

0:12:19

0:07:04

0:07:04

0:36:23

0:36:23